Bots, Barrels, Banks, And Biopharma: Inside 2023’s Dividend Doldrums

The latest report from Dan Lefkovitz, strategist at Morningstar Indexes, examines dividend-stock underperformance in 2023.

Recent weakness among Morningstar dividend indexes is less about interest rates than a narrow equity market; long-term upside remains.

Equities have logged solid gains so far this year. After the aggressive monetary policy response to stubbornly high inflation sent markets diving in 2022, stocks have clawed their way back in 2023. The Morningstar Global Markets Index, a broad gauge of developed and emerging-markets equities, is up roughly 16% for the year through July 14, 2023, while the Morningstar US Market Index, has advanced more than 18%.

What then explains the poor showing for dividend-paying stocks? Why is the Morningstar Dividend Yield Focus Index 2 in negative territory in 2023? Why are Morningstar dividend-growth indexes lagging so far behind the overall market? Is the long-term case for dividend-paying stocks still intact?

Key Takeaways

- Rising interest rates are an unlikely cause of dividend-stock underperformance in 2023. The historical relationship between rates and dividend payers is mixed. In 2022, for example, dividend-paying stocks outperformed the broad equity market even as rates rose dramatically in the US and across the globe.

- The equity income section of the market has suffered from lack of exposure to artificial intelligence-related businesses (bots) and too much exposure to underperforming banks, biopharma stocks, and the energy (oil barrels) sector.

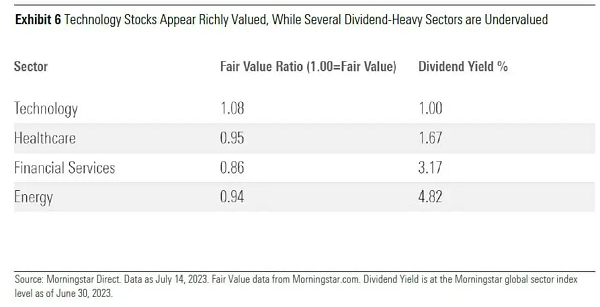

- Morningstar’s forward-looking equity research views the technology sector as overvalued and several dividend-rich sections of the market as attractively valued. Dividend-paying stocks have underperformed for stretches before, but resilience during downturns sets them up for long-term success.

- Dividend stock underperformance in 2023 has more to do with the dynamics of a narrow, tech-led equity market. Companies perceived to be benefitting from artificial intelligence have soared in 2023, but few of these stocks are dividend rich.

Dividend Doldrums Can’t Be Pinned on Interest Rates

Could rising interest rates be undermining dividend-paying stocks? The conventional wisdom holds that when interest rates go up, the equity-income section of the market goes down. Higher rates lift yields on bonds and cash deposits, making dividends less attractive for income investors. That’s the theory.

In practice, though, interest rates have an unpredictable impact on dividend-payers. Consider the behavior of Morningstar dividend indexes since March 2022, when the U.S. Federal Reserve began hiking its federal-funds rate to combat persistent inflation. Seven hikes in 2022, including four straight hikes of 75 basis points, then three hikes of 25 basis points in the first half of 2023, raised the funds rate by more than 5 percentage points. Dividend-payers responded by outperforming the broad equity market in 2022 and then underperforming in 2023.

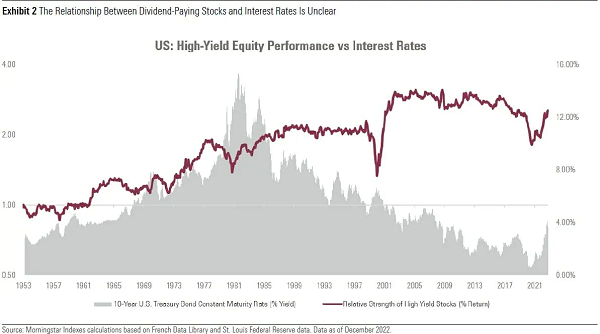

If that seems like a head-scratcher, consider the historical record. Morningstar Indexes have examined the performance of dividend-paying stocks under different rate regimes across several equity markets using the French Data Library, the IMF, and the St. Louis Federal Reserve. We observed no clear relationship between interest-rate regimes and the performance of dividend-payers in Australia, Germany, Japan, the United Kingdom, or the United States.

Below, we compare the relative performance of U.S. high-yield stocks to the yield on the 10-year Treasury. This graph demonstrates no clear relationship between interest rates and the relative performance of income-generating equities.

In some periods of rising U.S. interest rates, such as in the mid-1970s, dividend-paying stocks outperformed the market. As rates fell from the mid-1980s to the mid-1990s, the performance of high-yield stocks relative to the market was fairly flat. When the Federal Reserve cut rates in the late 1990s in the wake of the Asian financial crisis, it did not benefit dividend-payers. During the technology bubble of that time, investors cared little for earnings, let alone dividends. Then, in the extremely low interest-rate environment extending from 2008-15, high-yield equities lagged again. The problem this time was the struggles of high-yield sectors, from financial services to energy and materials.

A Narrow, Techy Market

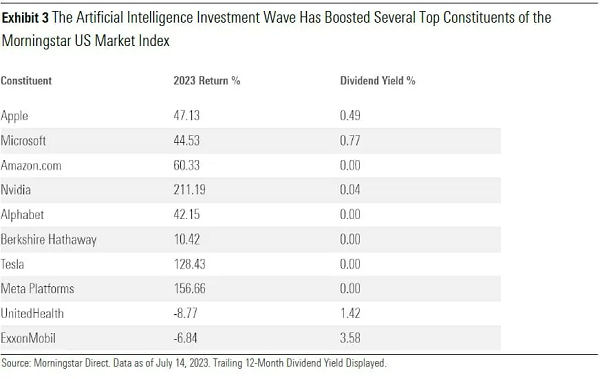

The Morningstar Global Markets Index may be up 16% so far in 2023 and the Morningstar US Market Index up more than 18%, but those gains are anything but broad-based. Three quarters of the gain from U.S. equities can be attributed to just seven stocks: Apple, Microsoft, Nvidia, Amazon.com, Meta Platforms, Alphabet, and Tesla.

