Will These 15%-38% Dividend Growers Repeat In 2022?

Here’s the surest, safest way to double our money in any kind of market. This works whether we’re comparing 2019’s roaring bull run or 2022’s blabbering bear:

Buy the dividends that are growing the fastest.

Over long time periods (months to years), stock prices follow their dividends. For better or for worse! It’s that simple.

When a company cuts its payout, its stock price drops. On the other hand, firms that raise their dividends year after year enjoy steady annual gains. This is thanks to a financial phenomenon I call “the dividend magnet.”

The Dividend Magnet

Dividend growth is a one-two-three combo for income investors.

- Growing payouts create a higher “yield on cost.” The yield on our original price basis keeps climbing with each dividend raise. Our 1% yield grows to 2%, 3%, 4% and more over the years.

- Growing payouts outpace inflation. With 8% inflation, payout raises are important. Dividends that aren’t growing are dying.

And here’s the most important benefit. The dividend magnet.

- Dividend growth drives stock-price growth. A dividend is a statement of confidence about a company’s ability to generate consistent (and likely growing) earnings—with room left over to continue spending on future growth. And when a company hikes dividends, it’s doubling down, expressing even more confidence about its ability to maintain a robust bottom line.

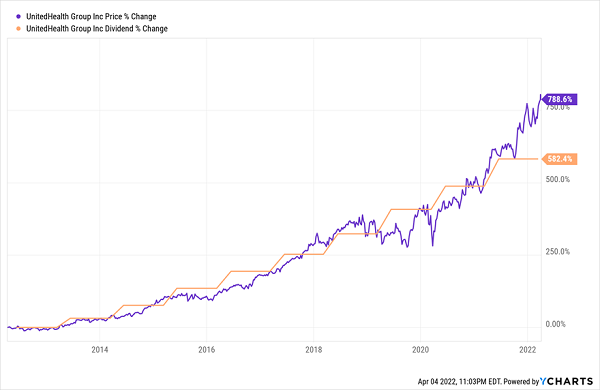

One of my favorite dividend magnet examples is Dow component UnitedHealth Group (UNH), which has crushed the broader market over its publicly traded life.

Here’s why. UNH’s stock price takes its cue from dividend hikes. As goes the dividend, so goes UNH. As my four-year-old says on the swing: “Higher and higher!”

And Wouldn’t You Know It? UNH Is Due for Another Payout Hike Soon!

Spring is an ideal time to buy dividend growers. The first-quarter earnings season is upon us, and companies usually love combining dividend announcements with their quarterly results. That means now’s the time to consider “front running” some of these payout raises.

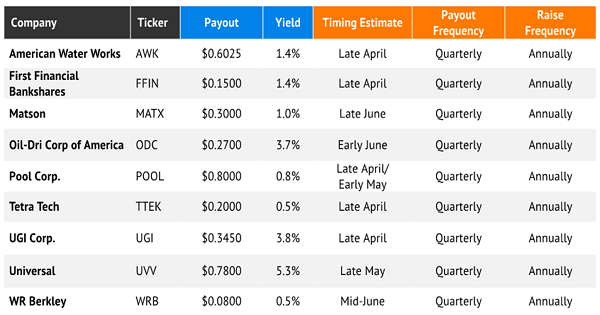

Here’s a look at 29 companies that are set to raise their payouts over the next couple of months. We’ll look at them in sectors and highlight a few big raises on tap.

Blue-Chip Stocks

Featured Stock: Target (TGT)

Dividend Aristocrat Target (TGT) marked its 50th year of consecutive payout hikes not with some token dividend increase, but with a blowout 32.4% upgrade to its quarterly distribution.

And why not? While the pandemic was a nightmare for some retailers, Target put together a stellar 2020:

- Full-year revenues popped by nearly 20%.

- Comparable-store sales rocketed more than 19% higher.

- Digital comps were up nearly 150% year-over-year.

- Adjusted profits jumped by 47%.

Times were good, and Target made sure all of its shareholders enjoyed the spoils.

That makes me very curious about what’s in store for Target shareholders this June, when the company should make its 51st consecutive dividend increase.

While full-2021 revenue growth wasn’t nearly as robust, at 13%, it still had another massive year of comps growth (+13%) that saw all five core merchandise categories improve comparable-store sales by double digits. And most importantly, earnings per share (EPS) growth was still sizzling at 44%.

