Dogs Of The Dow 2024: Cheap Dividends, But Are They Values?

The 2024 Dogs of the Dow are particularly homely hounds—which means we’re talking big dividends.

This year’s Dogs yield more than three-times the broader market’s paltry payout. So, should we hold our noses and buy? Let’s grab some peanut butter treats and investigate. But first, a review of the “Dogs” strategy.

The “Dogs of the Dow” strategy means buying the Dow Jones Industrial Average’s laggards. It’s a simple three-step strategy that often outperforms in the year ahead:

- Step 1: After the final trading day of the year, identify the 10 highest-yielding stocks in the Dow.

- Step 2: Buy all 10 stocks in equal amounts and hold them for a year.

- Step 3: At the end of the year, sell, then rinse and repeat.

The core concept here is the dividend. For a blue-chip stock, a high yield is an indicator of value.

Dow stocks generally aren’t cheap for a reason. They don’t go out of business. They tend to yield a lot simply because they are out of favor.

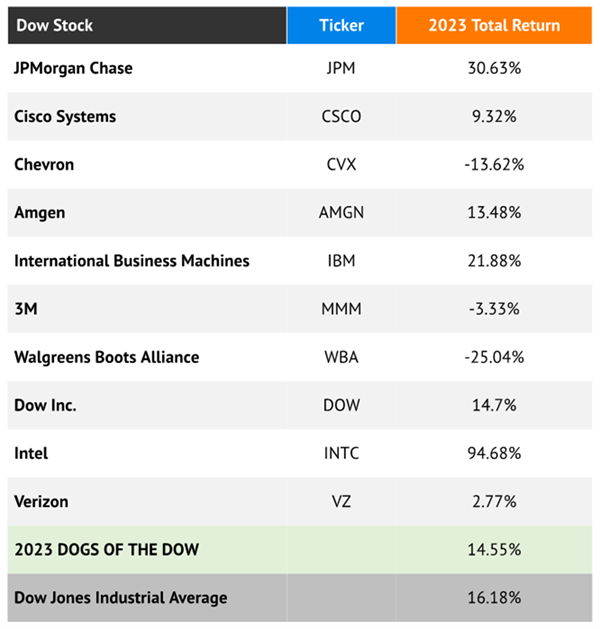

The Dogs have historically boasted an outstanding long-term track record, but they’ve panted recently. The Dow Dogs lumbered behind the market in 2019, 2020, and 2021. They raced ahead in 2022, but they laid down once more in 2023.

2023’s Dogs Trailed the Pack

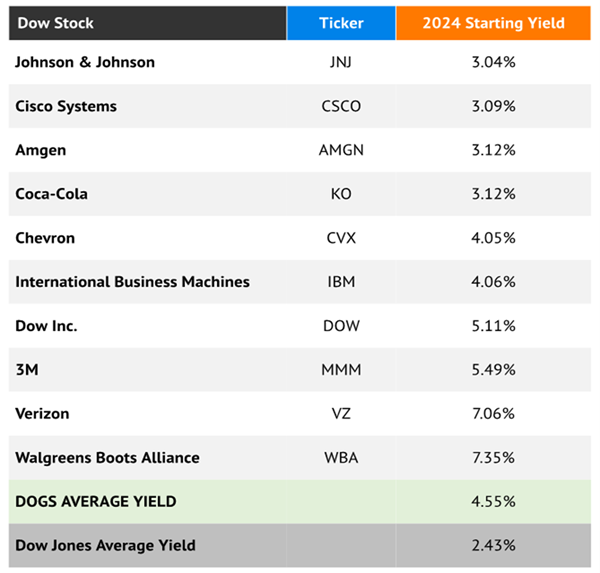

Very few of 2023’s Dividend Dogs cycled out—a whopping eight return, with Coca-Cola (KO) and Johnson & Johnson (JNJ) joining the group this year.

The 2024 Dogs

While the Dogs still sport a respectable long-term performance, a 20% beat rate of the Dow Jones Industrial Average over the past five years suggest we may want to use our brains before we let any cold nose into our 2024 portfolio.

Even with the Dogs averaging a 4.6% annual yield, we’d still be well behind the “perfect” amount of portfolio income (which is closer to 8%). That means a million bucks put to work in the Dogs would generate just $46,000 annually—so we’d need some upside potential as well.

Now let’s begin the Dow Dog show with a classic breed.

