Beaten-Down REIT Raises Its Dividend 12%

I’ve been keeping a very close eye on a struggling REIT.

How bad did it get?

At one point, its stock price was down over 80% from its highs in 2022!

And its dividend wasn’t too far behind.

The REIT used to pay $0.29 every quarter in dividends.

But in 2023, it dropped the payment almost in half to $0.15.

And then followed it up with another cut in 2024 to just an $0.08 dividend payment.

It was a 72% drop in its dividend payment!

The company is Medical Properties Trust (ticker: MPW), a REIT specializing in healthcare properties like hospitals and doctors’ offices.

If the stock price and dividend dropped so far, why am I talking about Medical Properties Trust?

It’s because Medical Properties is making a comeback.

So far in 2025, Medical Properties is up over 40% while the real estate sector has barely been positive.

And Medical Properties is raising its dividend again.

Its next payment will be $0.09, which is 12% higher than before.

But you need to act fast.

You need to own shares in Medical Properties on December 10 (Wednesday) to get the higher dividend payment.

While the dividend payments are low, especially compared to a few years ago, Medical Properties’ dividend yield is around 6.3%.

Its 6.3% dividend yield is almost double the yield for the Vanguard Real Estate ETF (ticker: VNQ) used in the chart above.

And Medical Properties’ 6.3% dividend yield is higher than before its stock price collapsed in 2022.

But Medical Properties’ dividend growth and dividend yield don’t matter if the company is just going to make further cuts.

What caused the initial drop in Medical Properties, and should we still be worried?

Medical Properties largest tenant, Steward Health Care, filed for bankruptcy in 2024 and vacated many of its properties.

To make matters worse, another top tenant, Prospect Medical Holdings, filed for bankruptcy in early 2025.

Medical Properties’ stock price took a nose dive on worries the company might also file for bankruptcy.

And Medical Properties cut its dividend to shore up its own financial position.

While Medical Properties isn’t out of the woods, the worst has passed.

Rent revenue is up 7% in the 3rd quarter compared to 2024.

Medical Properties also refinanced a lot of its debt to mature after 2030 rather than in the next few years.

The debt refinancing gives Medical Properties more room to right the ship.

And Medical Properties is turning it around.

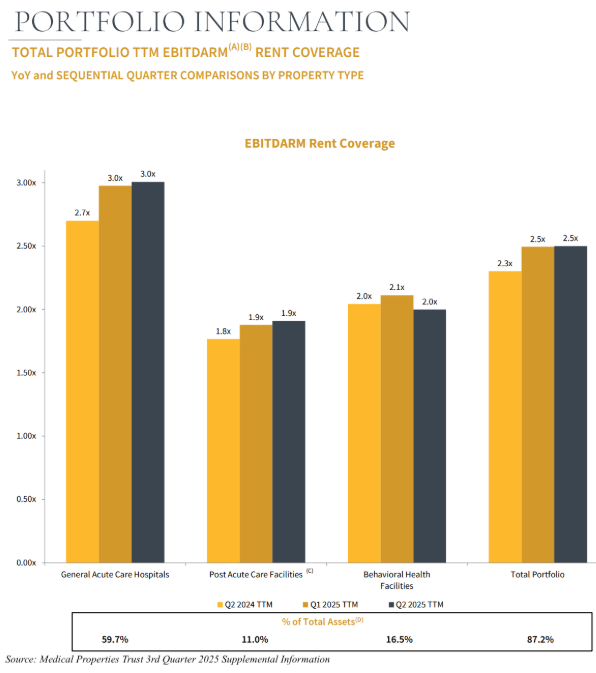

Rent coverage is really important for REITs as it measures how well a REIT can cover its interest expense.

Anything above 2x is considered stable and Medical Properties has raised its rent coverage to 2.5x.

The risks are certainly there.

More of Medical Properties’ tenants could go bankrupt.

But I have a lot more confidence in the stock following its dividend increase.

And a dividend yield over 6% is too good to pass up.

What are some of your other favorite REITs?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?