Double-Digit Dividend Growth From A Surprising Industry

Some industries in our economy are doing really well.

Anything related to AI is booming!

But some parts of our economy are lagging behind.

Honestly, they’re downright awful.

There has been so much written about the demise of department stores, I probably couldn’t add any new information.

Sears is no longer in business. JC Penney went bankrupt in 2020 and no longer trades on the stock market. Macy’s and Kohl’s are still around, but their stock prices are down more than 75% from their all-time highs.

Department stores don’t seem like a great place to invest money at the moment.

But one has been making people a lot of money.

Dillard’s (ticker: DDS) is a smaller department store with only 270 locations.

And it’s been making a killing.

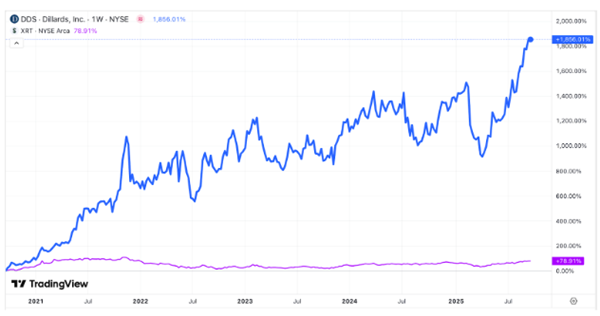

Over the past five years, Dillard’s stock price is up almost 1,900%!

The retail sector hasn’t even doubled in the last five years!

The rise in the stock price is awesome, but don’t ignore the dividend.

Dillard’s just increased its payment for the 15th straight year.

Its next payment will be $0.30 per share, which is 20% higher than the last payment.

But you need to act really fast.

You must own the stock by the end of TODAY to get the higher payment!

Hold on a second, though.

Dillard’s stock price is around $600.

An annual dividend of $1.20 means Dillard’s dividend yield is only 0.2%.

Google Finance, Yahoo! Finance, Dividend.com… they all have Dillard’s dividend yield at 0.2%.

Even Morningstar, a paid service, has Dillard’s dividend yield at 0.2%

But they’re ALL wrong!

Every December, Dillard’s pays a massive special dividend.

Last year, Dillard’s paid a special dividend of $25!

The year before, Dillard’s paid $20 in special dividends.

Dillard’s dividend yield is actually 4.4%.

Just because everyone else is ignoring the special dividends doesn’t mean you should make the same mistake!

Why is Dillard’s doing so well in a struggling industry?

Dillard’s just knows how to make money!

Dillard’s profit margin of almost 9% is more than 4x higher than the industry average.

Its Return on Equity (ROE) of 30% is almost 6x the industry average.

And Dillard’s is doing it without taking on tons of debt.

Dillards’ debt-to-equity ratio of 0.3x is half the industry average.

Do you want to know the best part?

Besides the dividend, of course!

Dillard’s price-to-earnings ratio is only 16x.

Generally, stocks are cheap if the price-to-earnings is less than 15x.

But I’m willing to pay a little more for such a great company like Dillard’s.

What are some of your favorite retail stocks?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?