5 Ways To Find The Best Long-Term Dividend Stocks

We love dividend stocks because they pay us now. But hey, I’m greedy. And when I research income plays, I want more than just those payouts.

I’m looking for price gains, too. Give me a dividend with a stock that could potentially double, and we’re talking.

These types of stocks are rare, but they’re not impossible to find. They tend to share five key “dividend double” characteristics. Let’s discuss them now.

Dividend Key #1: Annual Dividend Growth

The core trait of an excellent long-term dividend holding is dividend growth, for numerous reasons.

For one, dividend growth is a pretty sure sign that the underlying company has the financial fortitude to pay the bills. Once a business starts a dividend program, there’s only three directions for the payout to go:

- If the company is in trouble, they pull back on (or suspend) the dividend.

- If they’re unsure about the future, they’ll keep their dividend level.

- And if they’re confident about their ability to churn out profits, they’ll split more of that wealth with shareholders through increasingly fatter dividends.

Also vital to shareholders: Dividend growth means (obviously) more income. That means, rather than stretching for questionable stocks with fat current yields, you can jump into high-quality stocks with OK current yields, knowing that your yield on cost will plump up over time.

That’s especially important when you remember you need to factor inflation into your retirement plans.

2022’s ridiculous rocket ship of consumer prices aside, inflation averaged 3.8% annually from 1960-2021, meaning your portfolio’s dividend growth needed to average 3.8% annually for your purchasing power to at least break even.

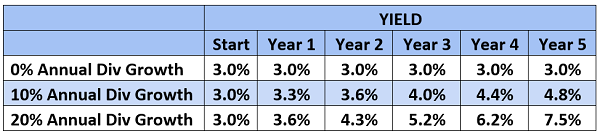

To illustrate the importance of growing payouts, let’s take a look at three dividend portfolio profiles: One with no dividend growth, one with 10% annual dividend growth, and one with 20% annual dividend growth:

It’s pretty obvious which of these three portfolios would outrun inflation the best—and that’s the portfolio I’d want to own.

Dividend Key #2: Dividend Magnet

Another benefit of rising dividends is a financial phenomenon I call the “dividend magnet.”

You see, dividend growth isn’t just about dividends—it’s about growth, too!

Like I said earlier, companies typically don’t spend more on dividends unless they’re confident about their ability to generate more earnings. In fact, many investors look at dividend-increase announcements as a statement of corporate quality—a buy signal, if you will.

That’s why, every quarter, we publish a list of anticipated dividend increases for income investors to put on their radar.

And I put my money where my mouth is. In my Hidden Yields service, I start by “timing” our buys just as dividend hikes are announced. There’s often a lag between when a hike is declared and a rise in the stock, and that’s our time to pounce.

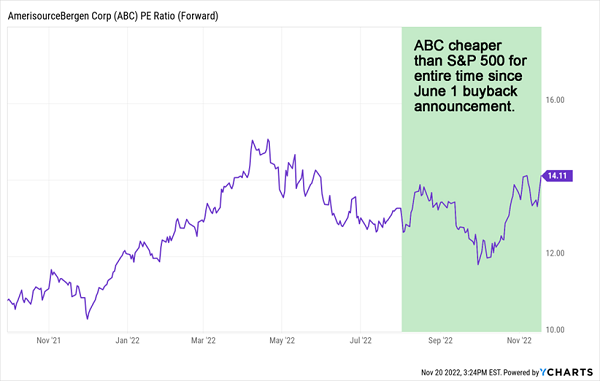

You can see this “set-your-watch-to-it pattern” in shares of drug distributor AmerisourceBergen (ABC), a Hidden Yields holding. That has delivered 59% returns since we bought in June 2020.

ABC’s Dividend Telegraphs Its Next Price Move

The lag between the rise in the dividend and the share-price jump is crystal clear. That’s our window to start participating in the Dividend Magnet.

Dividend Key #3: Buybacks

As discussed, serious income investors need to be greedy.

That doesn’t mean making questionable investments to get the highest yield possible.

No, being greedy means demanding more than dividends—specifically, we want management to splash some cash on stock buybacks, too.

When done right, repurchase programs help to put a floor under your stock. After all, they’re cutting the number of shares outstanding, as well as juicing earnings per share and other per-share metrics. All this tends to lift the share price.

And for those of us with survival-focused lizard brains, buybacks are, in an odd way, a cash-flow safety valve. If a company finds itself in the midst of, oh, let’s say a global recession, if all of your cash flow is being pumped into dividends, you might have to cut your payouts to make ends meet. But if a company’s cash is going into both dividends and buybacks, they can pull back on the latter to preserve the former—keeping our income stream intact.

Dividend Key #4: Value Pricing (Makes the Buybacks Worth It)

Thing is, companies spend cash to reduce that share count. So, like you and I, companies need to be smart about when they buy their own shares.

Let’s go back to AmerisourceBergen.

Valuations across the broader stock market have been coming back to earth in 2022. But ABC is already a deal. It’s the type of low beta, recession-proof stock that we are comfortable holding into a potential recession.

ABC’s board of directors agrees.

The company in June announced a $1 billion share repurchase plan, enough to reduce the current outstanding float by 3%. When your own stock offers a great deal, smart companies buy it back. These buybacks create a “virtuous cycle” that sends the share price higher and higher. Fewer shares mean the important metrics—profits and, of course, dividends—look better and better on a “per share” basis.

Unsurprisingly, this helps to power our Dividend Magnet.

Dividend Key #5: Recession-Resistant (Given 2023 Outlook)

Lastly, we want a dividend stock that can take a punch.

Just about every economist and market strategist I keep tabs on is predicting at least a mild recession in 2023. As I said after Fed Chair Jerome Powell’s most recent FOMC presser, back in early November:

“A recession is the only way we’re going to tame inflation at this point. An inevitable economic slump is coming.”

Yes, investing is all about the long game, so in theory, we could buy high-quality, high-yielding stocks and hold them in perpetuity, no matter how cyclical they are, and come out ahead.

But you and I aren’t investing in theory. We invest with real money, and we all have real emotions that we need to keep in check. Recession-resistant companies give us a better shot at evading deep losses in a downturn, which prevents us from panicking and selling low.

They Key to 15%+ Annualized Returns in Bull AND Bear Markets

You should always prioritize durability, no matter what the market’s doing, but with a recession looking like a slam dunk within the next year or so, safety is of the utmost importance.

ABC is a stellar example of a stock that checks off all five boxes—but you can’t build a durable income portfolio with just one stock.

Fortunately, ABC isn’t the only “recession-resistant” dividend stock in our Hidden Yields portfolio. In fact, we have seven more stocks that don’t really care whether it’s a bull or bear market.

Their businesses are sure and steady, which results in a dividend—and share price—that gradually ticks higher over time. And as the S&P 500 bobs and weaves over the next year, these types of recession-proof dividend plays are going to become even more popular with investors.

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks