Massive Bank With AMAZING Dividend Growth

When talking about banks there are a lot of really big names out there.

But only one can call themselves #1: JP Morgan Chase (ticker: JPM).

JP Morgan is a $700 billion behemoth in the financial world.

They’re more than double the size of the second largest US bank, Bank of America (ticker: BAC)!

Just some quick background on JP Morgan.

JP Morgan was founded in 1871.

That’s not a typo – JP Morgan has been around for over 150 years!

And JP Morgan is big.

Scratch that – they’re MASSIVE!

JP Morgan has over $4 trillion in assets, which is the most of any US bank.

Size really matters for a bank.

Larger banks give customers peace of mind and confidence that their money is safe.

And for JP Morgan it shows.

Going back a decade, JP Morgan is lapping the competition.

JP Morgan grew 4x as much as the overall banking sector!

And their stock price is not the only thing growing.

JP Morgan has been paying a dividend for almost 30 years.

More importantly, JP Morgan has increased their dividend every year since 2010, essentially ever since recovering from the financial crash.

The amount JP Morgan is growing their dividend will astound you!

JP Morgan has more than tripled their dividend payments over the last decade.

They’re far from finished too.

JP Morgan increased their payment again.

This time it will rise to $1.40 per share, which is 12% higher than their last payment and more than 20% above their April payment in 2024!

Recently, JP Morgan has been increasing their dividend payments multiple times each year!

Only a handful of companies raise their dividends more than once a year.

And the ones that do aren’t making 10+% increases like JP Morgan.

This next part is really important – you must act fast for this higher payment.

Only investors who hold JP Morgan stock on April 3rd will get the dividend.

If you wait too long someone else is getting that money!

Here’s a potential downside: JP Morgan has a dividend yield around 2.25%.

That’s pretty low.

But JP Morgan’s dividend yield is cursed by their success.

The stock price is going up so much that the dividend can’t keep up!

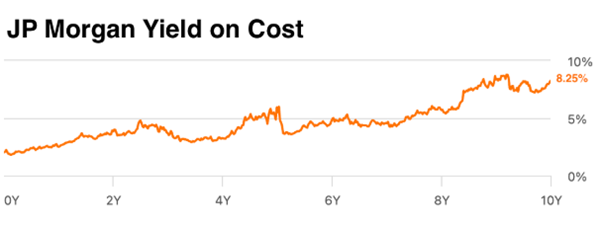

Yield on cost is really helpful because it measures the dividend yield based on when investors bought the stock.

For JP Morgan it’s incredible!

The yield on cost for investors who bought JP Morgan 10 years ago is over 8%!

10 years ago (January 2015) you could buy JPM for $54… and now JPM pays $5.60 in dividends! That’s more than a 10% Cash on Cash return… not to mention all the dividends you collected along the way!

Not too bad for a company that usually yields between 2-3%.

Do you consider JP Morgan a must-own dividend company? Are there other banks you like better for dividends?

Send us a note to let me know!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?