3 REITs Yielding Over 7% You Can Take To The Bank

Did you know that over 36% of US publicly traded REITs either cut or slashed their dividends during the pandemic?

This combination of dividend cuts and demand from yield-hungry investors has led to bottom-of-the-barrel yields across the industry.

The Vanguard Real Estate ETF (VNQ), which is a solid proxy for the REIT market, now pays only a 2.2% dividend yield, well below historic averages.

It shows the importance of finding high-quality, well-managed REITs that can sustain their dividend payments, even in the throes of a financial disaster.

I’m here to tell you that despite the dividend cuts, there are still plenty of attractive high-yielding REITs out there.

In fact, I’ve discovered three great REITs that not only survived but thrived during the global shutdown.

Plus, these REITs yield more than 7%, more than 3x that of the broad REIT market, and more than 5x that of the broader equity markets!

REIT High Yield Pick #1: High Yield Backed By Private Equity Behemoth

KKR Real Estate Finance Trust (KREF)

Dividend Yield: 8%

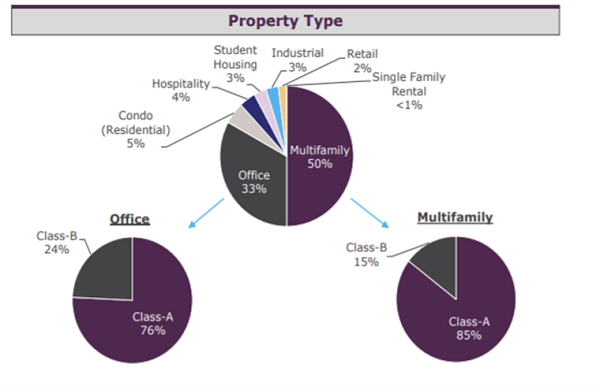

KREF is a commercial mortgage REIT focused on institutional quality real estate owned by high-quality sponsors in the most liquid markets. KREF is fully integrated with KKR (KKR has 26% ownership), the second-largest Private Equity firm in the US. I see this as a huge advantage, allowing KREF to leverage the data, resources, and relationships that KKR provides.

Its $5.6 billion loan portfolio is positioned in the most liquid real estate markets with an average loan size of around $32 million. The focus on high-quality asset loans has led to strong collections overall, with 97.3% of interest payments paid in the most recent quarter, even despite a loan book that is 30% comprised of office real estate loans.

Since the IPO, KREF has worked to emphasize property types less sensitive to economic cycles. Thus, despite the office exposure, the loan book is geographically diversified and KREF has increased exposure significantly to Multi-Family loans (which now account for roughly 50% of the portfolio).

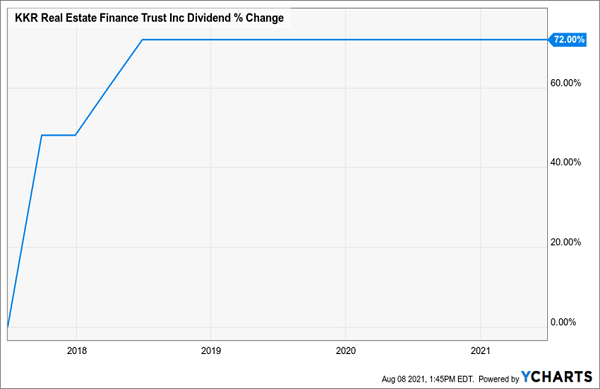

KREF came public in 2017, so it doesn’t have a long track record to examine from a dividend perspective, but since coming public, it has grown its dividend by over 70%:

Its book value per share now stands at $18.91, which puts the current price at around 1.1x book value, which in my mind is a very reasonable price to pay for a high-quality portfolio of loans providing a current 8% dividend yield.

REIT High Yield Pick #2: This Cannabis REIT Will Get You High (Yield)

AFC Gamma (AFCG)

Dividend Yield: 7.4%

AFCG is blazing new trails; it is the first publicly traded lender to cannabis companies.

As a mortgage REIT, it does not own the properties but simply finances real estate for cannabis operators.

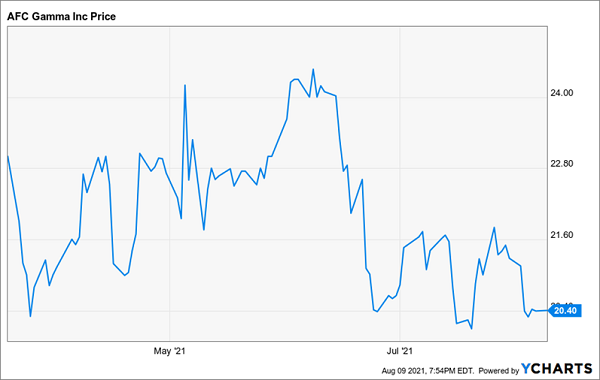

AFCG initially shot out of the gates in its first few months of trading but has since come back to trade below its IPO price.

Marijuana is big business; in the United States, sales of legal recreational cannabis are expected to reach an estimated 42 billion U.S. dollars by 2026.

The one issue?

Operators need access to funding, however current federal regulations limit access to traditional bank financing.

This is where a company like AFCG steps in and fills a huge need in the industry.

