5 Dividend Yields Up To 13.6%: Buy, Hold Or Sell?

It’s a no-yield world we dividend investors are living in. But believe it or not, there are some payers with serious yields that get zero mainstream attention. We’ll discuss five in a moment.

I’m talking about dividends between 9.5% and 13.6%! Yes, you read that right—one of these stocks dished 13.6% back to its happy income investors over the past twelve months.

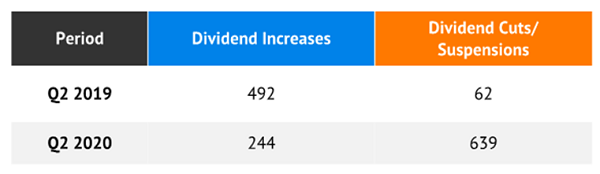

Are these yields safe? That is always the question. The backdrop is certainly better than last year. One year ago, the emergence of the COVID-19 pandemic in 2020 triggered a slew of dividend cuts and suspensions as companies scrambled to preserve cash and remain solvent through the uncertain future. In Q2 2020, we experienced more than 10x the number of dividend cuts from Q2 2019.

Source: S&P Dow Jones Indices

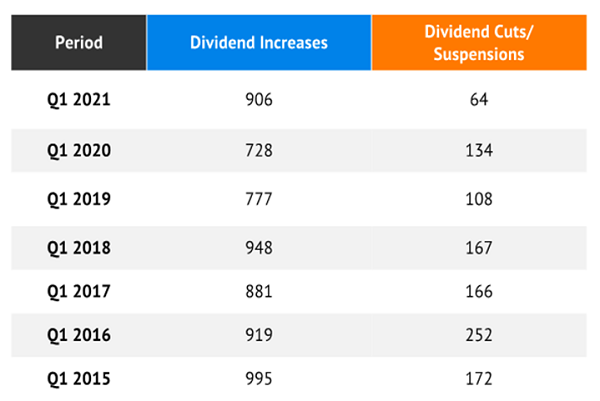

Now every bear brings a silver lining, and 2020 maybe have rattled loose a lot of dividends that were “just hanging on.” The remaining payout programs reflect much stronger financial situations on the whole, and now these companies have the benefit of a recovering economy and improving profit prospects.

Indeed, the latest information from Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, shows that dividend increases returned to a brisk pace in Q1 2021, while dividend cuts and suspensions were their lowest in years.

Source: S&P Dow Jones Indices

That’s certainly good news, but we need to remain vigilant, especially when it comes to chasing super-sized yields.

The S&P 500 yields just 1.6%. Supposedly yield-friendlier sectors like consumer staples and utilities only yield about 2% to 3%, and even real estate investment trusts (REITs) are barely sniffing 4%.

Yes, a few more areas of the market, such as BDCs and mREITs, yield even more on average, but these mammoth yielders we’re about to explore deliver far, far more yield than any category average—and whenever that’s the case, we need to use a critical eye and determine whether those juicy yields won’t suddenly run dry.

It’s worth the work. Because if they can keep it up, we have a way to secure anywhere between $47,500 and $68,000 annually on just $500,000 invested.

Apollo Commercial Real Estate Finance (ARI)

Dividend Yield: 9.5%

Apollo Commercial Real Estate Finance (ARI) is a mortgage real estate investment trust (mREIT) that originates and invests in senior mortgages and mezzanine loans and other commercial real estate (CRE) debt across the U.S. and Europe.

As of their March investor presentation, ARI boasted a $6.5 billion global debt portfolio, with 84% of that in first mortgage loans. The portfolio consists of 67 loans with heavy weights in office (29%) and hotel (24%) real estate, with other investments in residential for sale, urban retail, healthcare and other real estate.

Apollo CRE has a few things going for it. Like many of its brethren, ARI is in recovery mode; fourth-quarter adjusted book value improved a little, from $15.30 per share to $15.38. The board authorized a $150 million increase to its buyback plan. And 95% of the portfolio is “floating rate”—a boon if interest rates keep rising (but that’s a big if for now).

