Magnificent 7 Move Over: “Dividend 6” Yields Up To 8.3%

Magnificent Seven? Tired.

Dividend Six? Wired.

Plain vanilla investors fawn over chipmakers and AI stocks. They hope they can buy them high, and sell them higher.

Contrarian income investors like us? We focus on the companies that support the AI hype. The “pick and shovel” providers. A “Dividend Six” that plays on AI and pays $26,000 to $41,500 in dividends alone on a $500K stake.

With that we’ll say move over, Magnificent Seven—a term coined by Bank of America’s Michael Hartnett (and inspired by the classic Sturges Western) to describe the market’s predominant tech names.

Those stocks? Microsoft (MSFT), Apple (AAPL), Facebook parent Meta Platforms (META), Amazon.com (AMZN), Google parent Alphabet (GOOGL), Nvidia (NVDA) and Tesla (TSLA).

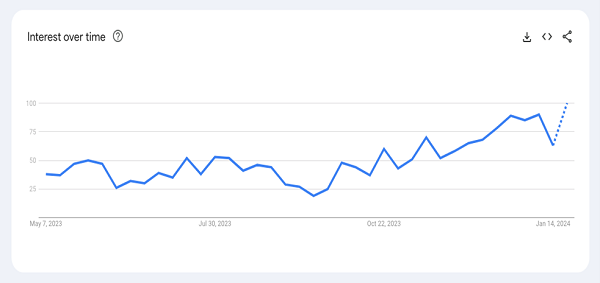

Lately, though, the Magnificent 7 has become a bit too popular. Check out Google Trends, a real-time measure of vanilla excitement:

More and More, People Are Searching for the Magnificent 7

Another problem with these popular blue chips? Most of them don’t pay.

Blue-chip they might be, but you can forget about income. Three don’t pay a penny in dividends, and four that do offer up the meagerest of yields.

Enter the Dividend Six, a six-pack of underappreciated tech stocks that yield 5.2% to 8.3%. That’s no typo.

Worthy of a spot in our retirement refrigerator? Let’s split the six apart to have a look.

Xerox (XRX)

Dividend Yield: 5.2%

At a 5%-plus yield, Xerox (XRX) delivers nearly 7x the yield you can expect from the tech sector—an extraordinarily irregular amount of income for what is a notoriously chintzy group of stocks.

But are you getting any growth?

On its face, Xerox doesn’t look great. While it’s trying to pivot to digital document services, it’s a printer company at its core. And printers have simply been vanishing, both as digital technologies have supplanted paper documents, and as many white-collar businesses have partially or completely exited physical office space. Perhaps no other business has lost more to those three little letters: WFH.

The investment case is more cloudy than you’d expect, though.

Xerox is laser-focused on both cutting costs and optimizing free cash flow, much of which it wants to continue directing toward investors through its quarterly dividend. And from a profitability standpoint, there’s a lot of sunlight—the bottom line is expected to improve by about 15%-16% both this year and next. Moreover, XRX shares are dirt-cheap, trading at just 6 times next year’s earnings estimates.

But actual growth remains evasive. The company’s most recent quarter saw total sales dip 9%, largely because of a hemorrhaging in equipment sales (-17%). While XRX might be pivoting to software, that pivot needs a push—some 80% of revenues still are generated by the print business.

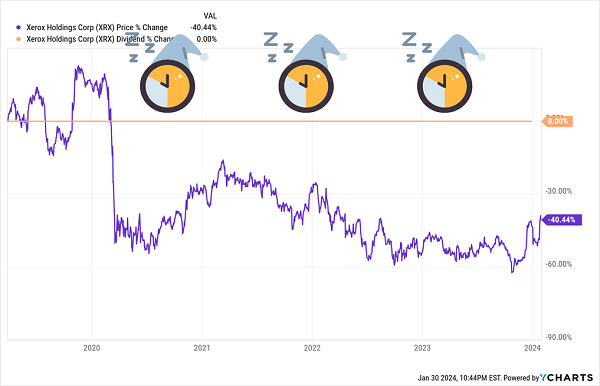

It’s also hard to get excited about the dividend, which, while certainly well above-average, has stagnated and is losing ground to inflation every year.

No Life in the Dividend, No Life in Shares

Opera (OPRA)

Dividend Yield: 7.1%

Growth hasn’t been an issue for Opera (OPRA)—a Norwegian browser provider whose primary products include the Opera line of mobile browsers, Opera News, Apex Football, and Opera Ads (an online advertising platform). It also owns 2D gaming development platform GameMaker Studio. You might not be familiar with it, but it’s better-known around the world—it operates in England, France, Germany, Ireland, Nigeria, and Spain, among other countries.

Browsers and search portals have quickly become popular venues for consumer-facing AI applications. Like Microsoft (MSFT) and Alphabet’s (GOOGL) Google here in the States, Opera is implementing AI functions into its browsers and other software. Right now, both Aria (Opera’s browser AI) and ChatGPT are fully integrated with Opera browsers, reaching customers in more than 180 countries.

