Private Equity’s Loss Can Be Your Gain With These Three Income Stocks

Higher interest rates have put a damper on the funding of venture capital investments from the private equity world. When interest rates were near zero percent, private equity firms could borrow money with no cost, which could be employed as venture capital investments.

This led to some headline-grabbing returns.

The higher rates brought on by the Federal Reserve in response to inflation have made venture capital investing much less attractive for private equity. However, start-up companies need capital to grow, opening the door for public companies operating in the venture capital space.

And it’s giving us a nice opportunity to lock in some very attractive dividend yields…

Investopedia defines venture capital as a: “type of financing that investors provide to start-up companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.”

Business development companies (BDC) provide debt and equity financing to small to medium-sized corporations. BDCs operate under special rules: specifically, they do not pay corporate income taxes as long as 90% of their income gets paid out as dividends to investors. As a result, BDC shares carry attractive yields and are popular with income-focused investors.

Most BDCs make loans to established, profitable companies. However, I am aware of three that focus on providing capital to start-up companies. These BDCs often work hand-in-hand with other venture capital investors.

Here they are in alphabetical order:

Hercules Capital (HTGC) is one of the oldest BDCs in this space, founded in 2003 and available to investors after a 2005 IPO. The company is internally managed with a $2.0 billion market cap. In the BDC world, a $2 billion market cap with a $3.2 billion enterprise value (market cap plus debt) makes it one of the larger companies. What sets Hercules apart from its peers is its client focus. Hercules works with venture capital and private equity firms to fund pre-IPO companies or ones being groomed for mergers or acquisitions.

Hercules Capital has a history of dividend growth and paying supplemental dividends, and its regular quarterly dividend increased by about 10% over the last two years. A supplemental dividend has also been paid for the previous eight quarters. Based on its regular dividend, HTGC yields 10.1%.

Runway Growth Capital (RWAY) is a newer BDC, launched with an October 2021 IPO. This description comes from the company factsheet:

Runway Growth Finance Corp. is a growing specialty finance company focused on providing flexible capital solutions to late-stage and growth companies seeking an alternative to raising equity. Our mission is to support passionate entrepreneurs in building innovative businesses. The company lends capital to companies looking to fund growth with minimal dilution.

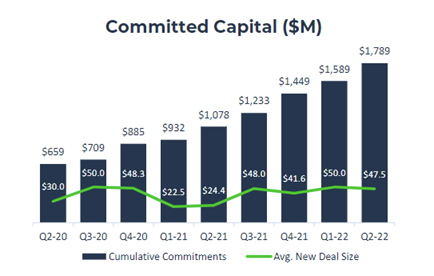

Runway is in the early stages of growing its investment portfolio. Here is its growth over the last several years:

The Runway dividend has grown at a similar pace. From an initial $0.25 per share paid in November 2021, the payout has increased every quarter, with $0.36 per share paid in November 2022. RWAY yields 11.1%.

SuRo Capital Corp (SSSS) is not your typical BDC.

Whereas most BDCs operate primarily as lenders and pay dividends out of net interest income to investors, SuRo invests in start-up venture capital-supported companies. This BDC generates profits when one of its portfolio companies goes public with an IPO or is acquired at a premium to an earlier valuation. The company targets investments of $10 to $15 million in new companies. I think of SuRo as a BDC looking to hit home runs. As a result, the SuRo portfolio can get very overweight in just a few names.

Because of its capital gains-focused business model, SuRo, at times, pays very large distributions and, at others, almost nothing. For example, investors earned $8.00 per share in distributions in 2021. However, as the stock market fell in 2022, the company paid no dividends and focused on buying back shares. This BDC lets you invest more like a typical venture capitalist.

These three venture capital-focused BDCs let you tailor your risk from looking for home runs to a long-established player in the space.

This post originally appeared at Investors Alley.

Category: Dividend Stocks