How We’ll Build An Automatic “Dividend-Momentum Machine” In 2023

We dividend investors know that 2023’s going to throw us some curveballs. So let’s talk about a simple strategy that helps us buy more shares of our favorite stocks during pullbacks.

Because the truth is, the Fed is still hiking, inflation is well north of 2% and the economy is humming along. That last point is a headache for Fed officials as they need to “cool” the economy to get inflation down. That’s code for inducing a recession.

A New Spin on a Classic Strategy

This uncertainty is why I’m counseling caution when it comes to buying stocks these days. But if you are tiptoeing into this market, only do so if:

- You have a long time horizon and …

- You do so gradually, using our “modified” dollar-cost averaging (DCA) approach.

What do I mean by “modified” dollar-cost averaging? It’s a lot like the DCA strategy you may have used to build your own portfolio, but with a potent upside kicker. Here’s what this “perfect for 2023” strategy will do:

- Give us an income stream that grows all year long. And if we reinvest our payouts, we get a “dividend momentum machine” that rolls along on its own, boosting our dividends every quarter (and providing a nice inflation hedge) without us having to do anything at all.

- Boost our long-term gains, by letting us roll our extra cash into our favorite dividend payers on pullbacks.

The best way to show you how this savvy approach works is to put it in play with the kind of stock we income seekers are always on the hunt for: one with a decent yield and a growing payout backstopped by a strong business.

Blue-chip networking play Cisco Systems (CSCO) ticks those boxes, with a 3.2% current yield (more than double the payout on the typical S&P 500 stock) that’s safe, accounting for just 47% of the company’s last 12 months of free cash flow. Cisco’s payout is also growing nicely, up 124% in the last decade. That includes 2022, when tech—from blue chips to profitless crypto peddlers—got hammered.

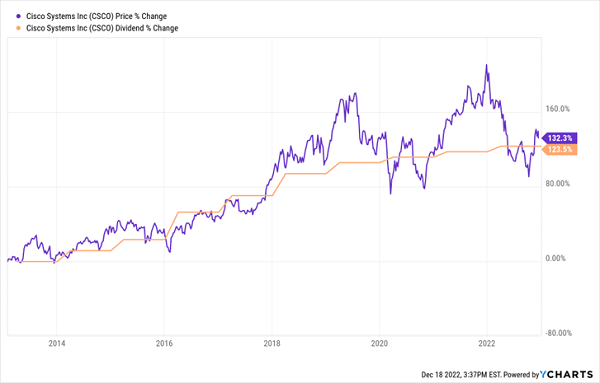

Cisco is also an excellent example of my Dividend Magnet approach (the predictable pattern of a rising payout pacing a company’s share price higher) in action. As you can see below, over the past decade, Cisco’s payout has tracked the stock higher, point for point:

Where Cisco’s Dividend Goes, Its Stock Follows

As the above chart shows, the stock has returned 132% in the last decade, but Cisco has swung widely for a blue chip: over the past year, you’ve been able to buy it for as little as $39 a share (in early October) or as much as $64 (in late December 2021). That makes the stock a good test case for our “modified” DCA strategy.

So let’s set up a simple scenario where we had $100,000 to invest in Cisco. Instead of going in all at once on a specific date, we rolled our cash in at the start of every month over the past year, in lots of $8,333.

During that span, we were able to buy for as cheap as $41.30 a share (at the start of October), at which time our $8,333 got us 201 shares. Our highest price, $63.16, came in early January, when our $8,333 bought 131 shares. So right away, we can see that we’re naturally throttling back our purchases when the stock is pricier.

Here’s the key takeaway, though: over the 12-month period, our average purchase price on Cisco was just $49.23, which is far below our $63.16 peak. So with a DCA strategy, we always avoid the risk of going all-in at the peak.

There’s more, though: while that average price is right around today’s level of $49, by following a DCA approach, we’ve been collecting a growing stream of income from Cisco all year long. That gives us a big advantage over an investor who waits for the right price, and risks missing out entirely.

Finally, the “modified” part of our strategy: if we’d kept some extra cash on hand for moving into the stock when it got overly cheap, we’d have grabbed ourselves some nice “bonus” upside, too. Since the stock hit its low in early October, for example, it’s soared 21%, as of this writing, as positive news on inflation powered tech stocks higher.

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks