They’re Small. They’re Cheap. And They Yield Up to 14.7%

The index huggers are, rightfully, fretting about the only position they own, the S&P 500, which is heavy on Nvidia (NVDA). The soon-to-be-fallen angel is the third largest component of the index at 6.3%.

“America’s ticker” SPDR S&P 500 ETF (SPY) yields only 1.2% and trades for 22-times earnings. The S&P SmallCap 600, meanwhile, which nobody owns, trades for a more reasonable P/E of 16.

And select small caps even pay serious dividends. I’m talking about yields between 9.1% and 14.7%.

But are these value stocks? Or are they merely cheap for a reason? Let’s explore a group of five small caps paying big dividends.

Xerox (XRX)

Dividend Yield: 9.1%

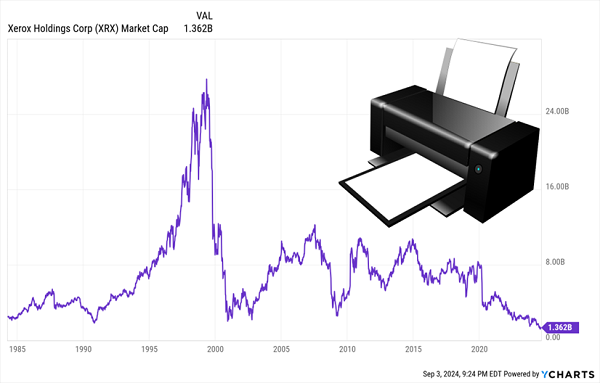

Yes, this once-great office-technology titan now qualifies as a small cap. It’s a relatively recent phenomenon—Xerox (XRX) slipped below the $2 billion mark once in the back half of 2023, and again this year by virtue of a nearly 40% year-to-date dip. Prior to that, the last time anyone called Xerox a small cap was in 1990!

Are Xerox’s Days of Printing Gains Over?

Xerox’s story is pretty well-known to most at this point. The maker of printers and copiers had its stock-market heyday in the late 1990s. Like most tech stocks, it ate dirt in the dot-com bust. But its subsequent recovery has largely been temporary, with newer technologies, a move to “paperless offices” and, later, a shift to flexible work arrangements weighing on both its commercial and home lines.

Earlier this year, I wrote that XRX has become one of Wall Street’s most hated stocks. It’s not difficult to see why. While it has tried to pivot away from its core printing business, it has been slow to do so, and those efforts haven’t borne as much fruit as management had hoped. In July, for instance, Xerox reduced its guidance to a revenue decline of 5%-6% (from 3%-5%), adjusted operating margin of 6.5% (from 7.5%), and free cash flow of at least $550 million (from at least $600 million).

Xerox has become an outlier in the tech sector, offering no growth but a massive dividend. Some might think that 9%-plus payout seems safe for the moment, at 60% of lowered expectations for this year’s earnings. But I wouldn’t touch this evaporating business.

Dorian LPG (LPG)

Dividend Yield: 10.7%

Dorian LPG (LPG) is a liquefied petroleum gas (LPG) shipping company. It owns and operates a fleet of very large gas carriers (VLGCs)—massive ships that typically run 250 to 300 meters long and can transport 100,000 to 200,000 cubic meters of gas.

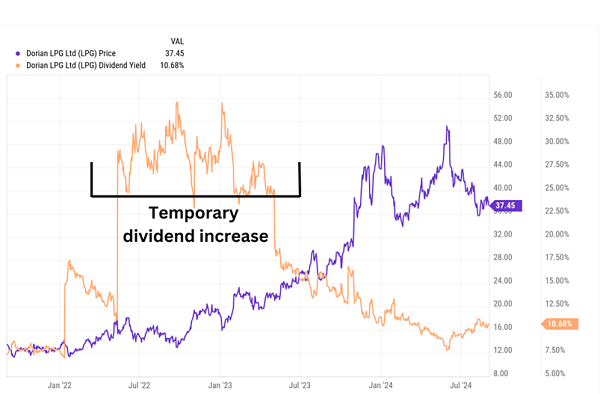

LPG’s yield has precipitously fallen since the last time I looked at it, from 25% then to roughly 11% now. That’s actually very good news for current shareholders, as a large part of the dividend shrinkage has come from a 66% run-up in shares. But part of it has to do with the nature of its dividend. While Dorian LPG pays out a seemingly regular dividend ($1 per share quarterly for a few years now), the company explicitly calls its dividends “irregular.” Its yield was temporarily inflated by a one-time outsized quarterly dividend of $2.50 per share in 2022.

