New Fund Offers 40% Dividend Yield… And Pays Dividends Twice A Week!

Wall Street has done it again.

People are loving high income funds.

Funds like the JPMorgan Premium Income Fund (ticker: JEPI) have pulled more than $40 billion into its fund.

And its popularity makes sense.

JEPI aims to track the S&P 500, while increasing the dividend yield from 1.2% to over 8%.

JEPI gives 6x as much dividend income as the S&P 500.

Plus, JEPI pays dividends every single month while the S&P 500 only pays every quarter.

JEPI started out in 2020, and income ETFs have evolved a lot in 5 years.

In 2024, Defiance, an ETF provider, released its S&P 500 Target 30 Income ETF (ticker: WDTE).

WDTE looks to track the S&P 500, just like JEPI, but increase the dividend yield to 30% instead of 8%.

And WDTE pays a dividend every single week.

We’re not going to talk a lot about WDTE.

It’s because Defiance just outdid itself.

Defiance recently released the S&P 500 LightningSpread Income ETF (ticker: QLDY).

How new is QLDY?

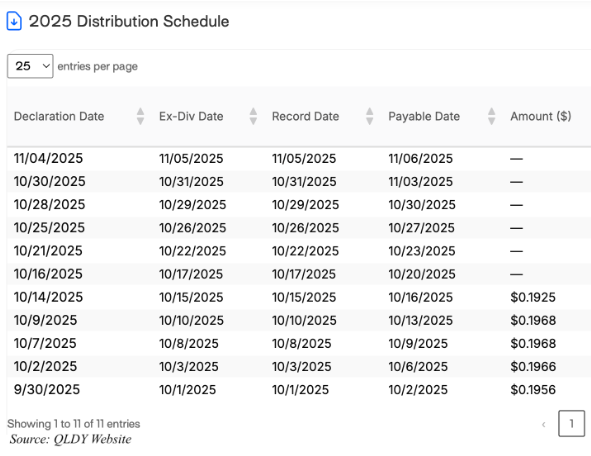

QLDY just started trading in mid-September and made its first payment in early October.

By the time you finish reading, QLDY will have made 6 dividend payments.

Put your counting fingers away and make sure you’re sitting down.

QLDY is paying dividends twice a week!

So far, QLDY is paying a dividend every Monday and Thursday.

It means you’re getting over 100 dividend payments every year from QLDY!

What does the dividend yield look like?

Nobody is publishing a dividend yield because QLDY is so new.

But we can calculate it.

So far, QLDY is paying just over $0.19 each payment.

Two payments for 52 weeks out of the year means we’ll collect around $20 in dividends.

The current stock price for QLDY is around $50, which gives it a dividend yield of 40%.

How does Defiance do it?

Defiance generates income by selling put spreads.

Put spreads are created when you sell a put option with a certain strike price and then buy a put option on the same underlying asset, but at a different strike price.

For QLDY, Defiance is selling a put option at a higher strike price than the put it’s buying.

The put option with the higher strike price pays a higher premium to QLDY than it must pay to buy the other put option.

The income is based on the spread in premium between the two options (hence its name LightningSpread).

Fidelity has an awesome website explaining put spreads.

If you don’t understand put spreads, then don’t invest in QLDY.

Only invest in things you understand!

But if you feel comfortable with put spreads, two payments a week with a 40% dividend yield is really nice.

What high income ETFs do you own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Yield