Keys to investing in a cannabis mortgage REIT are finding, one a team with strong credit expertise, and two, finding a team that is able to understand the complexities of the cannabis industry.

I think AFCG has both well taken care of.

Management is headed by Chairman and CEO Leonard Tannenbaum, who was one of AFCG’s early lead investors, putting $50 Million of his own money into the company. He started his own credit asset management shop – Fifth Street in 1998, ultimately selling the business to Howard Marks Oaktree Capital in 2017.

And based on the calls I’ve listened to, Tannenbaum and team are well versed on cannabis regulations and risks in the space. To date, they have focused only on limited license states, avoiding states like California, Oregon or Washington which are much more competitive.

Note however they are starting to take a closer look at California, given that there could be more crackdowns on black market operations, making it a much more attractive operating environment for legal operations.

In their recent earnings call, AFCG announced that their pipeline for deals is at ‘elevated levels’ and that they closed on $71 Million in commitments across 14 borrowers during the quarter.

AFCG believes that it can generate average annual cash returns on loans in the range of 12% to 20%, thus the reason it is able to generate such an attractive dividend yield, currently sitting at 7.4%. As of Feb 2021, they had generated a whopping 21.4% IRR on their portfolio of loans.

I think AFCG offers not only the opportunity for high yield, but attractive growth in an industry that should continue to see increased demand for capital.

REIT High Yield Pick #3: A Diversified High-Yielder With Recovery Potential

Starwood Property Trust (STWD)

Dividend Yield: 7.5%

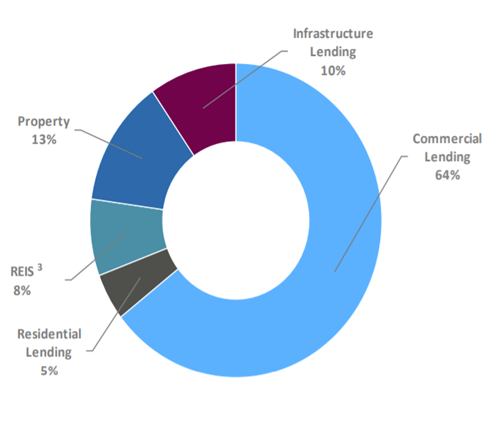

Like KREF and AFCG, Starwood Property Trust is a mortgage REIT whose primary business is first mortgages but it has a diversified line of exposures that make it a bit more differentiated. The bulk of its business is in Commercial, Residential, and Infrastructure lending (roughly 80% of its portfolio), while they also have investments in real estate while managing a CMBS book of business.

STWD also has the benefits of being tied to a larger global investment firm – Starwood Capital Group; over the past 29 years, Starwood Capital has invested over $175 Billion in Real Estate Assets. You might be familiar with Starwood Hotel and Resorts, which grew out of Starwood Capital and merged with Marriott in 2015.

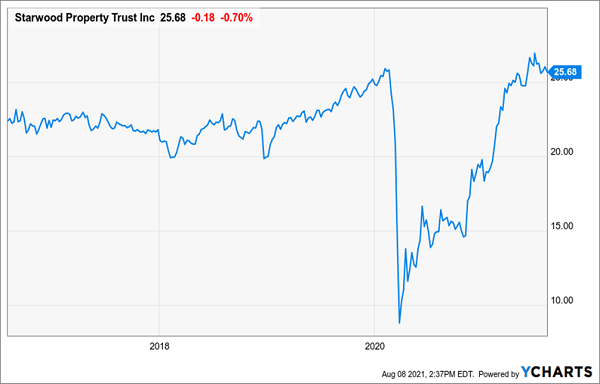

STWD was one of the hardest hit during the pandemic meltdown, mostly due to the fact that nearly 20% of its commercial loan exposures were tied to the hotel industry. Yet, as shown below, STWD stock price has recovered all of its losses and more.

The reason?

In my mind, management did a formidable job in shoring up their balance sheet at the height of the pandemic. They ‘manned the walls’ by stepping through each and every exposure to evaluate the risks to the portfolio.

“We analyzed every projected cash inflow and outflow, and we re-underwrote every asset multiple times. In the depth of the market volatility caused by COVID-19, we never contemplated a capital raise below our estimate of fair value of our shares, which would have destroyed shareholder value and impacted future earnings growth. We also never contemplated a sale of our assets at a loss”

-Starwood CEO Barry S. Sternlicht, 2020 Letter To Shareholders

STWD has paid consistent dividends since its 2009 inception without a cut. The fact that a cut wasn’t needed in 2020 (even with the COVID impacted exposures) is a sure-fire sign of a top-notch management team.

The current yield at near 7.5% looks safe, and management noted in its recent call that it was comfortable with its hotel exposures, noting no concerns with any of its loans from a payoff perspective.

STWD is a high-quality, diversified play in the mortgage REIT space and anyone looking for a 7% + yield should consider the stock for their portfolio.

Want More 7% Dividend Yielders That Won’t Require You To Draw Down Principal?

Chief Investment Strategist Brett Owens has you covered with his “No Withdrawal” Retirement Portfolio.

Here’s where you can earn a stress-free $35,000 on a half-million… $70,000 on a million… and $100,000+ annually on anything higher.

Plus, you won’t even have to tap your initial capital or “draw down” any of your priceless principal.

Category: Dividend Stocks To Buy?