7 Life-Changing Dividends Up To 18%

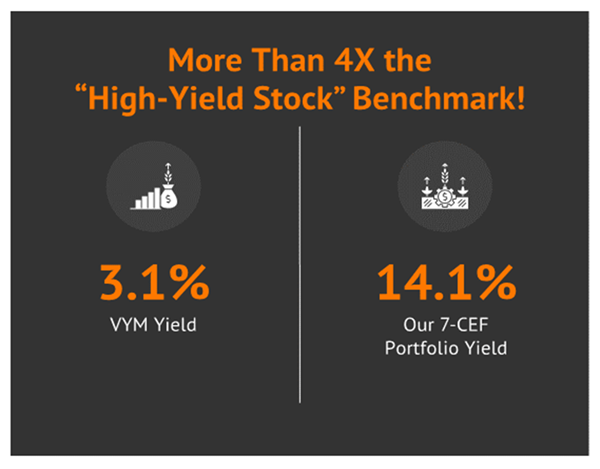

A safe double-digit yield makes it a lot easier to retire. Today we’ll discuss a portfolio that pays 14.1% (that’s no typo).

The math on 14.1% looks awesome. This yield generates $14,100 on a $100K every year. Or $141,000 on a million dollar portfolio.

Contrast this with “the market”—$1 million plunked into the S&P 500 would only net you $14,000 a year, which is actually below the federal poverty level!

And if you have even less to work with, well, you understand what I’m getting at.

Most importantly, if you manage to find these mega-yielders, you can finance your retirement on dividends alone. That means, if you pick the right stocks, you might never need to lay a finger on your retirement principal.

In looking ahead to 2024, then, I want to examine the world of massive yields. And I’m going to do it across a series of articles throughout the rest of the month.

Today, I’m going to start with one of my favorite sources of yields: closed-end funds (CEFs).

I could tell you just how world-changing CEFs’ income could be, but rather than write it out, I’ll let this table do the talking for me:

That said, we need to be able to rely on these dividends, so let’s examine some of the most garish yields in the CEF space and see which ones can hold up to scrutiny. Better still, for us retirement planners, every one of these funds pays monthly, meaning we don’t have to rack our brains putting together a dividend calendar.

I’ll kick off this list with some fixed-income opportunities.

Has fixed income heated up? Absolutely. And it could be due for a breather. Regardless, if you’ve kept your money tied up in ultra-short fixed income, it’s time to add some duration and take advantage of some of these still attractively priced higher yields.

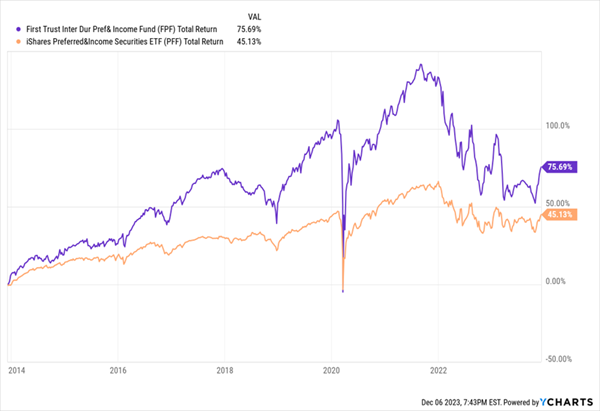

One way to dip your toe into the water is with a bond-esque “hybrid”—preferred stocks—which are both offering higher yields and would benefit from the Fed just staying put or even cutting. The First Trust Intermediate Duration Preferred & Income Fund (FPF, 10.4% distribution rate). FPF is a roughly half-U.S., half-international basket of preferred stocks—and while preferreds typically have no durations because they’re perpetual, this collection has an effective duration of about 3.5 years.

A thick 33% in debt leverage means FPF will swing much more than a plain-Jane preferred ETF. But if you can buy it at a discount—and you can, with FPF trading at 89% of NAV, compared to a five-year average pricing of 95% of NAV—the next swing might work out in your favor. A double-digit yield, paid monthly, adds to the allure.

Get More Out of Your Preferreds

An unloved CEF on my radar is FS Credit Opportunities Corp. (FSCO, 12.0% distribution rate), another monthly payer that invests in “non-traditional” public- and private-market credit. Roughly 60% of the fund is invested in senior secured loans, 17% is in senior secured bonds, and another 7% is in subordinated debt. (Equity and asset-based finance make up the rest.)

