Huge Dividends EVERY MONTH, An 11% Yield

One of my favorite dividend resources is Dividend.com.

Its screening tool is great for finding new, interesting dividend stocks.

But you need to be careful.

Sometimes the data is accurate… but, sometimes, the data doesn’t make a lot of sense.

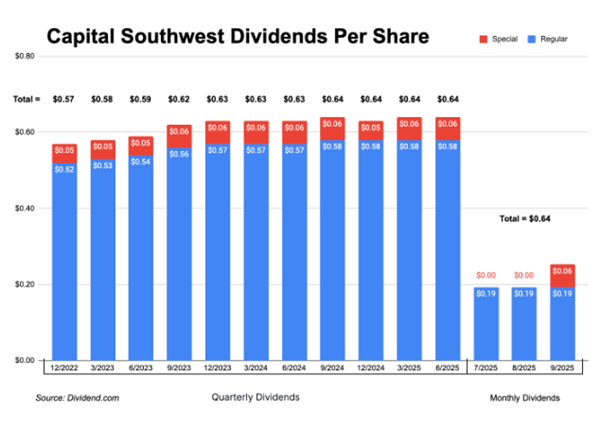

For instance, a popular dividend stock showed a 66% cut in its dividend.

I don’t own the stock, but the company was on my radar.

I couldn’t believe it!

So many dividend investors will be crushed by lower payments.

But it’s important to verify and re-verify everything, especially in the stock market.

A quick look showed the dividend didn’t get cut by 66%.

Phew!

The company didn’t lower its payments. It simply shifted its payout schedule… paying dividends every month instead of every quarter.

I’m definitely more interested now.

The stock is Capital Southwest (ticker: CSWC), which is a business development company (BDC).

A BDC is a special kind of company.

They loan money to small and medium-sized businesses or organizations.

Places like local restaurants or a regional HVAC company.

BDCs like Capital Southwest make money by loaning money at higher rates than their borrowing rates.

And BDCs are very popular dividend stocks.

For tax purposes, BDCs must pay out 90% of their income as dividends.

High payout ratios lead to really high dividend yields.

Capital Southwest is currently yielding over 11%, even after changing its payment schedule.

What will the new dividend look like?

The dividend amount will actually be the same.

Capital Southwest used to pay $0.58 every quarter along with a $0.06 special dividend (a total of $0.64).

Now, Capital Southwest will pay $0.1934 per month and a $0.06 special dividend at the end of each quarter.

Every quarter you’re getting the same $0.64.

The change is happening soon.

But since the payouts hit your account every month, if you like this stock, there’s no reason to wait to buy it.

Who cares if Capital Southwest is paying monthly or quarterly?

We all should care and here’s why.

Dividend stocks paying monthly are helpful for people using dividends to pay their bills.

Mortgages, utilities, internet, car insurance, etc., are bills coming due every single month.

Having a company pay us monthly to line up with those bills makes balancing income and expenses so much easier.

Most BDCs pay dividends once per quarter.

Main Street Capital (ticker: MAIN), a competitor of Capital Southwest, is one of the few BDCs paying dividends every month.

However, Capital Southwest’s 11% dividend yield is significantly higher than Main Street Capital’s 7% yield.

BDCs are very popular with dividend investors, and if Capital Southwest isn’t on your radar, you should give it a look.

What BDCs do you currently own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Yield