Secret Stock Has Doubled Its Dividend In Just 5 Years!

Everyone reading my articles knows how much I love dividend growth.

If the company is flying under the radar, then I’m in heaven.

When people think of real estate investing, they usually think about buying a second property.

They can charge rent to people interested in living there or they look to sell the property at a higher price in the future.

For dividend investors, we think about REITs!

St. Joe Company (ticker: JOE) is a real estate company operating in the Florida panhandle.

But St. Joe isn’t a REIT.

REITs make money by charging rent on their properties.

St. Joe is a real estate development company.

Real estate development companies make money by purchasing land, developing it, and then selling the developed property for a profit.

St. Joe operates in some of the fastest-growing areas in the United States.

And since 2020, no state in the United States has grown faster than Florida.

The population in Walton County, a county where St. Joe operates, grew more than 20% over the last five years.

With the southern and eastern parts of the state getting overcrowded, more and more people are going to set their sights on the Florida Panhandle.

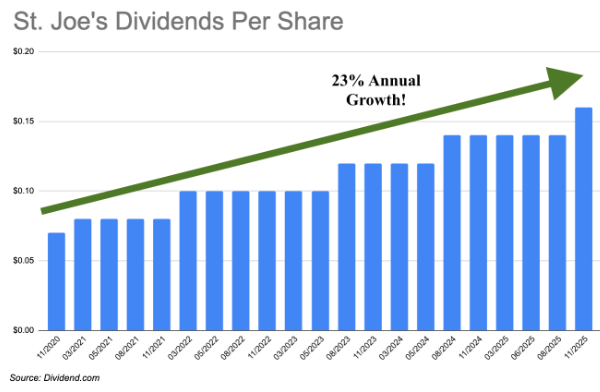

All of the growth is showing up in St. Joe’s dividend.

St. Joe started paying dividends in 1996 but stopped payments in 2007 when the real estate market crashed.

St. Joe restarted dividend payments in 2020 and it’s been making up for lost time.

St. Joe’s dividend grew 23% each year on average.

The dividend history isn’t there.

But St. Joe is rapidly raising its dividend, and it isn’t done.

St. Joe is raising its dividend again to $0.16 every quarter.

If you want the higher payment, you need to act quickly.

You need to own St. Joe by November 12 (Wednesday) to receive the higher payment.

Unfortunately, it isn’t all good news for St. Joe.

Its dividend yield is only 1.1%.

But don’t ignore the bigger picture.

If St. Joe can maintain a 20% dividend growth rate, your dividend checks would double every three and a half years!

And St. Joe’s dividend payout ratio is only around 30% over the last 12 months.

So there’s plenty of room for St. Joe to continue to grow its dividend payments.

And here’s something crazy.

St. Joe’s price-to-sales ratio is at its lowest level in 10 years.

So not only are we getting a company with insane dividend growth.

We’re getting the stock at an amazing price!

What other real estate companies do you own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?