Jerome Powell Is Secretly Helping Us Earn Yields Up To 13%

It’s a party on Wall Street! While the suits fawn over the hot “Trump trade” stocks, we dividend investors are going to dumpster dive.

Hey, we have no shame. We’re talking about yields from 7.8% to 13.4%, paid monthly!

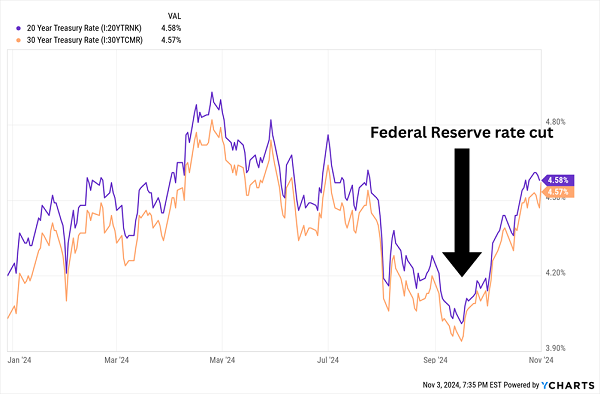

Why the bargains? Bonds have been bloodied since the Federal Reserve cut rates.

Wait, what? Let’s remember the Fed guides short-term rates. Long-term rates, on the other hand, march to the beat of their own drum:

20- and 30-Year Treasuries Above 4.5% Again

We could dip into bond exchange-traded funds (ETFs)—they’ll have the same tailwind at their back. But I prefer CEFs over bland ETFs for three very simple reasons:

- They yield more.

- They can use debt leverage to juice returns.

- We can buy some CEFs at a discount to their net asset value (NAV).

Note the emphasis on “some.” Once it was clear a bull run in bonds was a certainty, some CEFs’ discounts vanished and haven’t returned. But fortunately for us, other CEFs are still trading for less than they’re worth—while delivering an average of 10% in monthly income, no less.

Legit bargains, or cheap for a reason? Let’s explore.

PGIM Short Duration High Yield Opportunities Fund (SDHY)

Distribution Rate: 7.8%

We’ll begin with an oddball that goes a little against the grain of our theme: the PGIM Short Duration High Yield Bond Fund (SDHY). This offering from PGIM—which is part of Prudential Investment Management—plays on the short end of the yield curve. Specifically, SDHY’s managers try to maintain a weighted average portfolio duration of three years tops, and a weighted average maturity of no more than five years.

SDHY has decent-enough credit quality for a corporate junk fund, with 47% in BB-rated bonds, and another 26% in Bs. Interestingly enough, more than 10% of the portfolio is in investment-grade corporates.

If this was a plain-vanilla short-duration ETF, even on the junkier side, we could expect fairly low volatility. Not so here. That’s because SDHY utilizes a fair amount of debt leverage, at more than 20% currently.

Look at This Bond Fund Jump!

That means an awfully bumpy ride during downturns, as investors found out throughout 2022. But, near the end of the year, I pointed out that SDHY “has significant potential once the Fed starts slowing its hike pace (and especially once it actually throttles back rates).” And it did!

This PGIM fund trades at a smaller discount now (6%) than it did then (10%), but we’re still buying its bonds cheaper than we could on the open market, and we’re getting a nearly 8% yield, paid monthly, to boot.

But unlike these other funds, SDHY needs the Fed to keep its thumb pressed down on the interest rates we can see—if there are signs the Fed’s rate-cutting cycle will take a prolonged pause, this CEF’s juice could quickly run dry.

Western Asset High Income Fund II (HIX)

Distribution Rate: 13.4%

Western Asset High Income Fund II (HIX) is ostensibly a high-yield corporate fund, but it’s a little more complicated than that.

For one, it’s global; however, the U.S. makes up roughly 60% of the portfolio, while all other countries are 5% or less of assets. HIX has five double-digit sectors—four of them are actual corporate market sectors (consumer cyclical, communications, energy, and finance), and the fifth is emerging-market government bonds.

From a maturity perspective, it’s a mid-range fund—not as short-duration-focused as SDHY, but much of its allocation is bunched in the 5- to 10-year range.

And not only does HIX utilize a heavy 30% in debt leverage, but it also puts options and derivatives to use, which is how it manages to squeeze a jaw-dropping 13% out of its otherwise ho-hum portfolio.

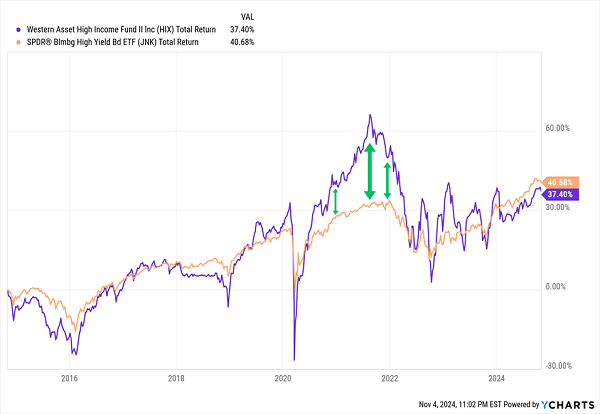

Unfortunately, for all of its fits and starts, it can’t even pull away from basic junk funds over time, and it trails its benchmark over every meaningful time period.

A Shining Moment in 2021

I don’t love turning away from a double-digit yield, but that much income has only brought HIX to par. To make matters worse, HIX has the smallest discount of all four funds here, at less than 3% currently.