LPG’s “Diminished” Dividend Is Still Generous, However

It’s not a criticism! Dorian’s dividend program is quite responsible given the company’s notoriously volatile industry: It pays dividends when it can, but it doesn’t make promises it knows it can’t keep.

Speaking of volatile, LPG’s earnings for the current (2025) fiscal year are expected to fall 36% from last year’s record profits. Fiscal 2026 should see a rebound, but even then, profits will be 25% lower from 2024 levels. That’s not necessarily a horrible thing—if LPG comes anywhere close to hitting those numbers, that will still represent historically elevated levels of profitability and should fund generous (albeit potentially smaller than current) dividends.

Shares trade at 7.7 times this year’s expected earnings—objectively inexpensive for investment thrill seekers.

Goldman Sachs BDC (GSBD)

Dividend Yield: 12.7%

The business development company (BDC) industry is a hunting ground for small-cap dividend dynamos.

Among them? Goldman Sachs BDC (GSBD), which isn’t your everyday BDC—it’s a BDC whose management may “draw upon the vast resources of Goldman Sachs to assist in the evaluation of potential investment opportunities.”

GSBD targets companies that earn between $5 million and $75 million in annual EBITDA (earnings before interest, taxes, depreciation and amortization). Its typical investment ranges between $25 million and $75 million, and it deals almost exclusively in debt.

The analyst community doesn’t love GSBD, and for once, I’m with them. Yes, GSBD’s dividend isn’t just massive, at nearly 13%, but it’s also well covered, typically sitting in a range of 67% of 80% of net investment income.

Unfortunately, that dividend hasn’t budged since the company went public roughly a decade ago. And despite GSBD’s “vast resources,” the company has underperformed the BDC industry for years.

GSBD Puts More Distance Between It and Other BDCs—In a Bad Way

The company is providing little reason to think that will change anytime soon. Last quarter, for instance, Goldman Sachs BDC placed two companies on non-accrual status, putting non-accruals at 3.4% of fair value, and its net asset value declined by about 6%.

Yes, GSBD does trade at a seemingly low 6.5 times estimates for net investment income per share. So you can argue it’s cheap. But it’s not cheap by the gold standard of BDC valuation—price to NAV—where, at 1.04x, Goldman’s BDC is actually a bit overvalued.

Barings BDC (BBDC)

Dividend Yield: 10.3%

Barings BDC (BBDC) is another BDC that still delivers a double-digit yield while being legitimately cheap, trading at an 11% discount to NAV right now.

As I’ve mentioned in the past, Barings is as much a redemption story as you’ll find in the BDC space. It was known as Triangle Capital until August 2018, when the company rebranded following years of writing off bad investments and hacking away at its dividend. But importantly, Triangle Capital didn’t just slap a new sign on the building—global financial services firm Barings became an external advisor and overhauled BBDC’s portfolio.

