Beat The Bear With 3 Tools: Dividends, Dividends And Dividends

It’s not easy to be upbeat in a bear market. This goes for people—and especially dividend stocks.

(And hey, who has time for feelings? We are looking to get paid without losing our entire portfolios. We’ll share emotions when the bear is done.)

For contrarians like you and me, it’s a time to be optimistic. We should be thinking about bargains, bargains and even more bargains.

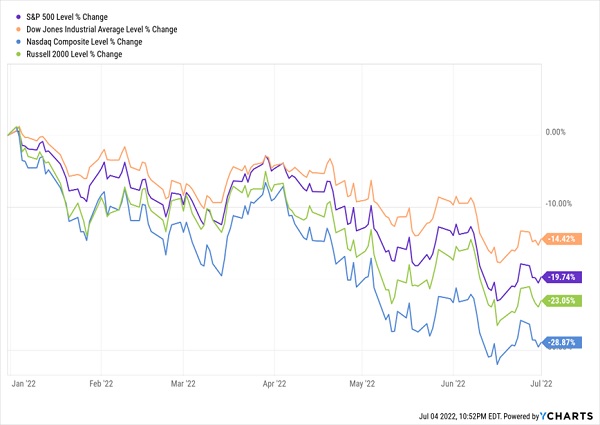

Now halfway through the year, every major index is deep in the red. The S&P 500, Nasdaq and even the small-cap Russell 2000 are all in bear-market territory, while the Dow is down considerably too.

Nowhere to Hide in ‘22

It’s no secret why.

Inflation has gone bonkers (a technical term). According to the Bureau of Labor Statistics, May’s annual inflation rate was a ludicrous 8.6%—the highest level seen since 1981! The Federal Reserve has slammed the monetary brakes in response, raising rates and green-lighting quantitative tightening to cool off consumer prices—at the very real risk of sparking a depression.

All the while, a warmongering Russia has only made things worse. Most of the developed world has weened itself off Russian oil, juicing commodity prices, plus its actions have further frayed a global supply chain already tattered by COVID.

So while no one is happy that stocks are getting pummeled, by this point, they’re probably not surprised, either.

But there has been one pleasant surprise in 2022:

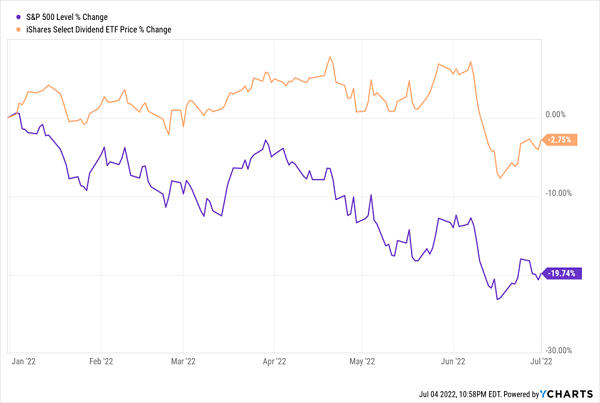

Dividend Stocks Hang Tough

Higher-yielding dividend stocks haven’t been entirely immune from the market’s downturn, but they have certainly provided better protection than our average vanilla blue chip.

There’s no one single reason. Some of this is investors piling into traditional safety sectors (think utilities and consumer staples). Some of this is a fantastic year-to-date performance from energy stocks thanks to sky-high oil prices. And some of this is a rush into anything with a decent yield as Wall Street bets on further rate hikes later this year.

Indeed, while the market looks for its eventual bottom, a handful of dividend payers have recently scratched out 52-week highs!

Thing is, if many of these headwinds refuse to subside, these unlikely momentum stocks might have still more gas left in the tank.

A few noteworthy stocks worth your attention right now:

Donegal Group (DGICA, 4.1% Yield): Donegal Group has been nothing short of stellar in 2022—though chances are you haven’t heard anything about it. While Donegal has been around for more than 125 years in one form or another, it remains a smallish mid-cap insurer providing full lines of personal, farm and commercial insurance products across various parts of the U.S. Commercial lines have grown in nine of the past 10 years, and retention rates have recently climbed above 90%. During its most recent quarter, net premiums improved by 6.4% and net investment income was up by 4.6%. Those results have helped DGICA run 23% higher in 2022 while its insurance brethren are off 4% and the broader financial sector is down by double digits. Also noteworthy is persistent, if modest, dividend growth—the payout is up 18% since 2018.

Donegal Gives an Irish Goodbye to Its Peers

Takeda Pharmaceutical (TAK, 5.8% Yield): When you think of Big Pharma and its above-average yields, you probably think of American mainstays like Pfizer (PFE) and Eli Lilly (LLY), or even European plays like AstraZeneca (AZN) and Novartis (NVS). But from a dividend standpoint, Tokyo-based Takeda takes the tako. Takeda boasts drugs including Entyvio (ulcerative colitis, Crohn’s disease), Vyvanse (ADHD) and Advate (hemophilia). In May, Takeda delivered a solid fiscal 2021 report, but more impressive was its forecast for 2022, which included estimates for nearly 28% bottom-line growth—numbers it expects won’t be materially affected by COVID nor the Russian war with Ukraine. Just remember: Takeda is an international company, and it pays dividends accordingly. Like many of its European counterparts, however, TAK only pays semiannually, and the payout has remained level for more than a decade.

British American Tobacco (BTI, 6.8% Yield): British American Tobacco looks as bulletproof as it ever has. Remember: BTI bought competitor Reynolds American in 2017 to improve scale, and it has entered new product types, including vaping. It is navigating a few challenges over the past couple years, such as selling its business in Iran and trying to transfer its Russian business. But the company expects revenues to grow 2% to 4% this year, and adjusted EPS to rise by mid-single digits—despite the entire globe cracking down on tobacco use. Moreover, the company says it should return about $2.5 billion via share buybacks this year. Better still: BTI switched from semiannual to quarterly dividends in 2018 and has been slowly but surely turning up the heat for years.

How to Lock Up $76K in Annual Income

My worry is that 2022’s popular safety plays could go out of style, leaving these highfliers in the lurch.

More important to me is sheer quality—and, of course, a high and durable level of dividends.

As I write, the stellar stocks in my Contrarian Income Report portfolio yield an average 7.6%. This baker’s dozen is spinning off $76,000 for every million dollars invested.

The important thing is that these yields are safe, which creates stability for the stock (and fund) prices attached to them. We want our income, with our principal intact. It’s really the only way to retire comfortably, without having to stare at stock tickers all day, every day. Sound good?

Best of all, many of my favorite dividends are paid monthly. So, we’re talking about $3,000+ in dividends every month on that $500K. Or $6,000+ per month in income on the seven-figure accounts that Fidelity brags about in its ads.

Click here and I’ll share my favorite 7%+ dividends—dividends that are being paid monthly to boot!

This article originally appeared at Contrarian Outlook.

Category: Dividend Stocks To Buy?