The Best, And Worst, Dividend Funds Out There (No. 3 Pays A 7% Dividend)

If you’re not one to invest through individual stocks, a fund is the way to go. And if you invest in one totally overlooked type of fund, you can get the best of all worlds: diversification, the profit-making power only the stock market can provide—and a 7% dividend, too!

1-Click Diversification

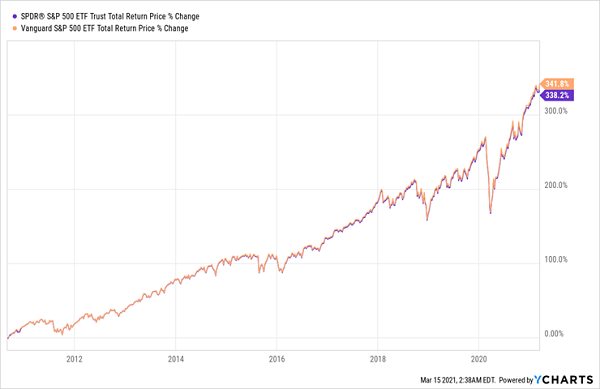

With a fund, you get part ownership in the stocks the fund holds. And if you buy a broad-based fund like the Vanguard S&P 500 ETF (VOO) or the SPDR S&P 500 ETF (SPY), you get ownership of hundreds of companies at once. These funds’ diversity helps protect and grow your wealth, as history shows us.

Diversified Funds Deliver

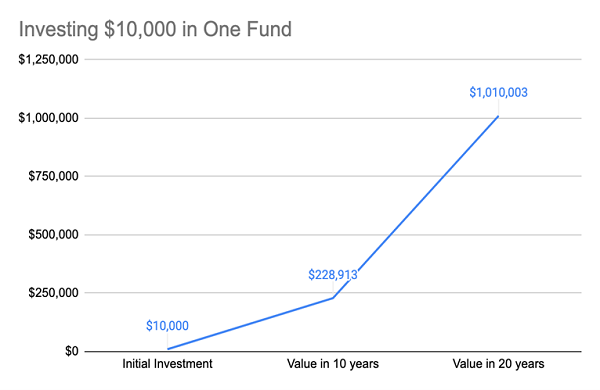

Investing $10,000 in these funds a decade ago would result in a portfolio worth $44,000 today. Add another $10,000 per year and you’ve got over $228,000 over a decade. Do that for another decade and you’ve got a million dollars.

Source: CEF Insider

The best part is that with a fund, you aren’t gambling on one company or other people buying your stock in the future—you’re betting on the entire economy growing. And the economy has been growing since the dawn of history, so that’s a pretty sure bet to make.

So funds are great to buy, but which funds should you buy? Read on as I introduce you to the three main types of funds out there and examples of each. No. 3 is the one you’ll really want to zero in on here: it throws off average yields of 7% and delivers nice upside, too.

- Index Funds: Not Exactly ETFs

Index funds are perhaps the most famous types of funds, and the two I’ve already mentioned are typical examples. They’re so called because they follow an index—that is, a rules-based list of assets that meet certain criteria, which these funds then use as the basis for guiding their asset purchases.

ETFs: The Market Darling (Currently)

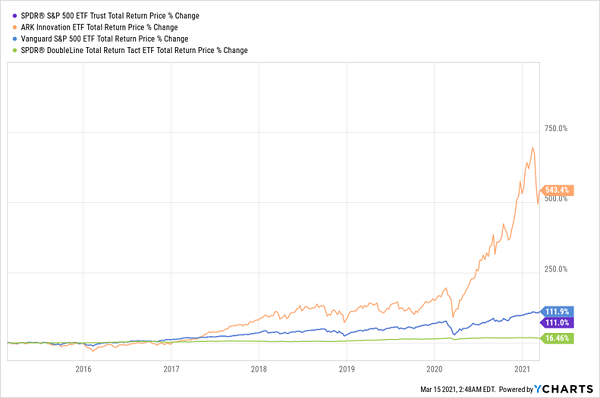

Index funds are often (but not always) ETFs, which is why many investors confuse the two. VOO and SPY are ETFs, but make no mistake, not all ETFs are index funds! Some ETFs, like the ARK Innovation ETF (ARKK) or the SPDR DoubleLine Total Return Tactical ETF (TOTL), are actively managed funds that are the opposite of index funds. Instead of using a rules-based list of assets, these funds select assets based on what those fund managers think is the best thing to buy at any given time.

Historically, active ETFs like these have underperformed index ETFs, but some of them have been doing ridiculously well in recent years. For instance, ARKK is up a shocking 543% as of this writing since its IPO in 2014—a return about five times bigger than those of VOO and SPY!

Some Active ETFs Win … Others Lose

But as you can see from the green line in the chart above, some active ETFs lose. TOTL is basically flat over the same period, giving investors a tenth of the return index funds delivered. For this reason, choosing an ETF must be done with care.