Johnson & Johnson

The Skinny: Johnson & Johnson (JNJ, 3.0% yield to start 2024) will start out 2024 much lighter than it started 2023, thanks to August’s spinoff of its Kenvue (KVUE) consumer-products division. The move didn’t exactly trigger any excitement last year—shares finished 2023 lower by 9% even after factoring in dividends, versus a slight gain for the healthcare sector and a 26% total return for the S&P 500. Even a boost to its top- and bottom-line forecasts in October wasn’t enough to get the stock back into the green.

What Has to Go Right: In short: Johnson & Johnson needs a catalyst. Medicare’s first price negotiations will begin this year, and J&J’s Stelara, Xarelto and Imbruvica (which it markets with AbbVie [ABBV]) are in those crosshairs. Also, in the same third-quarter update that saw JNJ upgrade its guidance, the company also reported lower sales for Imbruvica, Remicade and Zytiga. Meanwhile, Stelara—its hugely successful psoriasis and arthritis treatment—also faces a patent cliff in Europe this year, and U.S. competition in 2025.

Cisco Systems

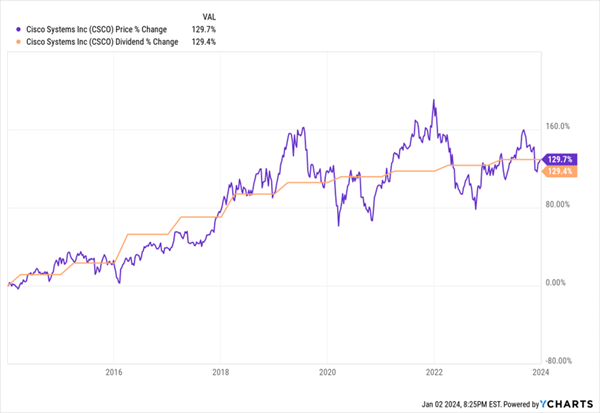

The Skinny: Cisco Systems (CSCO, 3.1% yield) largely tracked the market throughout 2023—until it delivered lousy guidance in November that knocked it off course, that is. While it improved earnings guidance for the full fiscal year, it brought revenue forecasts from a $57.0-$58.2 billion range down to $53.8 billion to $55.0 billion. It said that after three quarters of robust orders, “customers are currently focused on installing and implementing products.” That sent the stock skidding—shares delivered a mere 9% total return, not only underperforming the broader market, but lagging the tech sector’s 56% return by a whopping 47 percentage points.

What Has to Go Right: Apparently the only thing getting in Cisco’s way is its enterprise customers’ slow IT teams! I joke, of course, but clearly Cisco needs a pickup in orders. Right now, like with just about every large tech company, everyone is loosely pinning growth hopes to artificial intelligence offerings—in Cisco’s case, AI architecture. Also worth watching Cisco’s deal to acquire Splunk, which was announced in September 2023 and expected to close in 2024. Namely, will Splunk actually drive meaningful gains in cybersecurity share, or will it just create short-term improvements in margins? And I can’t stress this enough: A little momentum in the dividend couldn’t hurt CSCO shares.

Cisco (CSCO) Is a True Dividend Magnet, For Better and Worse

Amgen

The Skinny: Biotechnology firm Amgen (AMGN, 3.1% yield) had itself a respectable year—while its 13% total return was roughly half that of the broader market, it came in well ahead of a weak healthcare sector. As of its Q3 report, sales were pacing slightly higher for full-year 2023, and profits were booming, up more than 20% through the first nine months. Also worth noting: In October, Amgen completed its acquisition of Horizon Therapeutics, which specializes in treatments for rare inflammatory diseases. And a bonus for dividend investors: Near the end of the year, Amgen announced a 10% payout hike!

What Has to Go Right: Two words: Weight loss. 2023 saw an explosion of interest in GLP-1 agonists such as Ozempic and Mounjaro—diabetes drugs that have wowed the world for their spectacular weight-loss abilities. And now, investors are waiting for news on such drugs from every major pharma name. Amgen has two key data points coming up in 2024: Phase 1 trial data from an oral weight loss medication (AMG 786), due out in H1 2024, and Phase 2 trial data from an injectible drug (maridebart cafraglutide, formerly AMG 133), due out in H2.

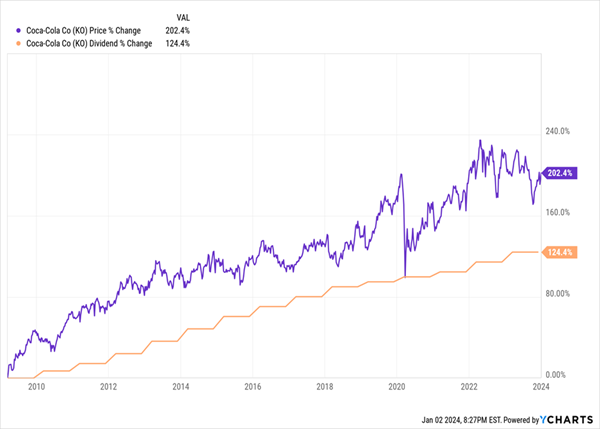

Coca-Cola

The Skinny: Consumer staples were left behind in 2023, delivering a slightly in-the-red finish even with dividends included—an unsurprising result as the market went fully risk-on. Coca-Cola (KO, 3.1% yield) did slightly worse, retreating about 4%. Funnily enough, at least some of the sector’s (and KO’s) difficulties can be chalked up to those aforementioned GLP-1 agonists, which some analysts fear will drastically reduce food consumption enough to make a dent in food stocks’ bottom lines.

What Has to Go Right: For one, investors could realize that these fears are perhaps a bit overblown—or at least too early. GLP-1 agonists are extremely cost-prohibitive right now, Medicare probably won’t cover it for years, they’re primarily injectables (which is limiting adoption), and very little is known about potential side effects that could pop up over the longer term. One potential driver of profits in 2024 is terribly boring but perhaps effective: the continued efforts to refranchise several of its bottling operations worldwide.

Coca-Cola: Just Taking a Break From Its Relentless Trudge Higher?

Chevron

The Skinny: In short: Oil didn’t do well in 2023, and neither did Chevron (CVX, 4.1% yield) shares. Don’t get me wrong: U.S. crude oil did plenty of moving, but it was a roller-coaster path just to arrive at a single-digit loss on the year. Chevron was pacing poorly all year, but a wide miss on Q3 earnings in late October was the final nail in CVX’s coffin—at least in 2023. Chevron started 2024 with an unwelcome announcement that it would suffer an impairment charge of up to $4 billion because of regulatory challenges in California.

What Has to Go Right: Perhaps investors will warm up to better prices on CVX shares, which now trade for less than 11 times earnings estimates. Or perhaps they’ll start to become optimistic over its acquisition of Hess—also announced in October—which provides the integrated energy major with assets such as Bakken shale acreage and a 30% ownership stake in offshore Guyana. But ultimately, most optimism around CVX is tied to optimism that commodity prices will recover in 2024.

International Business Machines

The Skinny: You can’t get through a day without seeing 30 ads about International Business Machines’ (IBM, 4.1% yield) watsonx AI platform, so in a year where everything AI kicked butt, you’d have thought IBM shares would’ve doubled or better. But no. Not that anyone is turning up their nose at a 22% total return in a big, blue-chip Dow stock, but IBM’s performance trailed both the S&P 500 and was woefully shy of the broader tech sector.

What Has to Go Right: IBM is perhaps as defensive as a tech stock gets, so at no point should you expect shares to suddenly go vertical. But a turbulent environment in 2024 might actually be beneficial to IBM, which provides investors with a way to participate in AI (and hybrid cloud) growth while still collecting a 4%-plus dividend.

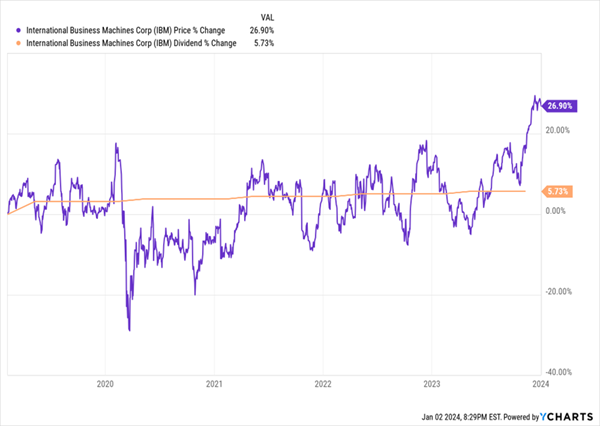

Maybe AI Can Pull IBM’s Stagnant Dividend Higher, Too

Dow Inc.

