A Utility With Rare 6% Dividend Growth

Utility stocks are great for dividend investors.

They’re very stable relative to the rest of the stock market.

Plus, they pay very high dividend yields.

However, utility stocks aren’t known for their dividend growth.

But there are exceptions.

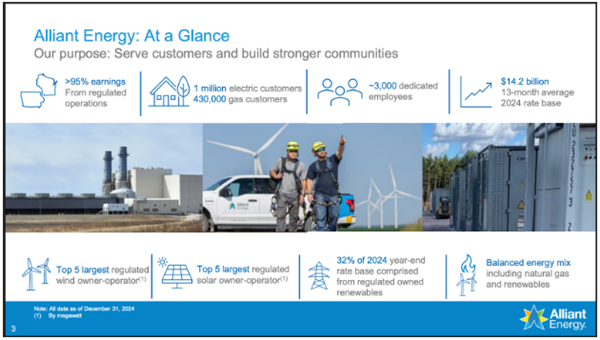

Alliant Energy (ticker: LNT) is an electric and natural gas utility in the Midwest.

Alliant isn’t particularly large.

The company only has around $4 billion in revenue and $800 million in profit.

Remember, size isn’t everything.

And Alliant more than makes up for it with its dividend.

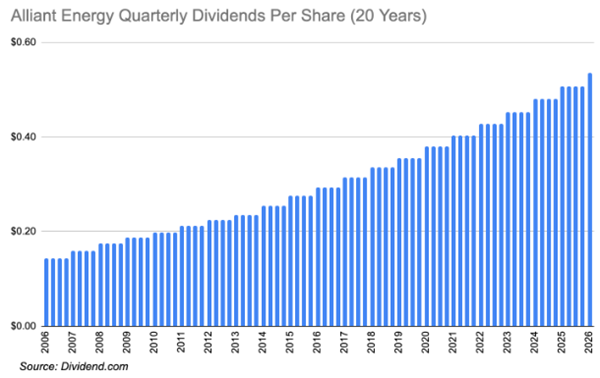

Over the past 20 years, Alliant has averaged 6.5% dividend growth each year.

Alliant’s dividend is doubling every 11 years.

And Alliant just increased its dividend again.

Its next dividend payment will be $0.54 every quarter, but you need to act soon.

You need to own Alliant by January 29 (Thursday) to get the higher payment.

Alliant’s dividend yield is currently 3.2%, which is pretty good.

It’s much higher than funds catering to utility stocks.

State Street Utilities Select Sector SPDR ETF (ticker: XLU) is the most popular ETF focused on utilities, and its dividend yield is only 2.7%.

There’s more to Alliant than just the dividend.

Alliant serves over 1 million electric and 400,000 natural gas customers in Iowa and Wisconsin.

Alliant is also very well diversified within the utilities sector.

The company is one of the largest operators of wind and solar power.

A nice mix of electric and natural gas customers means Alliant isn’t relying on a single energy source or customer type.

Alliant is also extremely profitable.

Alliant’s profit margin of 19% is one of the highest in the entire utilities sector.

Free cash flow margin is something we really care about as dividend investors.

Free cash flow is the source of our dividend payments, and the margin measures how effective a company is at converting sales into free cash flow.

Alliant’s free cash flow margin of 27% is the highest I can find in the entire utilities sector.

The only downside is the price.

Alliant’s price-to-earnings ratio of 21x is a little expensive relative to other utility stocks.

But Alliant’s price-to-earnings ratio is right around its historical average.

And I’m willing to pay a bit more for a utility stock with a good dividend yield and excellent history of dividend growth.

What utility stocks do you own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?, Dividend Yield