- Mutual Funds: High Fees, Limited Tradability

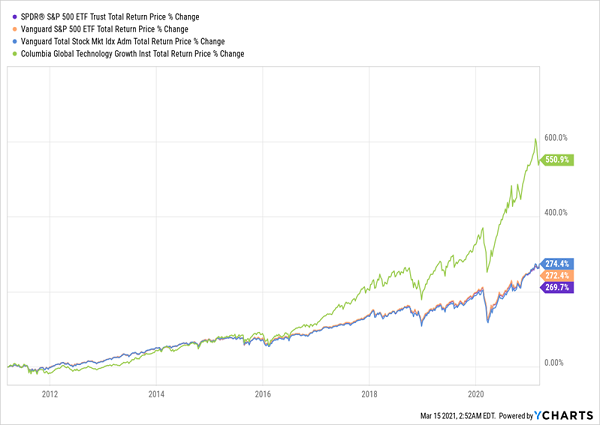

Best known for their prominence in 401(k) plans, mutual funds are similar to ETFs in that they pool money from various investors and use these funds to buy a variety of assets. And like ETFs, they can be active, like the Columbia Global Technology Growth Fund (CMTFX), or they can be passive, like the Vanguard Total Stock Market Index Fund (VTSAX). And like ETFs, they can be big winners or big losers.

CMTFX: Another Market Crusher

CMTFX’s active approach has meant its return has about doubled those of comparable index funds, meaning it’s been a darling for long-term investors. (VTSAX’s return is close to those of SPY and VOO, as these three funds track similar indexes.)

There are a couple drawbacks with mutual funds, however. For one, they cannot be traded during the stock market’s opening hours. If you want to sell, you need to wait until the market closes and then your order will be executed. Same thing if you want to buy.

A bigger problem with mutual funds is their higher fees. CMTFX’s fees are 0.97% of assets, much higher than VOO’s 0.03%. But since CMTFX has far outperformed VOO, fretting over fees in this case was clearly pennywise and pound foolish.

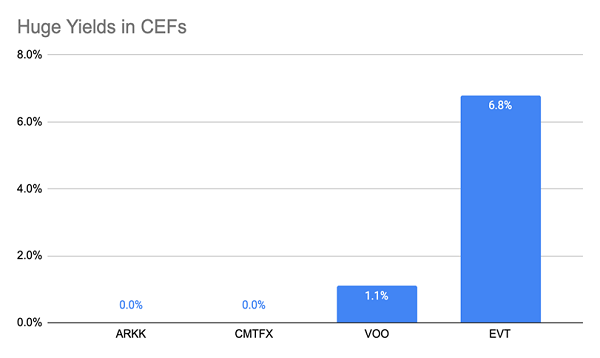

- Closed-End Funds: Huge Yields Hiding in Plain Sight

CMTFX and ARKK are great at delivering big returns to more aggressive investors, but what if you want a passive cash flow?

For instance, many real estate investors admit the hassles of a mortgage, property taxes, dealing with tenants and worrying about empty properties aren’t fun, but they’re worth it because they can get an income stream of at least 6% from their investment, after costs. So even if the value of the rental property doesn’t go up much, their $300,000 in equity gets them $1,500 per month, and that makes it all worthwhile.

That may be true, but there’s a way to capture the big gains of the best stock-market funds and the passive income of real estate: closed-end funds (CEFs).

A well-diversified stock CEF, like the Eaton Vance Tax-Advantaged Dividend Income Fund (EVT), shows us how. Not only does EVT hold many of the same stocks as VOO, but it also yields 6.8%—over six times as much as VOO. (EVT is no outlier—the average yield on the 500 or so CEFs out there clocks in at around 7%.)

Source: CEF Insider

That means $300,000 in EVT gets you $1,700 per month, and without the hassles of vacancies, collecting rent, property taxes, mortgages and the rest.

Plus, there are many CEFs that pay even higher dividends and have stronger returns than EVT. This is just one of hundreds of such funds that provide the big passive income stream of real estate, the tradability of ETFs, the reliability of index funds and the diversity of mutual funds.

ALERT: These 4 Big CEF Dividends Are Cheap (but not for long!)

CEFs are the answer to the pathetic dividends most folks are stuck with now. And I want to let you in on 4 funds throwing off particularly large payouts—I’m talking a cool 7.4% average dividend between them!

That’s 5 times more than the typical S&P 500 stock pays.

And these funds are ripe for buying now. In fact, they’re one of a very few investments you can truly call bargains in today’s overbought market … which is why I’ve got each of them pegged for 20%+ upside as America’s recovery picks up!

These 4 funds are perfect income-and-growth plays, and you do not want to miss out on the biggest upside. Go here to get all the details you need, including the names, tickers and upside potential and complete dividend histories of all 4 of these 7.4%-paying CEFs.

Category: Dividend Stocks To Buy?