Thirty Years Of Double-Digit Dividend Growth

Dividend Aristocrats are companies with more than 25 years of consecutive dividend growth.

It’s a great benchmark to determine how long a company has raised its dividends.

25+ years of dividend growth isn’t required, but it helps me sleep better at night knowing how committed a company is to increasing dividend payments.

In the last 25 years, we had the dot-com crash, the Great Recession, and the COVID-19 pandemic.

So to continue to raise dividend payments through all of the turmoil is a really big deal.

It’s why Ecolab (ticker: ECL), a large chemical company, should be on every dividend investor’s radar.

It would take pages to list out all of the products Ecolab sells, so I’ll focus on the main ones.

Ecolab sells water treatment products to help companies conserve water in their manufacturing processes.

Restaurants and food service companies use Ecolab’s sanitation and cleaning products to keep their cooking and eating areas clean and safe.

Ecolab also provides products to the paper and pulp industry to improve the efficiency and quality of its customers’ paper products.

Ecolab’s entire business model is to reduce costs for its customers.

If you’re really curious, Ecolab’s website has tons of information on the different industries it serves.

Ecolab is massive and had over $2 billion in profit in 2024.

And its dividend is pretty incredible too.

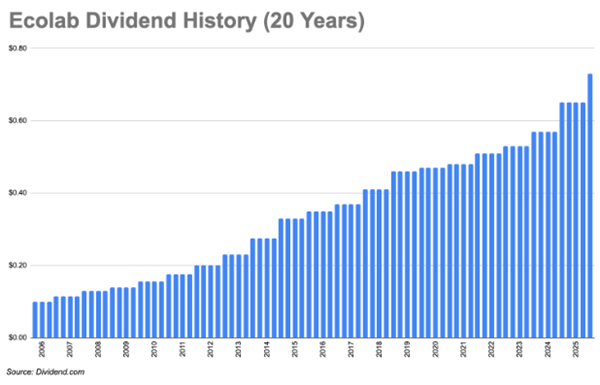

Ecolab started paying dividends in 1989 and has increased its payment every year since 1991 (34 years)!

Ecolab just increased its payment again by another 12%.

If Ecolab maintains a 12% growth rate, your dividend payments would double every 6 years!

But you need to act really fast for the next higher payment.

You need to own stock in Ecolab by the end of today to get the higher payment.

Ecolab’s dividend growth has been outstanding.

Over the last 20 years, Ecolab has averaged a 10.5% growth rate in its dividends each year.

Ecolab’s divided yield of only 1.1% is the only negative.

So Ecolab isn’t the company for you if you need a lot of income.

But if you want a great company with excellent dividend growth, then give Ecolab a closer look.

And while Ecolab’s dividend growth is awesome, there’s so much more to love about the company.

Ecolab’s profit margin of 12.5% is one of the highest in the entire materials sector.

Plus, Ecolab’s return on equity (ROE) of 22% is more than 4x its peers in the chemicals industry.

And if you’re worried Ecolab is going to run out of money to keep paying its dividend, don’t be.

Ecolab’s dividend payout ratio is only 35%, so there’s plenty of room to continue to grow the dividend.

What other dividend trades are you making before the end of 2025?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?