Here’s A Sneaky Way To Get A (Nearly) Free Meal… (And Discover A Cool Company Too!)

When looking for more dividend-paying companies, I came across a company with a weird name. I’d never heard of it before…

I knew its restaurants, though!

Places like Olive Garden, Longhorn Steakhouse, Cheddar’s, Capital Grille, and Ruth’s Chris.

We’ve all had the amazing breadsticks at Olive Garden.

If you’ve never been to a Capital Grille or Ruth’s Chris, you must check them out.

They’re amazing steakhouses, leaving you satisfied… if not a little lighter in the pocketbook.

One way to help pay for an amazing meal is to buy stock in their parent company, Darden Restaurants (ticker: DRI).

Darden is a pretty interesting company.

The founder, William Darden, opened his first restaurant in 1938!

William Darden used the proceeds from his successful restaurant to expand his empire. He started Red Lobster in 1968 and Olive Garden in 1982.

General Mills (ticker: GIS) bought out Darden and owned the brands until General Mills spun off its restaurants in 1995 to the company we know today.

Now a bit of history… Red Lobster made major news in 2024 for going bankrupt. But don’t worry. Darden sold Red Lobster in 2014 for $2 billion to a private equity firm.

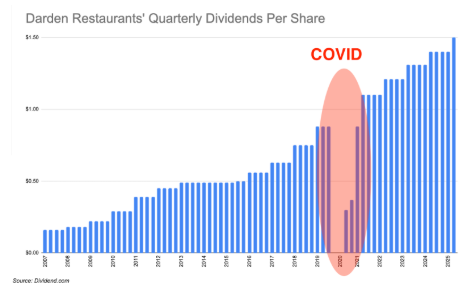

Darden has paid a dividend every year since being spun-off from General Mills, though it skipped a few payments during COVID.

You can’t blame Darden for dropping payments during COVID. Nobody was going out to eat!

Once the pandemic was over, Darden restarted payments right where it left off and maintained its historical growth.

Over the last decade, Darden has increased its dividends on average by almost 10% every year.

Darden is making its latest dividend bump up to $1.50, which is 7% higher than last year.

The payment is coming up quickly. You need to own Darden by July 9th to get its next, higher payment.

Darden shouldn’t have any problems keeping those payments coming.

Darden generates over $1 billion in free cash flow each year, and it only pays out about $600 million in dividends.

And while Darden is increasing its dividend on average by 10% over the last decade, its free cash flow is averaging 12% annual growth over the same period.

Free cash flow is what companies use to pay dividends, so having free cash flow grow faster than dividends is fantastic.

Darden’s dividend yield sits at around 2.75%, which seems a little low.

Why is the dividend yield so low? Darden’s stock has almost tripled in the last 5 years!

Yield on cost is a great measurement for companies with rising stock prices since it calculates dividend yield based on purchase price rather than current price.

Darden investors who bought in just five years ago have a yield on cost over 8%!

So, next time you go out to eat, consider going to one of Darden’s brands.

And use the dividend payments to cover the check!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?