These 8 Dividends Are Rising 23% Per Year

Thanks to two stock market pullbacks in 2020 and this current pause to begin 2021, equity prices are likely still “catching up” with their pre-2020 trajectories. Big tech is frothy but many lesser-known dividend growers are still cheap. And that’s music to my ears, because the surest, safest way for us to double our money in the stock market is to buy the payouts that are growing the fastest.

Specifically, I’ve got my eye on 8 that are boosting their dividends by 23% per year. Twenty-three percent!

Before I reveal the list, some caveats. First, past dividend growth does not guarantee future payout hikes. This is where we must look past the spreadsheet and use our brains to think about each business model and make sure that it properly projects dividend growth into the future. We are looking for continued success this year and beyond.

Second, the price that we pay matters. Ideally, we want a stock price that is lagging its payout. This means the stock is cheap with respect to its dividend, and we have potential upside when the stock price races to catch up with its payout.

Third, I would like to reiterate that these dividend growth numbers are real, and they are indeed spectacular. If you spend your life looking only at the 6%, 7% and 8%+ yields that we discuss in our Contrarian Income Report, you’ll miss out on dividend growth stories like these.

These current yields are modest by CIR standards, but don’t be fooled. It’s the trajectory of these dividend curves that has our attention. Now let’s crack this first six-pack.

6 Small Banks Depositing Higher Dividends

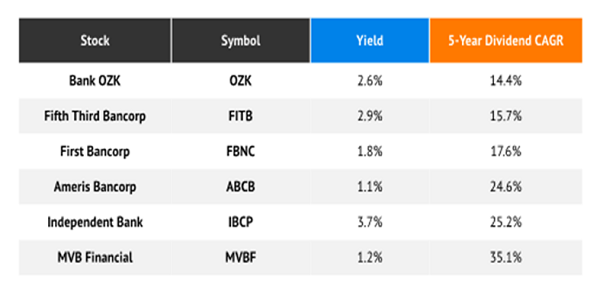

One group that stands out like a sore thumb is regional and community banks, which have been among some of the most generous, reliable dividend raisers of late. Consider this group of stocks boasting annual dividend-growth rates of 14% or more over the past five years:

And Arkansas-based Bank OZK (OZK) takes it a step further, delivering quarterly dividend raises, even through the pandemic.

The six banks mentioned here cover a wide swath of the U.S., along much of the East Coast, Texas, California and large tracts of the Midwest. You’ve got a larger bank like $26 billion Fifth Third (FITB), but a few, such as Michigan’s Independent Bank (IBCP) and West Virginia-based MVB Financial (MVBF) are in the hundreds of millions.

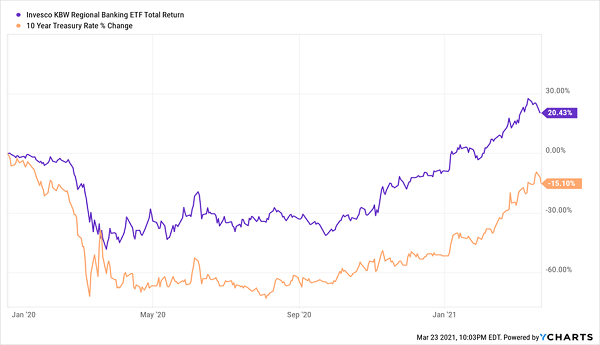

The thing about regional bank stocks is what’s in the name—they’re regional plays, and the smaller the bank, the more they’ll pivot on one or two states’ economies. But broadly speaking, they all have one thing in common, and that’s a pretty strong tether to interest rates.

As Goes Jerome, So Go Banks

The recent breather in rates has presented us with a modest buying opportunity. And from a valuation standpoint, most of the banks mentioned here trade for reasonable forward P/Es in the mid-teens.

However, a further breather in rates might still be in play in coming months. And that would likely provide a better entry point in these dividend growth banking plays.

KB Home

Dividend Yield: 1.3%

5-Year Dividend Growth: 33.2%

KB Home (KBH) and the rest of the homebuilding industry’s stocks have done just fine for themselves over the past year-plus. KB Home’s shares are up 33% since the start of 2020, and they’ve roughly quadrupled out of the March 2020 lows.

