These 3 Dividends Defy Xi, Putin And Powell (Payouts Grow 30%+)

Think back just four months: first-level investors were babbling on about “transitory” inflation and clambering for crypto and profitless tech stocks.

No more! The world has shifted. Russia’s war on Ukraine—a disaster on a human level first and foremost—has upended, well, everything.

Crappy crypto and bankruptcy-bound techs are out—and secure payers that benefit from today’s trends are in. (I’ve got three examples for you below, one of which has boosted its payout 119% in just the last five years.)

Secure Payers Thrive in a Volatile World

Let’s be honest: the Fed, Putin and President Xi of China are driving the market now. Just look at the headlines: when folks aren’t waiting for the next utterance from the Marriner S. Eccles Federal Reserve Board Building, they’re looking abroad for their next clue.

In China, Xi, sitting on a trillion dollars of US Treasuries, gazes across the Taiwan Strait. He let his pal Putin make his land grab first—and watched as sanctions locked up the Russian central bank’s assets.

Xi knows his cost of taking Taiwan just went up by a trillion dollars!

All of this is driving up demand for those secure payers I mentioned a second ago. So that’s where we’re focusing. Specifically, we want safe dividends that:

- Profit as inflation rises.

- Ride the “onshoring” trend, as US companies pull out of hostile places like China and head home, or at least to friendlier locales.

- Cash in as rising rates create new opportunities. I’ve got an apartment-owning real estate investment trust (REIT) for you below that’s just the ticket.

Plus we’re going to give ourselves a shot at even bigger upside (and dividend growth!) by going after midcap dividend growers in these sectors.

Midcap stocks don’t get the love blue chips enjoy, which is perfect for us because there are plenty of dividends in the space that literally double every few years.

Why Midcap Dividend Growers Are Smart Buys Now

First-level investors stick with the S&P 500 names that everyone buys. Small caps? They’re for gamblers. We like the middle ground because it’s a great place to find overlooked value—and tap into the next blue chips before everyone else does!

And with midcaps, that value is often unlocked—and booked into the share price—in the long run. Check out the returns posted by the S&P MidCap 400 Index, in blue below, versus the S&P 500, in orange, and the S&P SmallCap 600, in purple, since the mid-’90s:

Midcaps Are Where the Action Is

Midcaps are also a perfect play for today’s market for two other reasons:

- Midcaps don’t get much attention from analysts or the media, so there’s a greater chance we’ll be able to pick them up at unusually big discounts.

- Midcaps tend to be more domestic-focused. That cuts their risk, including the risk of getting hit by sanctions from the likes of Xi and Putin.

Here are three midcaps benefiting from the shifts we’ve been living through lately. All are growing payouts quickly—and their rising dividends are inflating their share prices, too.

Steel Dynamics (STLD)

Dividend yield: 1.6%

5-year dividend growth: 119%

Steel Dynamics is one of America’s largest steel producers and the second-largest maker of steel building components. STLD creates everything from flat roll, beam and bar steel to threaded rods to joists and girders. It also produces processed copper.

It’s a direct beneficiary of the onshoring trend, as manufacturers switch to “safer” sources of steel at home. It’ll also benefit from the Biden Administration’s recent infrastructure law and the unsnarling of supply chains, which will boost car production.

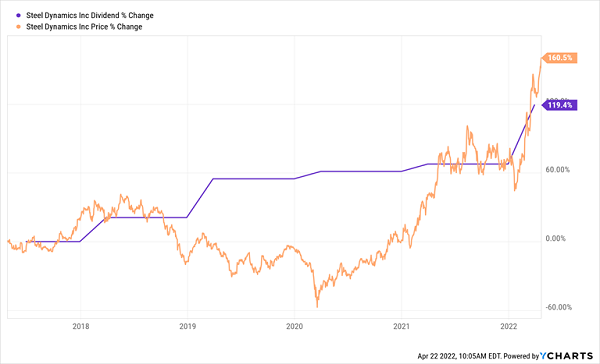

These catalysts should also help Steel Dynamics keep its payout on a growth tear, including a 30% hike late last year—a move that’s pulled the price up along with it:

STLD’s Dividend Magnet Switches On

With dividends taking up an almost insignificant 6.6% of earnings in the last 12 months and net sales soaring 57% in the latest quarter, we can expect plenty more payout (and upside potential) from this one.