The dominant investment theme of 2023 has been artificial intelligence. Ever since the launch of AI-powered chatbot, ChatGPT, in late 2022, enthusiasm has built around a potentially transformative new technology. Companies perceived to be benefiting from AI have soared, including many of the largest public companies in the U.S. (and the world). Nvidia, a semiconductor-maker seen as a key supplier for the AI boom, is the foremost example—like many of the largest stocks in the market, it’s not exactly dividend rich.

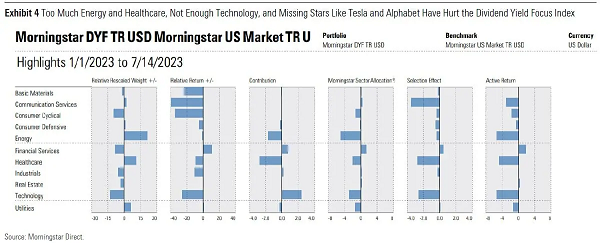

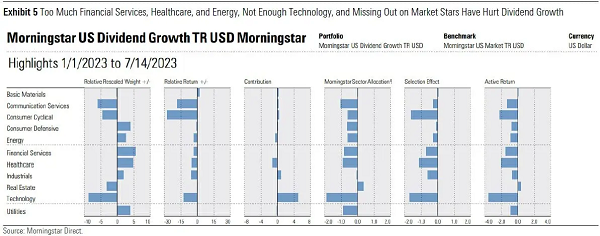

Attribution analysis in the Morningstar Direct investment analysis platform reveals the sector and security-level causes for dividend stock underperformance. Below are summary analyses for the Morningstar Dividend Yield Focus Index and the Morningstar US Dividend Growth Index.

Exhibit 4 shows that Dividend Yield Focus was held back by above-market exposure to energy and healthcare stocks and below-market exposure to technology. Missing out on stars like Nvidia and Apple (technology), Alphabet and Meta (communication services) and Tesla (consumer cyclicals) also hurt.

The Morningstar US Dividend Growth Index has more technology exposure than Dividend Yield Focus but did not include enough of the strongest-performing tech stocks. In general, it suffered from some of the same issues as Dividend Yield Focus. Above-market exposure to financial services was also a big detractor.

The attribution analysis reveals weakness across many areas of the equity market that is not connected to artificial intelligence in 2023. Uncertainty surrounding the direction of the economy, inflation, and interest rates has weighed on investor sentiment. Dividend-rich sectors of the market have struggled in various ways:

- Financial Services: A spate of bank failures has shaken confidence in the sector. Truist, a Dividend Yield Focus Index constituent, has seen its share price decline this year, as have Bank of America, U.S. Bancorp, and PNC Financial Services in the Morningstar US Dividend Growth Index.

- Energy: The price of oil per barrel soared in 2022 on Russia’s invasion of Ukraine and pandemic-related supply/demand imbalances, but the shock has subsided this year. Dividend Yield Focus Index constituents ExxonMobil, Chevron, and Pioneer Natural Resources are all in negative territory for the first half of 2023. Chevron and ConocoPhillips were the key Dividend Growth constituents to suffer.

- Healthcare: Biopharma stocks that have not benefited from the weight-loss drug craze have generally been out of favor in 2023. Pfizer and AbbVie, constituents of both Dividend Yield Focus and Dividend Growth, are coming down from COVID highs and are facing competitive pressures.

The Outlook for Dividend-Payers Is Strong

Longtime dividend investors know that periods of underperformance come with the territory. That’s especially true when equity markets are led by high-flying technology-related names. Though the sector has improved in its shareholder payouts, it remains relatively light on dividends. Alphabet, Amazon.com, and Tesla do not pay dividends at all.

After the runup in technology and AI-related names in 2023, the future may not be as bright as the recent past. Morningstar Equity Research sees the technology sector as overvalued when stock-level price/fair value ratios are aggregated to the sector index level. Nvidia and Apple, for example, both traded at premiums to estimates of intrinsic value as of midyear 2023. Meanwhile, the healthcare, energy, and financial-services sectors were viewed as undervalued with upside potential.

Meanwhile, dividend-paying stocks can boast a strong long-term track record. The reason the red line in Exhibit 2 slopes up and to the right is that over time, dividend-payers have outperformed the broad equity market. A substantial portion of the returns from equities comes from reinvested dividends and dividend growth. This is true not just in the U.S. but also across global markets.

Why? Dividend-payers tend to be established, steadier-than-average companies, confident enough in their cash flows to commit to returning cash to shareholders. Because investors are extracting income from their stock holdings, they are less likely to sell on bad news. Perhaps most importantly, the dividend commitment instills discipline. Corporate managers and directors find cash piles tempting. Rather than use excess cash to fund acquisitions that may or may not create value, buy back shares at prices that may or may not be attractive, or fund speculative growth initiatives, executives must steer a steady ship to maintain the dividend.

During periods in which markets are led by technology-related stocks, dividend-payers tend to underperform. Before the first half of 2023, this was the case in both 2020 and 2017. But in down markets like 2018 and 2022, they tend to decline by less than the overall equity market. Limiting losses is a key to long-term investment success.

Like all forms of investing, equity income requires patience. One of its benefits is that while waiting for performance to turn around, investors get paid through regular dividends.

This post appeared at ValueWalk.com.

Category: Dividend Stocks