There’s no secret why. While the rest of the economy went in the toilet last year, the housing market went bananas as people forced to work from home went out in search of, well, new homes. With the exception of some havoc caused by February’s winter weather, building permits, new housing starts and other important metrics have been through the roof for months on end.

That’s why, while many companies were busy cutting their payouts in 2020, KB Home’s dividend was growing like a weed. In November, KBH authorized a 66%-plus jump in its payout (from 9 cents per share quarterly to 15)—a year after a 260% dividend hike from 2.5 cents!

Despite its run-up, KBH only trades for 9 times future earnings forecasts, and it should continue to roll as long as the housing market does. That dividend seems plenty safe, too, at just 13% of profits.

Perhaps a lesson learned? This isn’t the first massive runup in KBH shares, or in its dividend. KB Home juiced its dividend by more than 500% in the mid-aughts before the Great Recession sent everything—including its payout—into a death spiral.

Will Things Be Different This Time?

For now, it’s difficult to bet against KBH. But the housing market isn’t invulnerable, so even if it remains a strong long-term play, you still might have to grit your teeth through serious bouts of volatility.

EOG Resources

Dividend Yield: 2.4%

5-Year Dividend Growth: 17.5%

Few industries suffered nearly as much last year as the energy sector, and exploration-and-production plays in particular. Shares were gashed and payouts were slashed as oil prices cratered to multi-decade lows, and momentarily even into negative territory.

And that makes EOG Resources (EOG) stand out.

EOG, which produces crude oil and natural gas in the U.S., China and Trinidad & Tobago, managed to generate $1.6 billion in positive cash flow in 2020. While paying down debt. And adding 1,250 drilling locations in South Texas. And upgrading its dividend by 30%. (It followed that up with a still-solid 10% payout hike this year, by the way, to 41.25 cents per share.)

It has done so by focusing on driving down drilling costs wherever possible. The company actually boasted in its annual report that it “replaced 159% of 2020 production at sub-$7 per Boe (barrel of oil equivalent) finding cost.”

How much additional upside potential oil has from here is very much in the air, even if the “summer of recovery” proceeds as planned. But the habit of stocks to “chase” their dividends higher is very much in play at EOG, and a modest sub-14x P/E on this year’s projected profits means Wall Street hasn’t overcrowded this play yet.

EOG’s Dividend Growth Hasn’t Been Properly Rewarded … Yet

Just remember: Despite all of EOG’s operational successes in the face of a miserable 2020, its stock still got creamed by more than 60% at its depths. Oil and gas plays live and die by the price of those commodities, so while EOG might outperform its peers, it’s not invulnerable to the whims of the energy market.

REVEALED: How to Make a PREDICTABLE 20% Gain in 2021 (Bull or Bear!)

The idea behind each of these stocks is on target: Ride robust dividend growth to red-hot total returns. That’s a staple of my investing plan, and if it’s not already one of the pillars of your retirement strategy, you need to fix that—today.

But you’re not going to find much stability from stocks that can be whipsawed around by energy prices or the fickle Fed.

That’s where my “Recession-Proof Retirement Plan” comes in.

Consider this: Right now, I’ve identified 7 recession-proof dividend growers that are better buys than even MA and AVGO as the calendar flips to 2021. I call them “recession-proof” because they have the perfect mix of qualities that enable them to deliver reliable, predictable returns of 12% to 20% every year, regardless of whether we’re in a bull market or a bear.

This 7-stock “mini-portfolio” puts the power in your hands. Each of these picks checks off the most important boxes for any retirement investment. They can:

- Predictably double or triple your investment every few years.

- Protect your portfolio from wild swings so you can enjoy a stress-free, secure retirement.

- Let you hold them for years without the “can’t sleep at night” worries you’ve no doubt been living with through 2020.

Get full details—names, tickers, buy-up-to prices and more—on all 7 of these stout dividend growers now. You have everything to gain and nothing to lose by giving them a look.

Category: Lists of Dividend Stocks