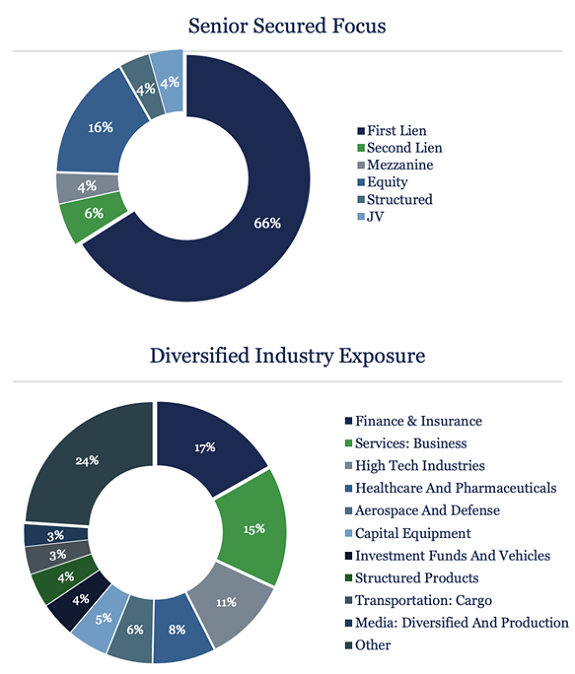

Today, Barings primarily invests in senior secured private debt investments in “well-established” middle-market companies across numerous industries. It currently boasts 329 portfolio companies. Two-thirds of its investments are first lien loans, though it also has second lien, mezzanine, equity, structured, and joint venture investments.

There’s a lot to like here. Barings BDC runs a high-credit-quality portfolio that, while non-accruals did rise in the most recent quarter, still boasts a low level of non-accruals. It also covers its dividend without breaking a sweat, and it has one of the more shareholder-friendly fee structures in the space.

We’ve booked gains in BBDC twice through our Dividend Swing Trader service, so I frequently have my eye on this one for short- and long-term opportunities alike.

Ready Capital (RC)

Dividend Yield: 14.7%

Ready Capital (RC) is in another industry where P/E isn’t necessarily a helpful valuation metric. It’s a mortgage real estate investment trust (mREIT)—a REIT subset that deals in “paper” real estate (e.g., mortgages). These companies are better evaluated through a book value lens. And in Ready Capital’s case, it trades at 0.63 times book, which is less than its peers (~0.7x for the industry).

As for the business itself: Ready Capital originates, acquires, finances and services small- and medium-sized balance commercial loans. Roughly half its distributable earnings are derived from bridge loans, while the rest is a combination of construction loans, fixed-rate commercial mortgage-backed securities (CMBSs), Freddie Mac loans, small business lending and USDA loans.

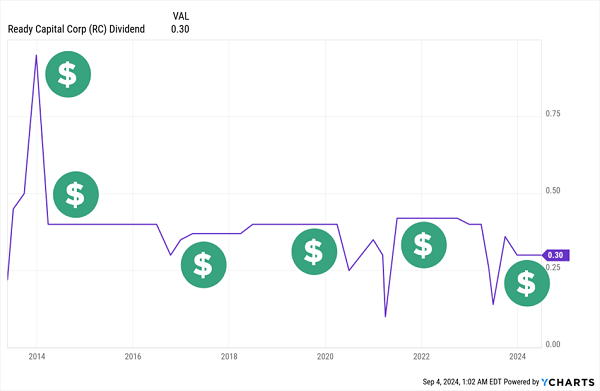

In 2023, it completed a merger with Broadmark Realty Capital, a specialty real estate finance company that originated and serviced residential and commercial construction loans. It followed that up with what at the time seemed to be a temporary dividend reduction sparked by having to absorb Broadmark’s tighter-margin portfolio.

Increasingly, however, it looks like an eventual rebound could take some more time.

RC: A Dividend in Flux

Ready is in the midst of a massive recycling, selling off underperforming loans and seeking out higher-yielding opportunities. It’s also shedding its mortgage-servicing rights business, leaning into its small business lending platform, and increasing its leverage. While all of this could generate significant earnings growth, the company is trying to get through a challenging past year or so that has seen distributable earnings come well below its 30-cent dividend.

Retire on Just $500K With a Higher Class of Dividend Stock

While consensus estimates imply that Ready’s dividend situation could become more tenable next year, that’s a shaky foundation for people looking to lock in a sky-high dividend for the long term.

If we want to retire on dividends alone, we need high yields, yes, but we also need stable, secure payouts that aren’t at risk of dropping or disappearing in a year’s time.

And those are the kinds of payouts I target in my 9% “No Withdrawal” Retirement Portfolio.

My “No Withdrawal” portfolio can do what your typical blue-chips-and-basic-bonds retirement portfolio can’t: Allow you to retire on dividend and interest income alone, without ever having to touch a penny of your nest egg.

Let me show you the stealth payout plays that Wall Street overlooks—names that do yield the 9% or more that we need to coast forever on dividends alone. Please click here and I’ll share the details on these secure funds with very generous dividends!

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks