How To Buy Yields Up To 12% For Pennies On The Dollar

As contrarians, we search for income stocks that vanilla investors hate. Today there are not many dividend deals left. No surprise, with the market levitating since last October.

But! When we expand our search to CEFland, we do find a few closed-end funds (CEFs) left at the bottom of the bargain bin. Today we’ll discuss five that pay between 5.7% and 11.7% and trade at discounts between 12% and 18%.

In other words, these five CEFs trade for 82 to 88 cents on the dollar. Let’s explore whether each dividend is “cheap for a reason.”

General American Investors (GAM)

Distribution Rate: 5.7%

Discount to NAV: 18.4%

General American Investors (GAM) is a straightforward large-cap CEF that holds “companies with above-average growth potential.” If you took a look at GAM from a sector perspective, you might convince yourself you were looking at an S&P 500 index fund.

Only once you dive into top holdings do you see a meaningful difference—typical positions like Apple (AAPL) and Microsoft (MSFT) are spiced up with holdings such as Republic Services (RSG), Arch Capital (ACGL), and Everest Group (EG). Also, unlike an S&P 500 ETF, GAM has the option of debt leverage at its disposal—though management only uses it modestly, at a 12% clip currently.

General American Investors is something of an institution; this CEF is just a few years away from its centennial. It’s rare to find any investment with a 50-year track record, but GAM has one—and at a 12.7% annualized total return, that track record actually has the S&P 500 beat, by 1.5 percentage points.

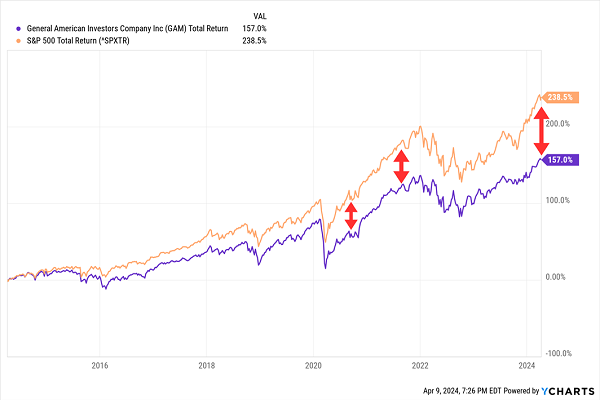

So, why the discount? Well, it’s possible that investors are buying the S&P instead given that GAM mirrors the benchmark, but always does “a bit worse:”

Losing Ground to the Index Probably Isn’t Helping

On one hand, we could argue that an investor could simply buy SPDR S&P 500 ETF (SPY) and be done with it. On the other hand, GAM is a way to buy the same stocks for just 82 cents on the dollar.

I don’t love SPY here, which means needless to say, I don’t love GAM either. But it is an interesting payer to keep in mind during market washouts. It’s a sneaky way to buy SPY for less.

Royce Value Trust (RVT)

Distribution Rate: 7.3%

Discount to NAV: 11.8%

The Royce Value Trust (RVT) is another institution: the first small-cap closed-end fund, coming to life in 1986. And it provides us with the potential to double up on value.

For one, Royce Value invests in small-cap stocks, but does so through a value lens, buying companies “trading at what Royce believes are attractive valuations.” Right now, that means a portfolio heavy in industrials, financials and (believe it or not) tech—top names include orthopedic med-tech firm Enovis (ENOV) and aircraft leasing firm Air Lease (AL).

RVT also trades at a 12% discount to NAV, which is a little cheaper than its long-term average 10% discount.

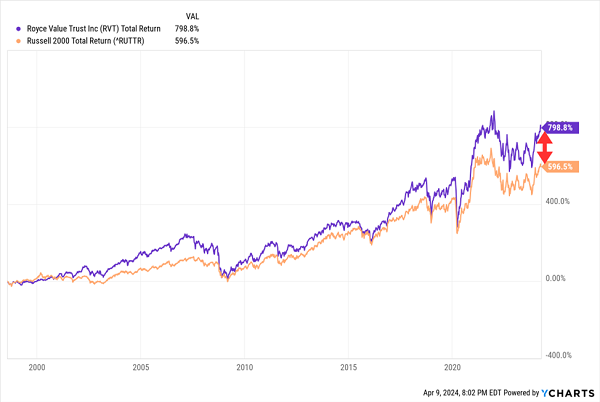

Here, Royce looks much better in recent years than General American Investors, actually outstripping its benchmark (the Russell 2000) by a fair margin.

