The Power Of Compounding Dividends During Rough Markets

I have encouraged my Dividend Hunter subscribers to put our high-yield, monthly dividends on automatic dividend reinvestment for at least the last six months. I contend that automatic reinvestment through a market downturn and recovery will quickly build wealth.

Today, let me show you a little math to prove that investment hypothesis – and give you a stock that you can use to put this into action…

My often-stated investment goal for my Dividend Hunter service is to earn a high-yield, stable – and growing – income. I view this earned income as the primary source of investment returns. I don’t try to time stock prices for capital gains – that doesn’t work, and even if it did, you’d have to stay glued to your computer 24/7.

Investing for income, on the other hand, allows you to buy shares at any time, at any point in the market cycle. Every share you buy increases your income.

You can also build your wealth by investing when the markets are down, thus growing your income and earning capital gains on the upswing.

These two concepts are very powerful when applied to investments that pay monthly dividends coupled with high yields. However, I had never attempted to quantify the results.

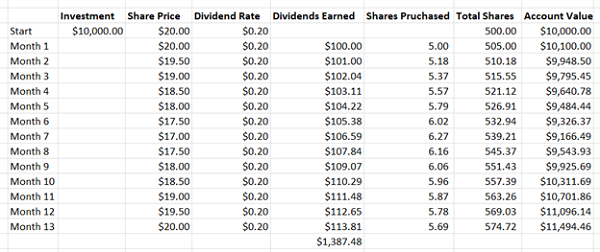

Today, I put together a little spreadsheet that ran calculations for a stock paying monthly dividends with a share price that drops and recovers. Here are the parameters:

The hypothetical investment fund, with the hypothetical symbol HIF, starts at $20.00 per share. I invested $10,000 to buy 500 shares. HIF pays a $0.20 dividend (1% per month). Over 12 months, the simulated stock price drops by $0.50 each month for six months, and then gains $0.50 each month, finishing the year back at $20.00 per share. This spreadsheet shows the results of reinvesting the dividends each month at the current price and the total position value for each month.

You can see the position bottomed at $9,166.49, down 8.33%. At that time, the share price was down 12.5%.

By the time the stock got back up to $20.00, the position was worth $11,494.26. That’s a 14.9% gain from an investment that yields 12%. Nice!

If you back out the $1,387.48 of dividends earned, the original $10,000 at $20.00 per share turned into $10,106.98.

The HIF share price started at $20, and in the example ended at $20, and the original investment showed a gain even net of the dividends earned.

The reason is that automatic dividend reinvestment lets you buy more shares when the share price is down and fewer shares when the share price is up, producing a lower average cost per share. Math is neat when it makes you money! If you’re looking for an investment like this, that pays monthly with a double-digit yield, check out the Global X NASDAQ 100 Covered Call ETF (QYLD), which currently yields 12.5%. It’s only one of many income investments like it in my Dividend Hunter portfolio. To see them all, and my strategy for how to best use them, click here.

This article originally appeared at Investors Alley.

Category: Dividend Stocks