A New Dividend King Is Crowned

I’ve talked about Dividend Kings in the past.

Dividend Kings are stocks with at least 50 straight years of dividend growth.

Well, there’s a new Dividend King, and I’ve never heard of it before.

Pentair PLC (ticker: PNR) is a water treatment supply company headquartered in the United Kingdom.

But don’t worry, almost 70% of Pentair’s revenue is from the United States.

And the stock trades on the New York Stock Exchange, so it’s very convenient for U.S. investors.

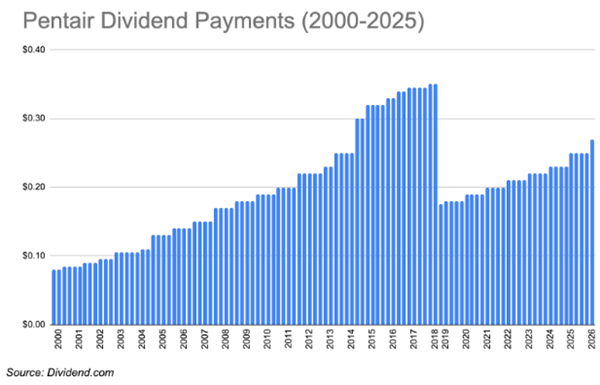

Pentair just raised its dividend to $0.27, which makes 2026 the 50th straight year Pentair increased its payment.

Wait, hold on a second!

What’s the massive drop in dividend in 2018?

Back in 2018, Pentair split from another company, nVent Electric (ticker: NVT), a company focused on electronic connections.

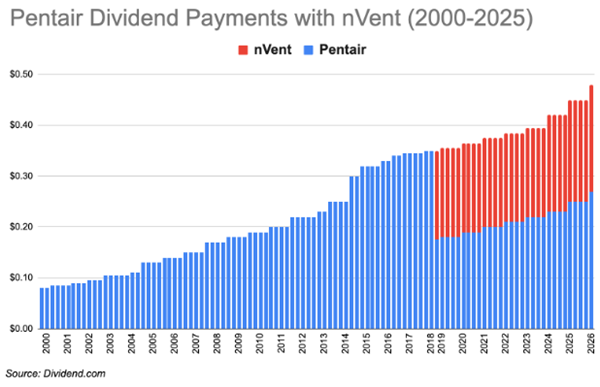

Each person got one share of Pentair and one share of nVent when the company split, so the dividend chart really looks like the one below.

If you bought Pentair before the split, your dividend payments would continue to rise since you would own one share of each.

Since 2000, Pentair’s dividend (combined with nVent) has grown on average by 7.7% every year.

After the split, which is what we really care about, Pentair’s dividend grows by about 7.5% each year.

Not bad for a company with 50 years of dividend growth!

Pentair’s next higher payment is just around the corner.

You need to own stock in Pentair by January 22 (Thursday) to get the next payment.

Let’s dig into Pentair a bit more.

Pentair sells products to improve the quality and safety of water.

And Pentair is growing really well, especially after the split from nVent.

Over the last 5 years, Pentair’s earnings are growing by 13% per year on average.

And its free cash flow, which we really care about since it’s the source of our dividends, grew on average by almost 12% each year over the last 5 years.

Pentair is also incredibly profitable.

Its net margin of 15.8% is more than 3x the average in the Industrial Products industry.

The only downside is its dividend yield.

Pentair’s dividend yield is only 1%, so look elsewhere if you need a lot of income.

But it’s not really Pentair’s fault, unless you blame the stock for doubling over the last 3 years.

It’s a problem I certainly wouldn’t mind having!

Despite the rise in price, Pentair isn’t overpriced.

Its forward price-to-earnings ratio of 19x is right around its industry average.

If you don’t mind the low dividend yield, Pentair is a great stock with some awesome dividend growth.

Do you own any stocks with low dividend yields?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?