The Yin And Yang Of Energy Midstream Stocks

In these uncertain times for investors, energy midstream stocks offer an island of stability. This sector provides an attractive combination of current yield and dividend growth. However, midstream companies divide into two distinct categories, and the differences are important.

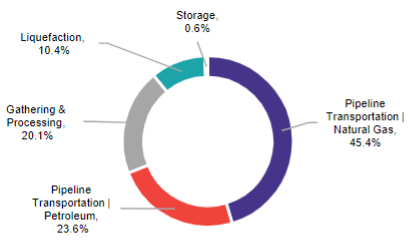

Energy midstream covers the movement and storage of energy commodities from the upstream drillers to the downstream refining, manufacturing, and utility companies. This graphic from the Alerian Midstream Energy Index fact sheet shows the services the companies included in the index offer.

Before the 2015-2016 energy sector crash, the majority of midstream companies were organized as master limited partnerships (MLPs). The crash forced massive restructuring, and many companies converted to corporations. Currently, the midstream sector includes some companies organized as corporations and others that have retained their MLP business structure.

If you invest in an MLP, you buy limited partner units. As a limited partner, you will receive a Schedule K-1 to use when reporting your taxes. The distributions (dividends) paid by an MLP are classified as return of capital and are not taxable income. Any tax consequences come from the K-1, and generally, MLP income will not be taxed.

Midstream MLP units should not be owned in a qualified retirement plan such as an IRA or Roth IRA, as they can cause severe negative tax consequences. The reason is too long to go into here. Just don’t do it.

Midstream corporate shares are just like owning shares of any other publicly traded company. You receive a Form 1099 for reporting dividend income, which will be qualified dividends. You can own these shares in a retirement plan without any negative consequences.

The differences between the two midstream business types have led to an interesting divergence in dividend yields. To illustrate, let’s compare three large midstream corporations to three similar MLPs. I want to look at current yields and dividend growth for the last two years.

Midstream Corporation:

- Kinder Morgan, Inc. (KMI): Current yield: 6.27%; two-year dividend growth: 5.7%

- ONEOK, Inc. (OKE): Current yield: 5.72%; dividend growth: 2.1%

- The Williams Companies (WMB): Current yield: 5.94%; dividend growth: 9.1%

Master Limited Partnerships:

- Enterprise Product Partners LP (EPD): Current yield: 7.26%; two-year dividend growth: 8.9%

- Energy Transfer LP (ET): Current yield: 9.45%; dividend growth: 100%

- Plains All American Pipeline LP (PAA): Current yield: 8.17%; dividend growth: 95.5%

You can see that MLPs sport higher yields to go along with the tax-advantaged income. The MLPs have also been more aggressive with dividend growth coming out of the pandemic. Going forward, I expect the midstream corporations to grow dividends at a mid-single-digit annual rate and the MLPs to grow theirs in the high single digits.

Outside of the IRA problem, MLPs currently provide much better investment potential. If you want to own them in an IRA, look at an MLP-focused ETF. The Alerian MLP ETF (AMLP) tracks the index with the same name. The InfraCap MLP ETF (AMZA) is an actively managed fund.

Unique in the space is Plains GP Holdings LP (PAGP). Each PAGP share is backed by one PAA unit and pays identical distributions. However, if you invest in PAGP, you get a Form 1099 for tax reporting, not a K-1—the market prices PAGP to yield about 0.3% less than PAA.

This post originally appeared at Investors Alley.

Category: Dividend Stocks To Buy?