A Delicious Special Dividend Doubles The Yield

Special dividends are a great tool for dividend investors.

But they’re very different from regular dividends.

First, special dividends are usually only paid once per year.

Regular dividends, on the other hand, are generally paid 4 times per year.

Second, regular dividends are much more stable.

Regular dividend payments are the same amount each quarter, unless the company raises its payments.

Special dividends aren’t stable at all.

One year it might be a few dollars, and the next year it might be a lot lower or higher.

Or the special dividend doesn’t even happen some years, which is the third difference.

Regular dividends are recurring and are paid every quarter.

Special dividends might be paid once and then never again.

And one company is dipping its toe into special dividends.

Nathan’s Famous (ticker: NATH) is known for its amazing hot dogs.

Its flagship store at Coney Island in New York is a major tourist destination.

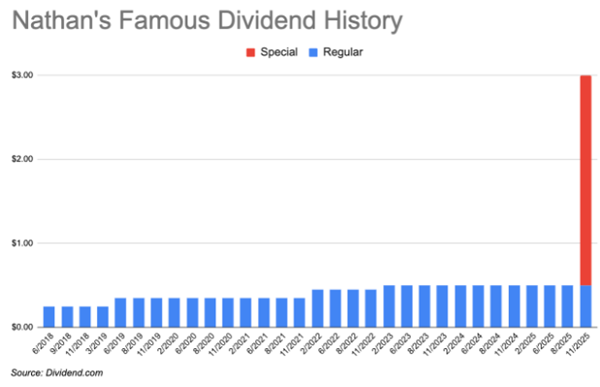

Nathan’s started paying dividends in 2018 and has paid $0.50 per quarter for the past 3 years.

Nathan’s stock price is currently around $100, so Nathan’s regular dividend yield is only 2%.

But Nathan’s is making a $2.50 special dividend payment, which is 400% higher than its regular dividend amount.

The special dividend raises Nathan’s dividend yield to 4.5%

If you’re interested in the special dividend, you need to act quickly.

You need to own Nathan’s stock by November 21 (Friday) to receive the special dividend payment.

Not only will you get the special $2.50 dividend, but you’ll also receive Nathan’s regular $0.50 dividend.

Let’s dig more into Nathan’s Famous as a company.

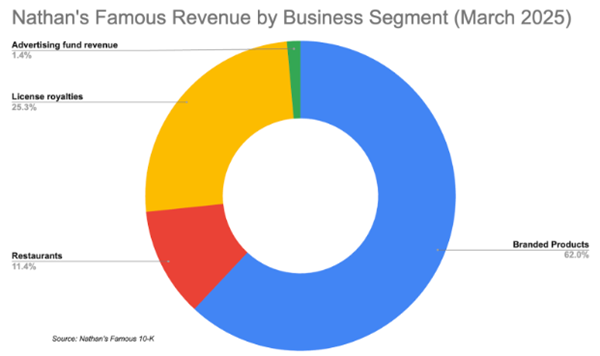

Nathan’s is considered to be a part of the restaurant industry.

But only 11% of the company’s revenue comes from its restaurants.

Over 60% comes from branded products, which is revenue from selling Nathan’s products to food distributors.

And another 25% is revenue from licensing, which are Nathan’s products sold in grocery stores.

So I really consider Nathan’s a packaged foods company rather than a restaurant.

And Nathan’s is a star compared to other packaged food companies.

Nathan’s net margin is 14.75% over the last 12 months, which is more than 4x the industry median.

And Nathan’s free cash flow margin is outstanding.

Free cash flow margin is a company’s free cash flow divided by its revenue.

It measures how efficient a company is in converting sales into free cash flow.

And we care a lot about free cash flow since it’s the source for dividend payments.

Nathan’s free cash flow margin of 12.9% is more than 5x other packaged goods companies.

Plus, you’re getting Nathan’s at a very reasonable price.

Nathan’s price-to-earnings ratio of 17.9x is right in line with its industry.

Sounds like a great deal to me.

Have you ever bought a company to get its special dividend?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?, Dividend Yield