Royce Demonstrates Its Value Against the RUT

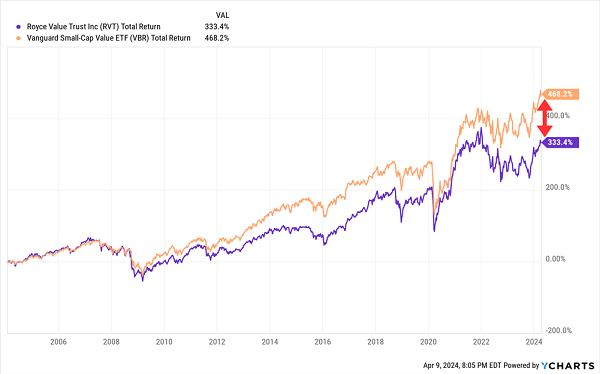

But on the other hand, an indexed small-cap value strategy has had RVT’s number for years.

Maybe It’s Not Such a Great Value After All

Neuberger Berman Next Generation Connectivity Fund (NBXG)

Distribution Rate: 10.1%

Discount to NAV: 16.4%

The tech sector is, ahem, a bit light on values at the moment. But we can buy some of the hottest stocks out there—Nvidia (NVDA), Taiwan Semiconductor (TSM), ASML Holding (ASML)—for roughly 83 cents on the dollar today through Neuberger Berman Next Generation Connectivity Fund (NBXG).

NBXG, a de facto AI play, holds stocks that fund management believes to “demonstrate significant growth potential from the development, advancement, use or sale of products, processes or services related to the fifth generation mobile network and future generations of mobile network connectivity and technology.” That results in a predominantly tech-heavy portfolio laced with chipmakers, though it also includes telecoms, consumer discretionary names, and sprinklings of other sectors.

And, being a CEF, Neuberger’s next-gen fund can also hold private and restricted stocks—14% of assets are spent this way, invested in firms including AI writing company Grammarly and cybersecurity name Arctic Wolf Networks.

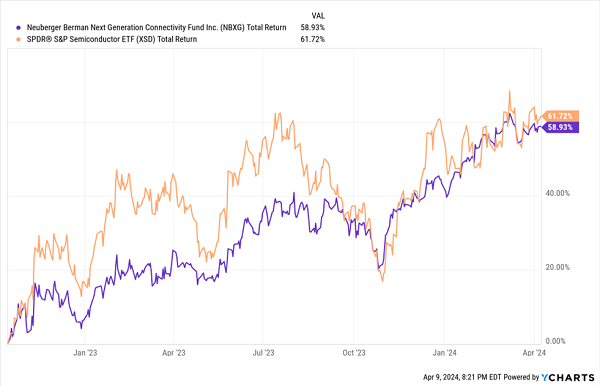

NBXG isn’t yet three years old, and it launched right ahead of the tech sector’s 2022 stumbles. And despite a somewhat more diversified portfolio—not to mention using a covered-call strategy that helps support the dividend—this tech fund has been able to keep pace with a full-fledged portfolio of red-hot chip names.

With Less Volatility, to Boot

abrdn Healthcare Investors (HQH)

Distribution Rate: 11.7%

Discount to NAV: 15.6%

How about healthcare, the sector that never goes out of style?

If abrdn Healthcare Investors (HQH) sounds strange, it’s because the fund changed hands. Last year, arbdn (itself formerly “Aberdeen”) snapped up HQH and several other tech and health funds from healthcare investment adviser Tekla Capital Management.

HQH is much the same, though. This is a portfolio of healthcare names—predominantly biotech (65%), with pharmaceuticals (14%), healthcare equipment (8%), and life sciences tools and services (7.6%), among other industries. Most of that exposure is through traditional public equity, but it does have a small 7% allocated to venture capital holdings.