Allspring Income Opportunities Fund (EAD)

Distribution Rate: 9.3%

The last time I looked at Allspring Income Opportunities Fund (EAD), back in 2020, it traded as the Wells Fargo Income Opportunities Fund. But a year later, GTCR and Reverence Capital Partners bought up Wells Fargo Asset Management, and renamed the resultant new company Allspring Global Investments.

New moniker, but the fund still has the same thrust.

EAD invests in junk of all sorts—not just high-yield bonds, but also below-investment-grade loans and preferred stocks. It’s technically a global fund, but nearly 90% of the portfolio is U.S.-based; the rest is a sprinkling of mostly developed foreign markets including Canada, Germany and France.

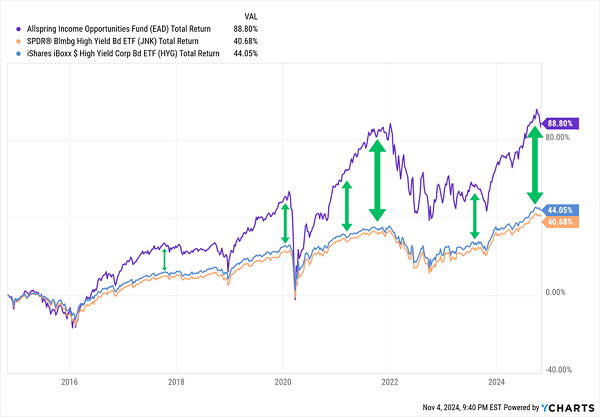

Allspring’s CEF is even more aggressive with leverage, at around 30%. That’s why, like with HIX, we’ll see wild swings compared to bare-bones junk ETFs.

But over time, EAD finds itself farther and farther ahead despite deep pullbacks when the bond markets go cold.

EAD Is a Long-Term Winner

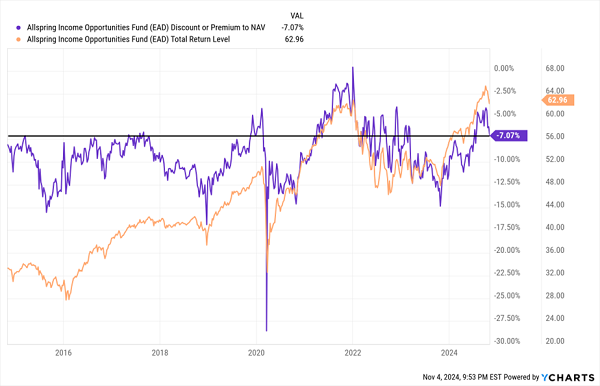

EAD will probably benefit from a tamping down of long-term rates. But I do wonder about its price right now.

Its current 7% discount to NAV is only a little slimmer than its five-year average discount of 8%.

But historically, we could do a lot better waiting for a wider discount.

EAD Doesn’t Often Trade This “Expensive.” And When It Does, It’s Not Great.

BlackRock Credit Allocation Income Trust (BTZ)

Distribution Rate: 9.3%

The BlackRock Credit Allocation Income Trust (BTZ) is a multisector bond fund that’s happy to dabble in just about everything.

It’s heaviest in traditional fixed income–roughly 65% of the fund is allocated to investment-grade bonds (35%) and junk (29%). But it also has significant exposure to non-U.S. developed-market sovereigns and securitized products, and a smattering of bank loans and emerging-market debt.

We’re also getting solid credit quality, with a roughly 60/40 split of investment-grade to junk. And BTZ is in our sweet spot on the yield curve, with a weighted average life to maturity of nearly 22 years.

One reason I like looking at BTZ is it exemplifies how CEFs benefit from active management and having more tools to work with. Managers can hunt down value-priced bonds rather than just plugging in whatever an index tells them to, and they’re also able to scour the credit world for other appealing instruments at times when bonds aren’t the top play. They can also push the pedal down on leverage—BTZ is using a high 35% right now.

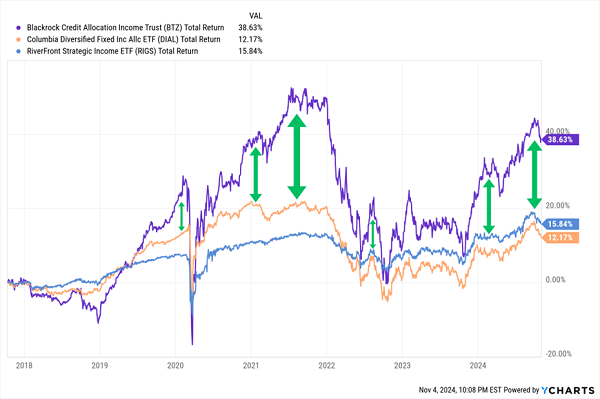

That’s why we’ll get volatility like this, but also outperformance compared to other actively managed ETFs in the multibond space.

BlackRock Knows What It’s Doing

A wild 9%-plus yield, paid monthly, further pads the case.

This Monthly Dividend Portfolio Pays Us 8%+ (Without the Drama!)

My greatest short-term concern here is that, like with EAD, BTZ, which trades for 93 cents on the dollar, is on the low end of its discount history—a place where it typically doesn’t fare well.

So where can we find high monthly yields that we can actually jump on right now?

I’ve taken the time to sort through nearly 500 CEFs to find the very best high-yield plays—at the best values—to stash away in my “8%+ Monthly Payer Portfolio.”

Don’t miss out on these terrific income plays while you can still get in at a bargain. Click here for all the details and to download a FREE Special Report revealing the names and tickers of all the stocks and funds in my 8%+ Monthly Payer Portfolio.

This post originally appeared at Contrarian Outlook.

Category: Dividend Yield