I’m more concerned about profits. Fourth-quarter distributable earnings came to a paltry 15 cents per share. Backing out realized losses on investments, Q4 distributable earnings were actually 36 cents per share, but that’s still barely enough to cover its 35-cent distribution. Expectations are for much of the same throughout the rest of the year—$1.43 in its bottom line, versus the $1.40 per share in payouts it’s expected to distribute.

That’s a close margin for a company that has already cut its payouts twice over the past year—first from 46 cents to 40, then again to its current 35. Meanwhile, ARI shares are approaching their pre-COVID highs, but profits aren’t expected to reach their pre-COVID levels for at least a few more years.

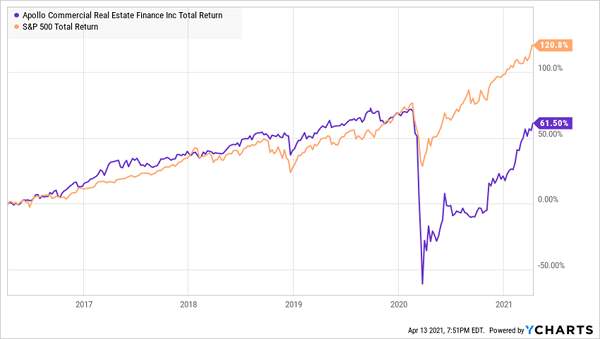

Will ARI Play Catch-Up With the Market, Or Is Wall Street Hesitant?

ARI is heading in the right direction, but I’d prefer to wait and see what happens to shares the next time we get a real test to this broader market rally.

Orchid Island Capital (ORC)

Dividend Yield: 12.8%

Orchid Island Capital (ORC) is another mREIT, and one with an even more problematic dividend history.

ORC invests in residential mortgage-backed securities (MBSes)—typically agency MBSes from the likes of Fannie Mae and Freddie Mac—on a leveraged basis. And like most mREITs, it earns the difference between what its mortgage assets yield and what it costs to borrow.

But that has been a flattish-to-declining proposition for ORC long before COVID struck. Quarterly earnings with gains/losses removed were as high as 70 cents per share in 2017 but have since dropped between the high teens and low 30s over the past year-plus. That has resulted in a steeply declining monthly dividend; ORC has chipped away at its payout four times since 2017, from 14 cents per share then to 5.5 cents through mid-2020, before hiking it back up to 6.5 cents currently.

That’s simply too much dividend variability, regardless of how large the headline yield might be, for anyone planning out more than a couple years out into the future.

Cornerstone Total Return Fund (CRF)

Dividend Yield: 13.6%

You can always count on closed-end funds (CEFs) to deliver tasty yields, but Cornerstone Total Return Fund’s (CRF) payout is downright succulent. This stock-focused CEF, which looks for a mix of value and growth through equities, and even ETFs and other CEFs, delivers a nearly 14% payout and has performed on par with the S&P 500 over the past five years.

But My Focus Is on That Orange Line

Problem is, CRF is waving two big red flags at the moment.

First and foremost is that it habitually cuts its distribution, which has been nearly halved in just the past five years. Nice performance or not, retirement planners typically don’t draw up a 45% income decline in their playbooks.

Also, Cornerstone typically trades at a premium to its net asset value (NAV), which means you’re overpaying for what the fund holds, but CRF’s current premium of 39%–meaning you’d be buying its holdings for $1.39 on the dollar—is in the stratosphere!

That’s a one-two punch of wealth destruction.

New Germany Fund (GF)

Dividend Yield: 12.1%

At $314 million in assets, GF likely wouldn’t even be a blip on most radars if it weren’t for the comically large yield. It’s a Matryoshka doll of niches—German common equities and even preferred stocks nestled inside of a closed-end fund. As of last check, GF held 89% equities, 6% preferreds and 5% cash. Industrials and consumer discretionary stocks make up more than half of the fund, and it holds a few familiar names, including Airbus (10%) and Hello Fresh (6.0%).