The Skinny: Dow Inc. (DOW, 5.1% yield) pretty much tracked the sector throughout 2023, putting up a decent total return (+12%) but lagging the broader market—and most of that gain came during the year’s final-quarter rally.

What Has to Go Right: Dour outlooks for global economic activity need to be proven wrong. Many core Dow chemicals, including propylene, ethylene and polyurethanes, are suffering from declining prices. “Team Dow continued to advance our long-term strategy while also taking proactive actions to reduce costs and maximize cash generation in a challenging macro environment,” CEO Jim Fitterling said in the company’s Q3 earnings. And as long as that macro environment continues to be challenging, Dow will have a hard time reverting to the mean like Dow Dogs are expected to do.

3M

The Skinny: 3M (MMM, 5.5% yield) stunk—again. MMM shares followed up on 2022’s 30% plunge with an admittedly better 3% decline (dividends included), but that’s not much condolence for MMM shareholders dealing with a half-decade of underperformance. The company announced yet another restructuring in 2023 amid disappointing sales growth and margin struggles. 3M actually upgraded its full-year 2023 sales guidance as part of its Q3 report, but that guidance is still for single-digit revenue declines.

What Has to Go Right: The spinoff of Solventum. 3M is expected to send its healthcare unit public during the first half of 2024, and this move is getting mixed reviews. On the one hand, Solventum has consistently failed to meet management’s growth targets despite several big M&A moves over the past few years. On the other, Solventum was responsible for 28% of operating income in 2022—and that’s income 3M very much needs to pay its very high dividend. I’m not quite ready to say that 3M’s 65-year dividend-growth streak is in danger, but the payout requires a closer eye than ever.

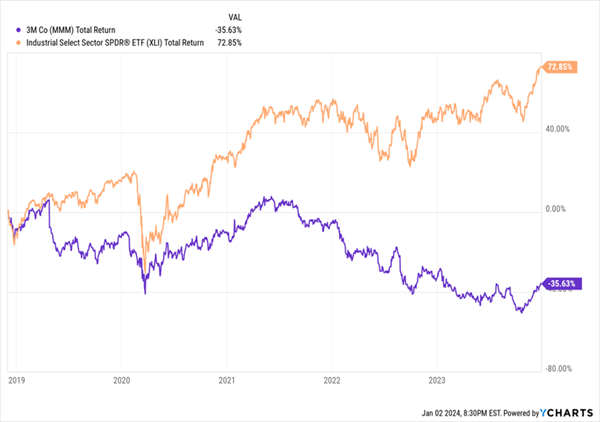

If You Know a Grouchy MMM Shareholder, Here’s Why

Verizon

The Skinny: Verizon (VZ, 6.9% yield) shareholders would surely love a mulligan of 2023, given that even counting their juicy dividends, VZ shares still finished 14% in the red. Compare that to the rocket ship that was Verizon’s sector (communication services, +84%), and clearly there’s very little reason for cheer. Among Verizon’s issues in 2023 was a difficulty holding on to prepaid subscribers as it continues to digest its 2021 Tracfone acquisition.

What Has to Go Right: A thin forward P/E of just above 8 shows that Wall Street might be disrespecting Verizon a little too much right now. The company is coming off peak 5G spend in 2022, it’s churning out plenty of free cash flow, and it provided raised guidance for full-year 2023 during its last earnings report. (Though 2024 results are expected to be fairly flat.) There are no growth catalysts on the horizon—instead, VZ must attract investors with a decent value proposition and one of the Dow’s biggest yields.

Walgreens Boots Alliance

The Skinny: Don’t get excited.

While Walgreens Boots Alliance (WBA, 7.4% yield*) started the year with the largest payout of them all, that payout is now half of what it was. Walgreens announced early in January that it was halving its payout, to 25 cents per share. Yes, at a 3.7% yield, WBA would still qualify for Dog inclusion, but this is no longer the payout powerhouse it otherwise would have been.

What Has to Go Right: The dividend cut is intended to free up cash for growing both its healthcare and pharmacy divisions. Is it a sensible strategy to turn around the diving stock? Probably. But investors looking for income security have little reason to trust Walgreens in wake of this massive payout cut.

This post originally appeared at Contrarian Outlook.

Category: Lists of Dividend Stocks