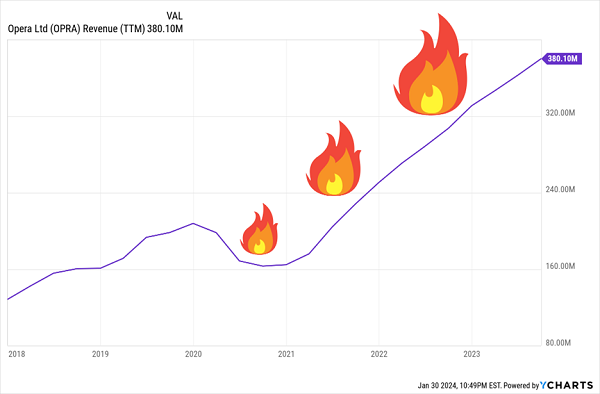

While Opera has been around since 1995, it’s a relatively recent tech IPO, going public in 2018. Growth has been red-hot so far—the company’s most recent annual revenues improved 33% year-over-year, and it boasts nine consecutive quarters of 20%-plus top-line expansion. And current-year profits are set to explode by 244%! Of particular note right now is a change in European Commission requirements that will force Apple to allow users to choose from multiple default browsers—something that could provide a tailwind of new iOS users for Opera, which monetize better than Android users.

Opera’s Business Has Caught Fire

However, Opera isn’t funneling all of these larger profits back into the business—in June, it announced a generous new 40-cent-per-share semiannual dividend that translates into a 7%-plus yield. Like with many fresh dividend programs, Opera might face questions about how long it can keep up its incredible growth ramp—indeed, 2024’s top- and bottom-line estimates are much more subdued. Still, this lesser-known tech play is worth keeping an eye on.

Opera’s dividend brings up a tradeoff you have to make with most (but not all) current high-paying tech stocks: They’re largely based overseas, which means that while they pay a lot, the payouts tend to be less frequent—and the payouts themselves can be variable based on profits, which could be problematic as you try to set up an income calendar.

Consider this quartet of high-yielding Taiwanese chip stocks:

- ChipMOS Technologies (IMOS, 5.5% yield): Taiwan-based ChipMOS is a large semiconductor services company. It provides back-end testing for high-density memory chips, mixed-signal semiconductors, and LCD drivers, as well as package assembly services. It’s in a strong financial position, with a touch more debt than cash and short-term investments. And it has been paying an annual dividend for years—though a highly variable one that came down from $2.88 per share in 2022 to $1.50 in 2023. Still, that translates into a 5%-yield today.

- ASE Technology (ASX, 6.1% yield): ASE Technology is another outsourced semiconductor assembly and test (OSAT) provider, this one offering assembly and front-end testing on four continents. Its debt-to-cash ratio isn’t as favorable as ChipMOS’s, but hardly problematic. The dividend situation is better, though—while it only pays annually, those annual payouts have been in a pretty clear uptrend for years. And its current 57.1-cent dividend is more 4x what it was in 2020!

- United Microelectronics (UMC, 7.4% yield): UMC has the distinction of being Taiwan’s first semiconductor company—a wafer foundry that was spun off by the nation’s Industrial Technology Research Institute in 1980. Like with service companies, foundries aren’t so much a play on any one chipmaker’s technological advancements—instead they’re a play on the overall growth in the chipmaking market. So as long as technologies such as AI and machine learning require more horsepower, companies like UMC can make a buck. UMC has a rock-solid balance sheet, and like ASX, its annual dividend has been surging higher in recent years.

- Himax Technologies (HIMX, 8.3% yield): Himax is a fabless semiconductor company, which means that while they design chips, the production takes place elsewhere. The Taiwan-based chip company is heavily involved in display drivers—its products power TVs, laptops, smartphones, digital cameras, and virtual reality devices, among other applications—as well as 3D sensing technology. Compared to other chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD), its product uses are fairly pedestrian, but there are still some growth opportunities here. Himax has only been paying an annual dividend for the past three years, and it has really jumped around—from about 27 cents in 2021 to $1.25 in 2022 to 48 cents in 2023. Still, it’s an obscene amount of yield for any stock, let alone a tech play.

Give Me 4 Minutes, I’ll 5X Your Retirement Income

If you’re a younger investor with plenty of horizon to spare, those dividend schedules are no big deal—just enjoy whatever growth you get and reinvest those occasional bursts of cash.

But if you’re picking retirement holdings, you need to “have it all.”

Big yields? Yes.

Growth potential? Absolutely.

A bargain price? A must.

Protection from the Fed, elections, and global disarray? You betcha.

And while we’re at it, more frequent (and more consistent) payouts.

If all that sounds like too much to ask, believe me, it’s not. Because those are exactly the kind of investments you can find right now in my “Perfect Income” portfolio.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

This post originally appeared at Contrarian Outlook.

Category: Lists of Dividend Stocks