Two Decades Of Annual 16% Dividend Growth

Sometimes I feel like a broken record when it comes to dividend growth.

I love companies growing their dividends.

It means more money for me in the future.

Well, one company is outstanding at growing its dividends.

And its dividend yield is at an all-time high!

The company in question is Accenture plc (ticker: ACN).

Accenture is a massive business services firm focusing on consulting and information technology.

The company had almost $70 billion in revenue last year!

And Accenture’s dividend is awesome.

Hold on a minute.

I said two decades of dividend growth, right?

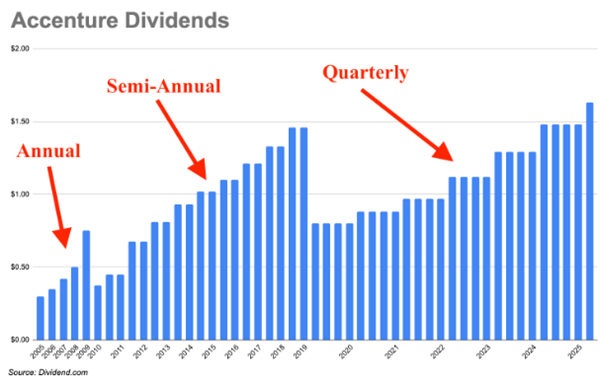

Well, the chart above looks like Accenture lowered payments twice since 2005.

But looks can be deceiving.

Accenture actually increased the frequency of its payments, so the dividend looks like it dropped.

Accenture switched from an annual payment to semi-annual in 2010.

And then switched to quarterly in 2020.

It’s a little confusing, but here’s what you need to know.

Accenture has raised its dividend on average by 16% each year over the last 20 years.

And there’s something else you need to know.

Accenture just did it again!

Accenture’s next payment is $1.63, which is 10% higher than the last payment.

But you need to act fast!

You need to own Accenture by October 9 (Thursday) if you want the higher payment.

Let’s get into Accenture’s dividend yield, which is currently 2.6%.

Do you want the good news or bad news first?

Let’s start with the good. Accenture’s dividend yield has never been higher.

Last fall, Accenture’s dividend yield hovered around 1.5%.

The bad news? Accenture’s stock price is down almost 30% so far in 2025.

What’s the reason?

Accenture does a lot of consulting work for the U.S. government.

But Accenture’s government contracts are at risk of getting cut.

And the current government shutdown doesn’t help either.

However, government contracts only account for 8% of Accenture’s revenue.

8% is a lot, but it certainly shouldn’t alone cause a 30% drop in the stock price.

Accenture’s current price-to-earnings ratio is around 20x, which is 20% lower than its historical average.

Do you know the last time Accenture’s price-to-earnings ratio was around 20x?

It was during the COVID pandemic!

Accenture’s commitment to its dividend, coupled with a historically high dividend yield and a great price, means it’s a great stock for dividend investors.

What are some of your other favorite, high dividend-growth stocks?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?