Camden Property Trust (CPT)

Dividend yield: 2.2%

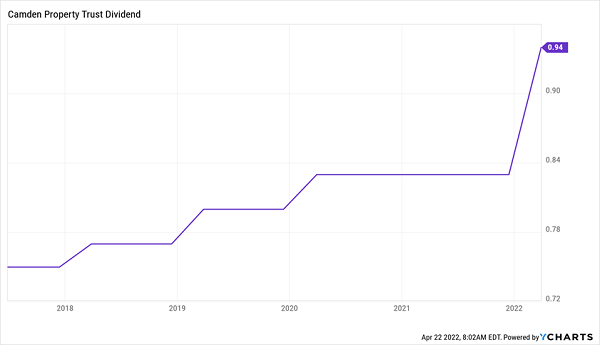

5-year dividend growth: 25% (including a 13% hike last year)

The apartment landlord is profiting as rising rates send more people back to the rental market. That’s also letting Camden raise its rents, which led to an 8.5% jump in same-property revenue last year and a 30% jump in adjusted funds from operations (FFO, the best metric for REITs).

Demand is still high, with Camden’s apartments essentially full, at 97.1% occupancy. This has all translated into steady dividend hikes for Camden shareholders, including a jumbo 13% raise late last year:

Camden Passes Its Rent Hikes on to Shareholders

Camden isn’t just sitting on its high occupancy rate: it’s building more than 2,400 units in hot markets like Atlanta, Orlando, San Diego and Charlotte. Meantime, the stock is (unfairly) down a little more than 4% this year, as of this writing, even though management is forecasting an even bigger jump in AFFO—33%, to be precise—for 2022.

ConAgra Brands (CAG)

Dividend yield: 3.3%

5-year dividend growth: 56%

Conagra, whose brands include Slim Jim, Duncan Hines, PAM and Hunt’s, benefits from inflation in a couple of ways: for one, it profits as high prices keep people eating at home.

Second, its products, which the Chicago-based company has been churning out since 1919, are seen as affordable staples, not the fancy fare consumers often cut first when tough times hit. That gives CAG pricing power it can use to offset rising ingredient and shipping costs.

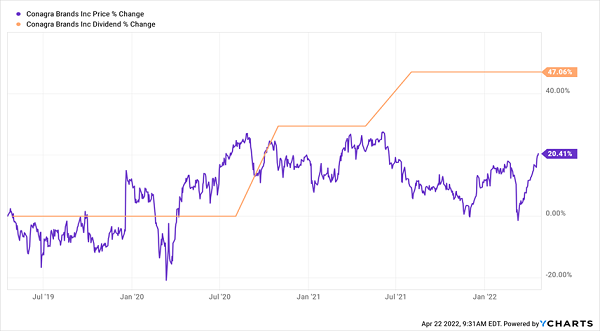

You can see that in CAG’s revenue, which jumped 5% in the latest quarter, even as inflation took off. That bodes well for another big hike in the dividend, which has already soared 47% since mid-2020:

CAG’s Dividend Springs to Life

Add in CAG’s safe payout ratio—dividends account for just 54% of earnings—and you’ve got a recipe for more hikes to come.

That, in turn, should fuel CAG’s “Dividend Magnet.” As you can see in the chart above, the payout paced the stock higher until late last year, when a gap opened up. That’s our upside potential—and it makes now a good time to buy.

7 “Recession-Resistant” Stocks to Buy for “Revolving” 15%+ Yearly Returns

When inflation roars, buying stocks like the ones we just mentioned—which provide food, housing and materials—makes a lot of sense. These companies are proven inflation hedges, so they tend to see their sales rise along with consumer prices, which translates into dividend growth you can use to outrun your rising costs.

But with a potential recession on everyone’s mind, you’ll want to make sure you add plenty of pullback protection to your portfolio, too. That’s where the 7 “recession-resistant” stocks I have for you right here come in.

These 7 companies are all growing dividends quickly, which helps support their prices in a pullback, as more investors scramble to buy these safe payers. My expectation? These 7 stocks are nicely positioned to return 15%+ annualized returns for years to come.

I’ve got all the details waiting for you in a new Special Report I’m ready to share with you now. Click here to get your copy and full details on these 7 stocks—names, tickers, current yields, dividend growth and more—plus my full dividend strategy for these volatile times.

This article originally appeared at Contrarian Outlook.

Category: Dividend Stocks To Buy?