FSCO has been around for a decade, but it has only been publicly traded over the past year. That likely explains the massive 19% discount to NAV. CEF investors loathe newness. I don’t—I just want to see the credit markets keep it together.

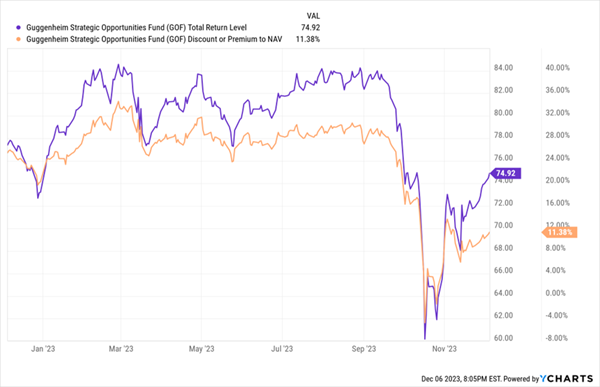

Guggenheim Strategic Opportunities Fund (GOF, 16.2% distribution rate) is the highest-yielding fixed-income CEF on this list, at a hair over 16%, which is downright luxurious.

This CEF owns all sorts of debt and credit, though I’m highlighting it because in addition to more exotic debt and credit like bank loans, asset-backed securities and preferreds, about half of the fund is invested in corporate bonds (35% junk, 12% investment-grade). And timing is important with bonds. You might think the bull run will come once the Fed finally starts cutting, and yes, it should produce some nice upside for bonds. But over the past five rate-hiking cycles, bonds returned almost double during the period between the last Fed rate hike and the first cut than what they earned in the month immediately following the last cut.

It might be difficult to justify a buy in this fund, though. GOF is perpetually overpriced—in fact, its autumn slump could largely be chalked up to a gashing of its massive premium.

But That Premium Is Back to Double Digits, So Beware

Now, let’s move on to more equity-heavy funds.

Highland Opportunities and Income Fund (HFRO, 10.5% distribution rate) is one of the most disrespected CEFs on the planet. Manager Jim Dondero is a savvy income investor with a contrarian mindset, and he puts his mind to work on an eclectic portfolio that’s roughly three-quarters real estate, with the rest in equities, collateralized loan obligations, loans, and more.

Many of HFRO’s holdings are nearly impossible for you and I to access otherwise—Dondero has a nose for privately held assets, including top holdings such as NexPoint Storage Partners, IQHQ and EDS Legacy Partners.

Why do I say HFRO is disrespected? The fund currently trades at a wild 30% discount to NAV—that’s 70 cents on the dollar! Of course, that discount was as wide as 45% not too long ago, so clearly, investors are starting to realize what’s sitting there.

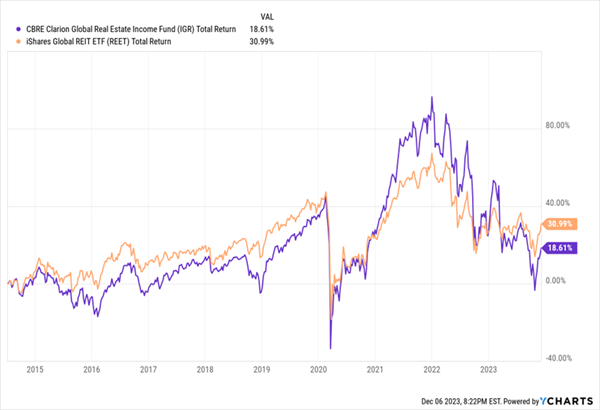

The CBRE Global Real Estate Income Fund (IGR, 15.2% distribution rate) is a more conventional real estate-focused fund.

I mean, its 15%-plus monthly distribution is hardly conventional, but its holdings are.

While most REIT funds focus primarily on U.S. REITs, which hold a multinational or two but rarely overseas specialists, IGR’s real estate portfolio is truly global. Some 60% of holdings are domestic players like Prologis (PLD) and Simon Property Group (SPG). However, the remaining 40% includes exposure to continental Europe, Japan, Hong Kong, the U.K. and a few other countries. (For the record, the CEF also is 6% exposed to preferreds.)

The yield is right. So is the 15% discount to NAV that’s 5 points deeper than its five-year average. But my main contention is performance. Simply put, management has had plenty of time to give investors reason to pick their CEF over cheaper vanilla funds—and simply hasn’t.