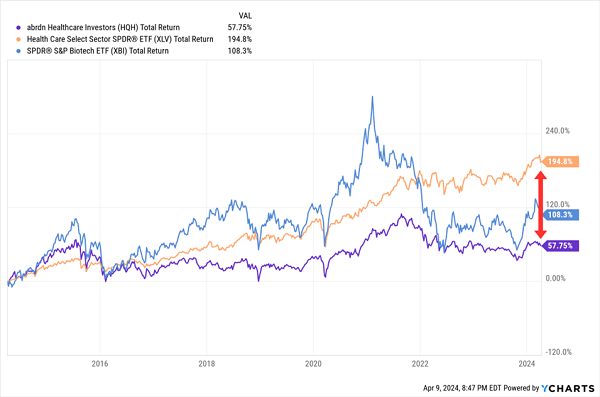

HQH currently offers a 16% cut on its holdings that’s far deeper than its long-term 9% discount to NAV. Unlike NXBG, however, HQH doesn’t have a great track record.

HQH Isn’t Flatlining, But It’s Not Exactly Full of Life, Either

That HQH is trailing both pure biotech index funds and diversified healthcare index funds tells you that you’re not really getting the best of any worlds here.

Kayne Anderson Energy Infrastructure (KYN)

Distribution Rate: 9.1%

Discount to NAV: 15.2%

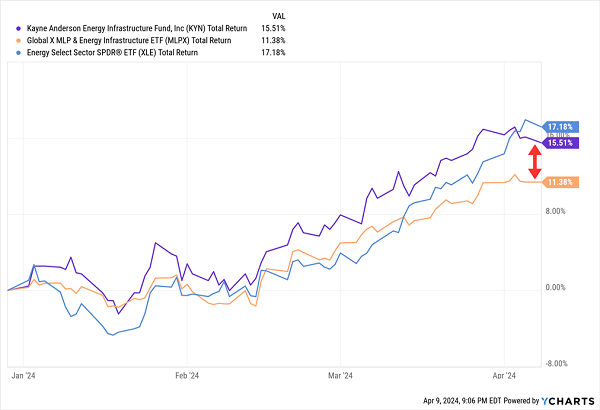

Energy is a clear leader in 2024’s rally, and MLPs and other infrastructure are enthusiastically joining. That’s good news for Kayne Anderson Energy Infrastructure (KYN), which is out ahead of plain MLP strategies and keeping step with the broader energy sector.

KYN is an energy infrastructure CEF, investing the lion’s share of its assets (93%) in traditional oil, natural gas, and LNG midstream firms, with 7% going toward utilities and other energy stocks. The firm is allowed to invest in renewable infrastructure but currently has no assets dedicated to that industry.

It’s a tight portfolio—one with roughly 10% weightings to Energy Transfer LP (ET), Enterprise Products Partners LP (EPD) and MPLX LP (MPLX). But it kicks these already high-yielders into a higher gear by using moderately high debt leverage (20%)—and as a result, it throws off a wild 9%-plus distribution.

I prefer to buy KYN when energy is out of favor. The sector is a bit hot for my liking right now.

Earn a Reliable 8%+ in Retirement—Paid MONTHLY

Yes, we need massive yields from our retirement holdings to ensure we don’t have to dip into our nest eggs later in life.

But big yields won’t mean a thing if our principal is bleeding out.

That’s why, rather than speculating on these B- and C-list CEFs, instead put my faith in the beautifully boring, high-yielding blue chips I hold in my “8%+ Monthly Payer Portfolio.”

The “8%+ Monthly Payer Portfolio,” as the name would imply, can clearly deliver high levels of yield.

But it’s not just about that—this portfolio is about earning high yields by leveraging steady-Eddie holdings with the potential to deliver meaningful price upside, too.

It’s time to get serious about locking down our core retirement holdings. Click here to learn everything you need about these generous monthly dividend payers right now!

This post originally appeared at Contrarian Outlook.

Category: Dividend Yield