A Century’s Worth Of Dividends

I wasn’t sure what I was going to talk about during the shortened trading week.

Most people are on vacation, spending time with their families over the holidays.

So I was more than a little surprised when I found a company raising its dividend payment at the end of the year.

And I was downright shocked at what McCormick & Company (ticker: MKC) has been doing with dividend growth.

If you do any cooking, you know all about McCormick.

McCormick is best known as a staple on the spice racks in our kitchens.

I just checked my own spices and I have over a dozen of McCormick’s products sitting on my shelf!

But the company does more than just spices.

McCormick owns many other well-known brands as well, including Frank’s RedHot and French’s condiments.

When looking at stocks to buy, I like industry leaders.

McCormick owns 20% of the global spice segment, which is more than 4x its largest competitor.

You can’t find many better market leaders than McCormick!

So what’s so great about McCormick’s dividend?

McCormick has been paying a dividend for over 100 years.

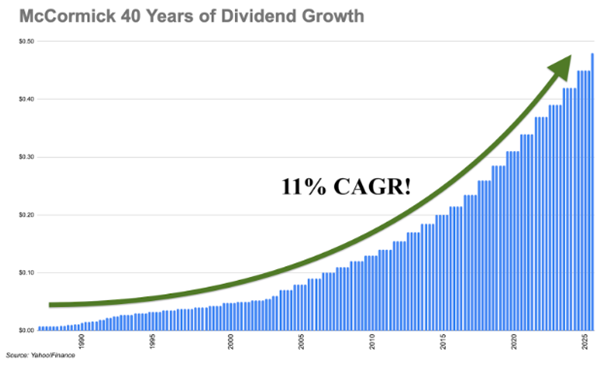

And its latest dividend hike now makes it 40 straight years of dividend growth.

McCormick just raised its dividend by another 7% to $0.48 per share every quarter.

The chart above is beautiful for dividend investors.

Over the last 40 years, McCormick has grown its dividend on average by about 11% each year.

For McCormick’s next payment, you need to own the stock by the end of the week.

If you don’t own McCormick by December 26 (Friday), someone else is getting the higher payment.

And don’t forget about the shortened trading week.

The stock market closes early on Wednesday and is completely closed on Thursday for Christmas.

McCormick’s current dividend yield of 2.8% doesn’t seem like a lot.

But its dividend yield hasn’t been near 3% since the Great Recession in 2009.

If McCormick maintains a 7% dividend growth rate, your payments will double every 10 years.

The dividend isn’t the only great part about McCormick.

McCormick’s profit margin of 11.5% is one of the highest in the entire packaged foods industry.

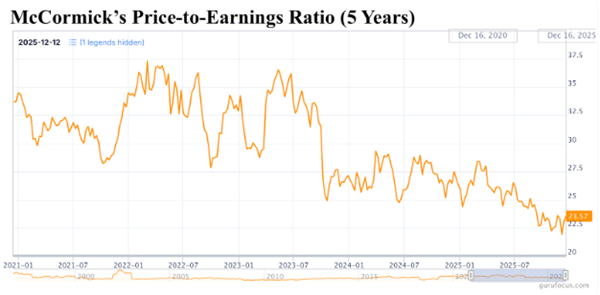

And while McCormick’s price-to-earnings ratio is a little higher than its peers, its current 23.6x ratio is much lower than its historical average.

I’m happy to pay a little bit more for McCormick to get such a great profit margin and excellent dividend growth.

Do you own any other companies paying dividends for more than 100 years?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?