An Incredibly Popular ETF With A 4.8% Dividend Yield Is Jumping!

I don’t usually talk about Exchange-Traded Funds (ETFs).

ETFs are very popular because they’re easy and provide a lot of diversification.

However, there are two problems with ETFs.

First, you’re paying fees to the managers of the ETF.

I’d rather the fees get paid to me in dividends!

Second, you’re trusting someone else with your money.

The managers of the ETF might do a bad job.

Investing in individual, dividend-paying stocks is more straightforward.

However, there’s one exception where I think investing in an ETF is the best option… and it’s international stocks.

Some of the largest international stocks trade on U.S. exchanges.

But not all of them do, and I don’t feel like trading Japanese stocks at 2 AM.

Plus, most reporting for international stocks aren’t in English.

I don’t care how long your Duolingo streak is… it’s not going to help you read an annual report in German.

International ETFs are gaining in popularity, but a dividend-paying one is flying off the charts.

It’s the iShares International Select Dividend ETF (ticker: IDV).

iShares is one of the most popular ETF providers.

And over the last 6 months, people have added over $700 million of IDV to their portfolios.

Why is IDV so popular?

IDV invests in international, dividend-paying stocks. Because investors have major concerns about U.S. trade policy, the ETF has been a huge beneficiary!

Here’s the question… should you do the same and buy some IDV?

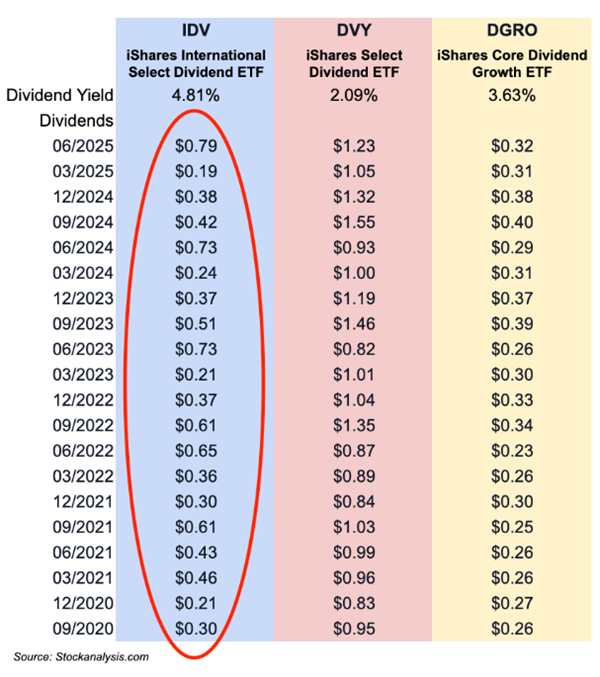

IDV has a great 4.8% dividend yield, which is higher than some of iShares’ U.S. Dividend ETFs like the iShares Core Dividend Growth ETF (ticker: DGRO) and iShares Select Dividend ETF (ticker: DVY).

But the dividend payments are all over the place.

There are two reasons for the dividend changing so much.

First, international dividends are paid in different currencies.

But IDV pays its dividends in U.S. Dollars.

So changes in exchange rates between the U.S. and other countries will change the dividend payment amounts.

Second, international companies don’t always follow a quarterly schedule normally used in the U.S.

Some international companies only pay dividends once or twice per year, so dividends paid out during those months will be much higher.

If you’re okay with a variable dividend, IDV is a great choice.

IDV owns some excellent international, dividend-paying stocks.

And IDV has been killing its U.S. counterparts so far in 2025.

Don’t completely bail on individual U.S. stocks…

But if you’re looking for some international exposure, there aren’t many spots better than IDV.

What international stocks do you own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Yield