Income From Cryptocurrency Without Getting Scammed!

Cryptocurrency is all the rage right now.

Bitcoin, Ethereum, Blockchain, Digital Wallets – there’s a lot to understand before jumping in!

You might be thinking: cryptocurrencies don’t pay dividends. So why are we talking about it?

Some really smart people figured out a way to get income from cryptocurrencies.

The first were stablecoins, which are cryptocurrencies pegged to something else, usually the US Dollar.

UST was one of the fastest growing stablecoins a few years ago by promising high interest rates for a savings account.

UST didn’t outright claim it was risk-free, but the name “stablecoin” certainly implied it.

They ran savings accounts paying rates around 20%.

Sounds too good to be true, right?

That’s because it was.

UST’s claims of a safe 20% return were false and people’s savings were wiped out.

That’s horrible!

If you’re curious, here’s a good article on stablecoins and the collapse of UST.

Unfortunately, one of the risks of cryptocurrency is getting scammed.

That’s not the case for this new dividend investment using cryptocurrency.

RoundHill Investments released the Bitcoin Covered Call Strategy ETF (ticker: YBTC) in early 2024 and their dividends are crazy!

How crazy? Try a dividend yield of 30% levels of crazy!

That’s fantastic, but far from the best part.

YBTC pays dividends every single week!

That’s more often than most people’s paychecks.

How does YBTC do it?

You guessed it! YBTC uses a covered call strategy.

YBTC buys Bitcoin, the largest and most popular cryptocurrency, and sells call options to pay out dividends.

A call option means that the seller, like YBTC, must sell the asset, in this case Bitcoin, at a later date at a specific price, called the strike price.

The seller receives a premium, which YBTC distributes as a weekly dividend.

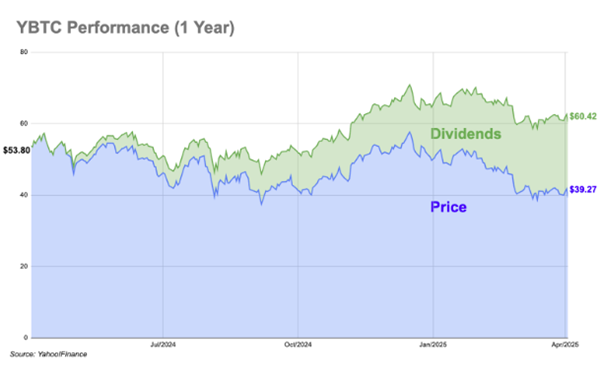

Here is a price chart for YBTC which highlights the importance of these dividends.

The price (blue line) for YBTC fell over the last year – almost a 27% drop!

Add in the dividends (green line) and you actually would have made 12%!

You can’t just ignore those dividends!

Bitcoin fared a little better than YBTC, why?

When the price of Bitcoin rises sharply, like it did in November, YBTC’s gains are limited if Bitcoin rockets past the strike price on the call option.

What about getting scammed?

YBTC has got you covered!

Roundhill Investments, the firm managing YBTC, manages almost $4 billion in assets and operates more than 20 ETFs (Exchange Traded Funds).

Bitcoin is by far the most popular cryptocurrency with a market cap over $1.5 trillion.

If you want to sell options on a cryptocurrency, then using Bitcoin is your safest bet.

YBTC also doesn’t pretend to be a savings account or act like they are risk-free.

YBTC is based on the price of Bitcoin, which has plenty of risks. If the price of Bitcoin plummets, this trade will see a loss.

But if cryptocurrency is the future, and you think Bitcoin is going to be moving higher… then YBTC might be worth a shot.

What are your thoughts on getting dividends from cryptocurrency?

A weekly dividend does sound pretty nice, right?

Send me a note with your thoughts!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Yield