Start 2026 With An Enormous Dividend

Special dividends are great for dividend investors.

The dividend amounts are really high.

For some reason, many investors overlook special dividends.

One company isn’t messing around in 2026.

Its special dividend accounts for over 95% of its dividend payments.

Its next special dividend is almost 3x as high as the special dividend it paid in 2025.

Everyone knows about Progressive Insurance (ticker: PGR) from some of its advertisements on television.

Side note: Progressive’s “Becoming your Parents” ads are hilarious.

But Progressive’s funny ads aren’t why I’m recommending the stock.

Progressive is paying an annual $13.50 special dividend at the start of 2026.

Its special dividend also accounts for almost the entire payment investors receive.

The company only pays $0.10 every quarter.

So if you want dividends from Progressive, you need to own the stock when it pays the special dividend.

And you need to own it quickly.

You must own Progressive by December 31 (Wednesday) to get Progressive’s special dividend.

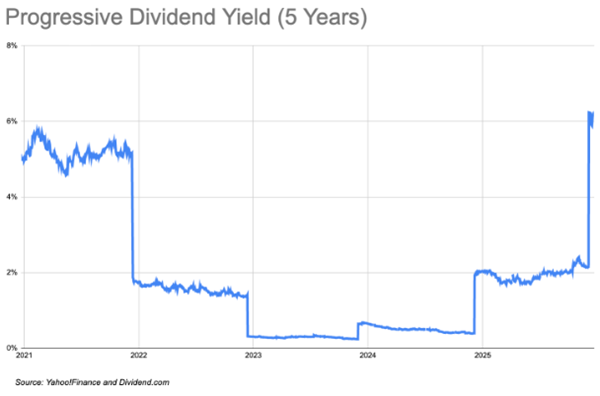

Progressive’s dividend yield is over 6%, which is the highest it’s been in the last 5 years.

Most dividend yield charts don’t look like the one above.

The reason the dividend yield jumps around a lot is because of the special dividends.

How high is Progressive’s dividend yield?

No other insurance company has a higher dividend yield than Progressive.

Progressive is an awesome insurance company.

With over 24 million auto policyholders, Progressive is one of the largest auto insurance providers in the United States.

Progressive is also the largest insurer for commercial vehicles, RVs, motorcycles, and boats in the United States.

And its growth is amazing.

Twenty years ago, Progressive was a little-known insurance company with less than 5% market share.

Now, Progressive is second, only behind State Farm.

How Progressive got there is really impressive.

Over the last decade, Progressive’s revenue has grown on average over 14% each year.

Its free cash flow, which we care a lot about since it’s the source of our dividend payments, has grown 22% each year over the last decade.

Progressive’s Return on Equity (ROE) of 36% is also one of the highest in the entire insurance sector.

And its price-to-earnings ratio of 12.4x is in-line with its peers.

If you’re looking to start off 2026 with a bang, then Progressive is a great place to start.

What dividend stocks are you looking at for the end of the year?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?