That’s no guarantee that Target will bring similar heat to its dividend hike again in 2022. But you have to like the odds of another significant raise.

Under-the-Radar Payers

Featured Stock: Pool Corp. (POOL)

Pool Corp. (POOL) boasts more than 200,000 branded and private-label products throughout nearly 400 sales centers in North America, Europe and Australia. As the name would suggest, that includes pools (and hot tubs, for that matter), but also repair parts, chemicals, pool pumps, water heaters, pool tile, and even other outdoor living gear including lighting, grills and outdoor cooking implements.

And as American workers fled their offices for the comfort of their homes, they began upgrading those homes inside and out, meaning big business for Pool Corp. Its top and bottom lines expanded by 23% and 40%, respectively, fueling a 38% dividend hike last May. And that wasn’t out of character for Pool—this is a dividend growth fiend whose payout has exploded by 125% over the past five years.

So if 2021’s results are any indication, investors could be due for a mouth-watering dividend increase come late April or early May.

The housing craze sparked record annual sales of $5.3 billion, up 35% year-over-year. Operating income shot 79% higher, operating margins were 390 basis points better, and earnings of $15.97 per share were also a company record.

It is worth noting, however, that growth is expected to slow here. The company is still projecting bottom-line expansion of about 10% in 2022, and only about $20 million in cash versus more than $1 billion in debt will make it very difficult to try to grow via acquisition. So what Pool’s dividend increase is largely up to whether it’s a reward for another good year or reflective of a difficult growth path to come.

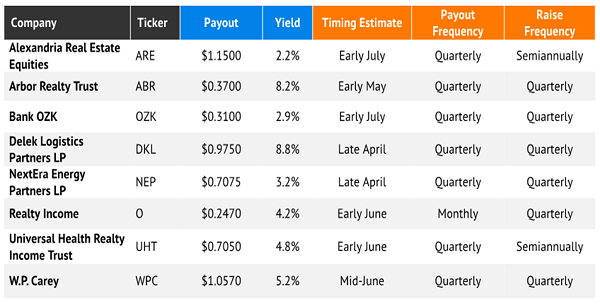

Rapid Hikers

Featured Stock: NextEra Energy Partners LP (NEP)

Like many energy master limited partnerships (MLP), NextEra Energy Partners LP (NEP) was created to hold energy assets—in this case, the assets of NextEra Energy (NEE).

Specifically, NextEra Energy Partners holds clean-energy projects that throw off stable, long-term cash flows. That includes about 8,000 megawatts worth of renewables (roughly 83% wind, 17% solar) and about 727 miles worth of natural gas pipelines.

Given that NEP is heavily reliant on the ebbing and flowing of energy demand, it should be of no surprise that it frequently vacillates from red ink to green. To wit, a $192 million bottom line in 2018 turned to $71 million and $50 million losses in 2019 and 2020, but in 2021, NextEra Energy Partners returned to a $137 million profit.

But what ultimately matters to income investors is that the company is able to regularly churn out ample cash available for distributions (CAFD), which is ultimately what keeps the income flowing. NEP has been astonishingly consistent in this regard, improving its quarterly distribution every quarter since going public in 2014.

The MLP continues to aim for 12%-15% annual distribution hikes through 2024—a range it easily maintained over the past four years, including a 15% jump last year.

Stocks and Bonds Are Flatlining, But We’re Doubling Our Money

Every major market index has been dead money in 2022. But while most of the darlings of the stock market are getting crushed, a small, overlooked basket of recession-proof stocks are not just surviving—they’re set to thrive.

These “Hidden Yield stocks” offer savvy investors the opportunity to double their money roughly every five years with predictable, reliable 15% returns no matter what the wider market does.

How are they able to do this while supposedly idiot-proof blue chips can’t? It all boils down to what I call “The Three Pillars”:

Pillar #1: Consistent Dividend Hikes Pillar

Pillar #2: Lagging Stock Price

Pillar #3: Stock Buybacks

Selecting companies with a proven track of increasing their dividend payments is the safest, most reliable way to get rich in the stock market. And I want to show you how it’s done. Click here to get a risk-FREE copy of my 7 Recession-Proof Dividend Stocks With 100% Upside, including tickers, dividend growth histories and full analyses of each pick!

This article originally appeared at Contrarian Outlook.

Category: Dividend Stocks