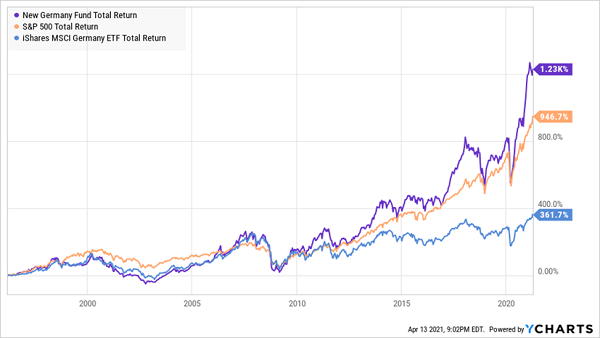

German stocks haven’t held a candle to the U.S. in quite some time, but GF has remained an astonishingly good performer for decades, handily beating the S&P 500 over the past quarter-century (and in shorter time frames, too).

Das Ist Gut, Nein?

Part of what’s powering those returns is an inconsistently paid but consistently high dividend. GF has managed to pay an annualized double-digit yield for years simply through special dividends.

This uncertainty is not ideal if you require regular income. But it’s a fantastic topper for investors looking for raw German horsepower.

OneMain Holdings (OMF)

Dividend Yield: 12.6%

OneMain Holdings (OMF), which provides consumer finance and insurance products under the OneMain Financial banner, is a horse of a different color.

It’s not a REIT, mREIT, CEF, BDC or any acronym. It’s merely a financial services firm with a big, fat dividend.

OneMain, which boasts 1,500 branch offices across 44 states, primarily provides personal installment loans to 2.3 million customers, many of whom have non-prime credit scores. But it serves them in a couple of nontraditional ways that appear to be contributing to a surprisingly low default rate: it charges no prepayment penalties, and it provides customers with a number of financial-education resources.

This can be an extremely cyclical and seasonal business—tax returns tend to cut into the need for its services for a couple months each year—but OMF has delivered steady growth in net interest income for years. NII of $624.1 million in 2011. Has improved in every year but one since then, to $3.4 billion last year.

This is a growing, well-managed business, but it has really caught fire over the past year, delivering a total return of 200% against the S&P 500’s 50% as Americans have flocked to personal loans to get through the COVID crisis.

OMF Heads Into Orbit

Of course, while the financial strain from COVID is far from over for millions of Americans, the economic sea change should drag on demand for OneMain’s products, and the stock could be in need of a cooldown after running so hot for a full year.

And at the risk of sounding like a broken record, dividend inconsistency is a concern here—but not for the same reasons as some of the previously discussed bad actors. OneMain has a short dividend history, but has so far utilized special dividends to share its extra profits with stockholders. In 2019, it paid 25 cents per share quarterly in regular dividends, but also paid a $2-per-share special dividend. It increased its quarterlies twice last year—to 33 cents, then to 45 cents—and paid a $2.50-per-share special.

This year, it kicked things off with a $3.95 dividend, and set a 45-cent-per-share minimum quarterly payout, with the possibility for “dividends above the minimum” to be reviewed every Q1 and Q3.

That’s still great! This policy demonstrates responsible cash management and a willingness to share whatever it can to shareholders.

Sky-High Dividends You Can Count on for DECADES

But let’s do the math. That 45-cent dividend translates into a 3.5% annual yield.

Could we get a lot more? Yes. Can we write that in stone? No.

That’s ultimately the rub with a lot of super-high-yielders. Their payouts are often much too unpredictable for people who need a substantial (but also dependable!) income stream to live off in retirement.

Fortunately, that’s what makes my “Perfect Income” portfolio … well, so perfect.

Most of my readers have told me that these stocks have doubled and even tripled the dividends they were earnings from their old income portfolios. (And in a couple of rare cases, readers reported a 4x jump in their regular checks!)

That alone is a massive upgrade to any set of retirement holdings. But more important is that my Perfect Income Portfolio delivers that level of cash while also …

- Paying those dividends consistently, predictably and reliably.

- Surviving, even thriving, in market crashes.

- Delivering double-digit returns across several safe investments.

- Gambling your hard-earned nest egg on flimsy day-trading strategies, options contracts or penny stocks.

Take control of your financial legacy today. Let me show you how to get 2x to 4x your current income with this simple, straightforward system. Click here to get a FREE copy of my Perfect Income Portfolio report, including tickers, dividend yields, full analyses of each pick … and a few other bonuses!

Category: Dividend Stocks