If You’re Paying Up, You Want to Beat the Index—Not Meet It

Cornerstone Total Return Fund (CRF, 17.9% distribution rate) and Cornerstone Strategic Value Fund (CLM, 17.7%) are two of the highest-yielding funds you’ll ever find. (And they’re monthly payers to boot!)

So, what exotic, kinky corner of the market are they using to squeeze out all these payouts?

Mostly large-cap stocks.

The portfolios of both funds are effectively a large blend—you could mistake them for S&P 500 trackers with top holdings including Magnificent Seven members Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and the like.

There’s little to no leverage here. No aggressive options trades.

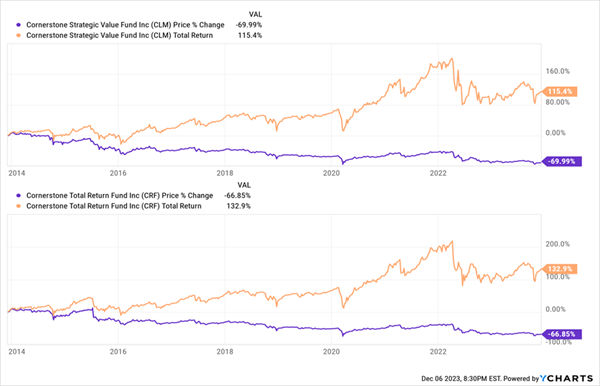

Where CLM and CRF differ from funds with similar portfolios is a high-level “managed distribution plan”: effectively a monthly payout, with new levels determined each year in October. And this monthly payout is an extremely high rate—one that actually turns wild underperformance into at least positive (but still below-market) performance on a total-return basis.

How Can a Distribution Swing Performance This Much?

The problem is, the distribution is part of their lousy price performance. From an explanation of the MDP:

There is a risk that the total Net Earnings and unrealized gain or loss for years from the Fund’s portfolio would not be great enough to fully offset the amount of cash distributions paid to Fund stockholders. If this were to be the case, the Fund’s assets would be partially reduced by an equal amount, and there is no guarantee that the Fund would be able to replace the assets. In addition, in order to make such distributions, the Fund may need to sell a portion of its investment portfolio at a time when independent investment judgment might not dictate such action. Furthermore, the cash used to make distributions will not be available for investment pursuant to the Fund’s investment objective.

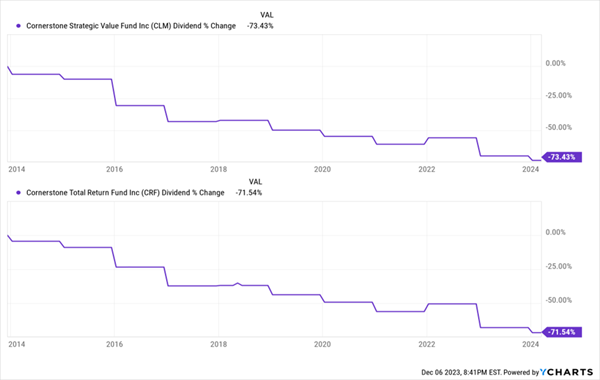

And both funds actually say that during recent years, the fund’s investments have failed to provide adequate income to meet the MDP’s policy requirements. So basically, Cornerstone is robbing Peter to pay Paul.

And Dividends Are Suffering For It

Earn a Reliable 9%+ in Retirement—Paid MONTHLY

If you want to retire comfortably, yes, you need high yields that can keep you paid so you never have to touch your nest egg. But just as importantly, you need to invest in stocks and funds you actually understand.

You won’t get that with CLM and CRF.

But you will get that with the beautifully boring, high-yielding blue chips I hold in my “9%+ Monthly Payer Portfolio.”

And importantly, I’m not just going to give you the tickers—I’m going to help you understand why these assets do what they do so you can make an informed decision that’s best for you and your family.

One thing you should know: The “9% Monthly Payer Portfolio” isn’t just about earning high levels of yield—it’s about earning high levels of yields by leveraging steady-Eddie holdings that won’t you reaching for the Pepto every time the S&P gets the jitters.

As we turn the page from 2023 to 2024, it’s time to get serious about locking down our core retirement holdings. Start today! Click here to learn everything you need about these generous monthly dividend payers right now!

This post originally appeared at Contrarian Outlook.

Category: Dividend Yield