3 Ways To Safeguard (And Grow) Your Dividends As Inflation Ticks Higher

Inflation worries are everywhere, so let’s dive into what’s behind them—and what we contrarian income-seekers should do right now. The three steps I’m about to show you could hand you a lot of fresh dividend income and price upside, too—even in this (still) overstretched market.

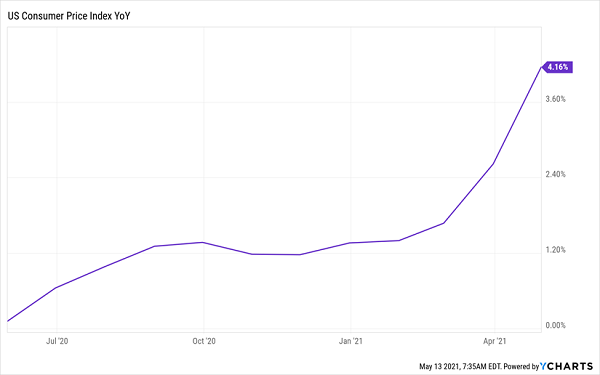

First up—is inflation a real fear right now? Let’s look at the numbers.

Inflation Rises Sharply …

That chart—and shortages of everything from microchips to ketchup—sure seem to indicate that a continued rise in prices is on the way.

But there’s a caveat: this chart compares today’s inflation rate to that of the crushed economy of last year, not to mention those supply-chain issues, which are likely to get ironed out as more of the economy reopens.

So while we can’t say for sure that we’re in for a big rise in inflation, we’re likely in for higher prices in the short- and medium term.

But we contrarians don’t fear inflation—we profit from it. Here are three ways we’ll do so, nicely setting ourselves up for that 6.8% dividend I mentioned earlier—and strong capital gains, too.

Step 1: Stick With Stocks (Particularly Service-Focused Ones, Like Tech)

The first step is to zero in on companies that benefit from inflation, and for that, we’re going to steer away from low-margin firms, or those that need to buy a lot of products, be they finished items or commodities.

Those firms suffer in times of inflation, as their input costs rise—and they may not be able to pass those costs on to customers. Consider, for example, a retail chain like Walgreens Boots Alliance (WBA), which will likely need to pay more for the merchandise it stocks on its shelves.

High-margin tech giants, however, don’t have this worry. A company like Alphabet (GOOGL) buys almost no physical objects to sell to customers, so it can raise prices alongside everyone else while not being charged more by its vendors. What’s more, big tech firms, like Alphabet, Facebook (FB), Apple (AAPL), Microsoft (MSFT) and Amazon.com (AMZN) are absolutely dominant over their respective markets, leaving consumers with few other places to go to escape any price increases.

Step 2: Buy Into Short-Term Dips

We only need to look back a couple months to see that buying dips pays off handsomely for cool-headed contrarians. Remember when inflation worries last triggered a tech selloff? That was in March, and the NASDAQ dropped, much as it’s been doing over the past few days.

But investors who were focused on the longer term and bought the dip have done well so far: even with the latest dip, the Invesco QQQ Trust (QQQ), which tracks the tech-dominated NASDAQ 100 Index, is still up about 6% since the March decline. That’s a solid start for someone planning to hold for years, if not decades.

The takeaway here is clear: hold for the long term, buy when other investors are fearful and stick with stocks—including tech stocks—through short-term market storms.

Step 3: Go With a 6.8%-Yielding CEF

The steps we’ve talked about so far are fine and good if you don’t have income needs in the short term. But what if you’re retired or want to retire soon? QQQ, the go-to tech ETF for most folks, won’t help you, with its measly 0.6% dividend. Nor will the typical tech stock, many of which pay no dividends at all.

This is where closed-end funds (CEFs), a unique type of fund known for high dividends (7%+ payouts are common among CEFs), come in.

Case in point: the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX), which yields 6.6% and holds the same large-cap tech stocks as QQQ.

The fund can pay us that huge dividend in large part because it sells call options (contracts giving investors the option to buy the stocks in QQQX’s portfolio at a fixed price in the future in exchange for paying the fund upfront, in cash, today). That’s a nice, low-risk way to generate extra income, and it’s particularly effective in a volatile market like the one we’re seeing today.

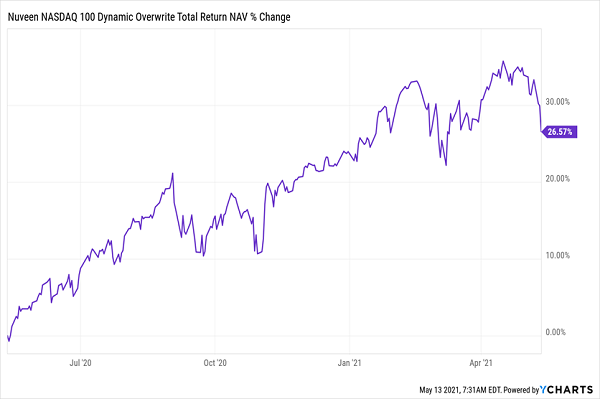

QQQX also has a strong history behind it. Over the last year, its underlying portfolio has returned a solid 27%, including dividends, with the usual two-steps forward, one-step-back pattern along the way.

Contrarian QQQX Buyers Ignore Volatility, Bag a 27% Gain

All of this makes QQQX a great way to get access to the tech stocks in the NASDAQ but with much higher dividends than you’d get from a tech stock or ETF. A payout this rich is a lifesaver in a pullback because you can simply sit back and collect it while you wait for the (inevitable) rebound. And if you’re automatically reinvesting your dividends, your payouts will buy more shares in a falling market (when they’re cheaper) and fewer in rising markets (when they’re more expensive).

And thanks to the current pullback, we do have a buying opportunity in disguise here, with QQQX trading right around its net asset value (NAV, or the value of the stocks in its portfolio). We often see CEFs’ share prices trade at different values than their per-share NAV, and QQQX has traded at significant premiums in the past, suggesting additional upside.

Our Contrarian Mantra: Tune Out the Noise and Think Long Term

At the end of the day, any short-term drops in stocks are really just signals to buy more and focus on the long-term, which is why investors who bought during March’s inflation hysteria got off to that strong start I mentioned above, with more ahead, thanks to the deal they got in the spring. A similar pattern is in store for those who buy now as everyone panics over a potential inflation rise.

5 Inflation-Crushing CEFs Yielding 7.3% (With Upside)

The 5 CEFs I’m urging readers to buy now yield an outsized 7.3%, on average. That’s more than enough income to outrun rising prices. And it’ll set your mind at ease during a pullback, too: as with QQQX, all you need to do is sit back and collect your dividends until the dust settles!

But with these 5 funds, you’ll get more income and more diversification: these 5 CEFs hold US blue chips from a range of sectors, from finance to pharmaceuticals, plus corporate bonds and high-yielding real estate investment trusts (REITs), too.

It’s a perfect set of picks for the period we’re living through now: in addition to a 7.1% dividend, you’ll be nicely set for further upside, thanks to these 5 funds’ ridiculous discounts, which have been widened even further by this latest selloff.

In fact, my latest analysis points to 20%+ price gains from these 5 funds in the coming 12 months (in addition to the rich 7.3% dividends you’ll collect).

That’s a 27% total return!

The buy window we have in front of us won’t stay open for long. Click here and I’ll share all the vital details on these 5 sturdy income-and-growth plays with you in an exclusive investor report.

Note: This article originally appeared at Contrarian Outlook.

Category: Dividend Stocks