Should You Write Covered Calls On Dividend Stocks?

If you’ve been trading options for any length of time you’ve no doubt heard about Covered Calls.

It’s a solid strategy that generates cash flow almost immediately, and is relatively safe to trade.

Heck, you can place covered call trades with just Level 1 Options approval… and you can even place these trades in your retirement account!

The Strategy Is Simple

Step 1 – Buy 100 shares of stock

Step 2 – Sell 1 call option contract with a strike price above the price you paid for the stock

Step 3 – Collect the Options Premium (That’s your profit right away!)

Step 4 – Wait for the option to expire worthless… or it gets exercised

Step 5 – Repeat the process

Like I said, the strategy is simple… but with most things there is great nuance to trading covered calls the right way.

You can trade covered calls on most stocks that have options.

The key is picking the right strike price and expiration date – depending on your investing objectives.

Funny thing – many traders try to stay away from dividend-paying stocks… and the reason is strange.

Here’s the deal. When a stock goes Ex-Dividend, the share price SHOULD actually fall by the amount of the dividend.

It makes sense… if the company is worth say $50… and they pay a $0.25 dividend… the company “gave to shareholders $0.25 and the company now has $0.25 per share LESS in capital.” As a result, the stock SHOULD be worth $49.75.

Like I said, this should happen.

And it does.

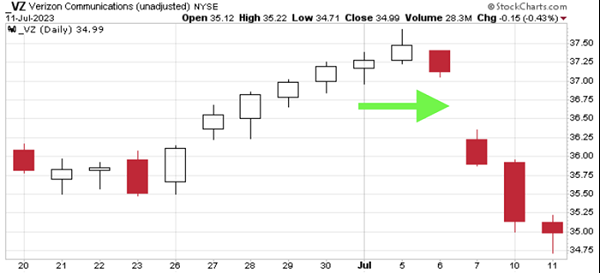

Look at the stock performance of Verizon (VZ) from earlier this week.

On July 7, you had to own the stock to collect the dividend.

On July 7 – the next trading day – you see the stock trade lower – because, if you buy the shares on the 10th, you do not get the dividend.

Interesting right?

Keep in mind, the dividend declared was $0.6525 per share… and that’s the adjustment from the prior day’s close.

Because of this price action, many traders avoid covered calls on these stocks.

They claim the call options are priced lower than normal… or the dividend messes with True Pricing… whatever that means.

While, the dividend impact on stock price is real… the truth of the matter is, the market is going to move with the outlook on the stock.

Funny thing – the Verizon stock traded right back down to where it was just a week before the Ex-dividend date. Essentially returning to the original value of the company 10 days earlier – BEFORE the dividend payout.

So, if you had bought the stock 10 or 12 days earlier – you;d have been at break even on the stock – and still collected the dividend!

Think about it long term… if you’re holding Verizon stock for the next 5 years – do you care that it gapped down by a few cents because of the dividend?

No, of course not.

You’re simply smiling all the way to the bank with the premium you collected for establishing a simple covered call option trade!

If you have shares of stock or ETFs that are core holdings – there is absolutely no reason not to write covered calls on these stocks. You might as well collect the extra cash flow from selling options – even if they pay dividends!

Who cares if the options are “priced optimally” in my book, cash in the hand is much better than cash in theory.

This post orignally appeared at NetPicks.

Category: Dividend Stocks