My Favorite Way To Invest Like Private Equity (And Earn 10%+ Dividends)

This is how wealthy people invest—and collect yields up to 12.5%.

Private equity (PE) is usually reserved for the rich. It’s the time-honored sport of milking cash from perfectly good businesses! Bleed ‘em dry and keep those dividends coming.

The minimum buy-in for most PE funds? From $500,000 to a cool million bucks or more. This lucrative pastime isn’t meant for the everyman.

Which grinds my gears, my dear friend. This is Contrarian Outlook, dedicated to dividends for said everyman. We have a loophole, and we’re going to share it today.

Business development companies (BDCs) are PE-esque companies. Many trade publicly and we can buy them just like regular stocks. For what it’s worth, many BDCs trade for reasonable share prices, between $20 and $30 or so.

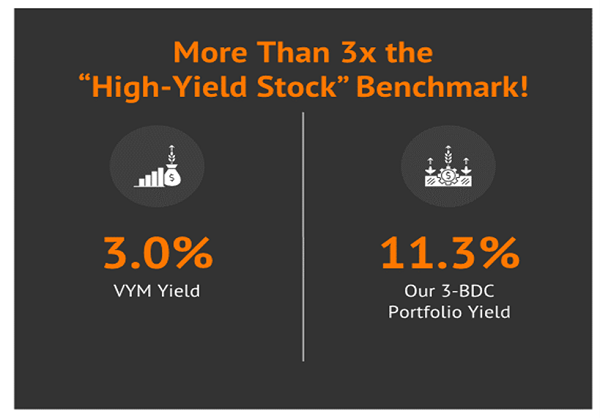

They tend to pay big dividends. The three BDC’s we’re discussing today yield between 10.7% and 12.5%.

Plus, they trade at a discount to their book values. “Free lunch” valuations, in other words.

Congress created BDCs in 1980 to boost small business lending. If you’ve never tried to get a bank loan for a small business—well, don’t. It’s nearly impossible. Enter BDCs, who receive a tax break from Uncle Sam provided they pay 90% of their taxable income as dividends to shareholders.

BDCs aren’t quite the piranhas that their PE cousins are. BDCs offer debt, equity, and other financing options to burgeoning businesses. And given that BDCs tend to invest in dozens if not hundreds of these companies at a time, they effectively become de facto private equity funds.

As In, Some of the Biggest Dividends We’ll Ever Find

The catch, of course, is that extremely high yields tend to be extremely fraught with risk. BDCs are a difficult business even in accommodative times, which means we can’t just greedily lap up every BDC yield there is. We have to be even more discriminating than usual and only pick the safest, surest names in the bunch.

Here, I’ve rounded up three BDCs yielding an outstanding 10.7% to 12.5% to demonstrate how some BDCs can anchor our portfolios, while others will simply drag us down.

Bain Capital Specialty Finance (BCSF)

Dividend Yield: 10.7%

Bain Capital Specialty Finance (BCSF) is a diversified BDC that provides a variety of financing solutions to 137 portfolio companies across 31 different industries. And unlike many BDCs, BCSF also offers some international exposure—while it’s predominantly invested in U.S. companies, it also includes European and Australian companies in its portfolio.

The lion’s share of Bain Capital’s investments are first-lien in nature—in addition to 64% exposure directly through portfolio companies, it has another 14% or so exposure to first-lien debt through other investment vehicles. The rest of its assets are sprinkled among second-lien debt, subordinated debt, equity, and other financing options.

BCSF has a sturdy financial base. While it does have some $1.6 billion in debt, none of that is set to mature until 2026. It also has investment-grade ratings from Moody’s, Fitch, and KBRA.

Dividend coverage has improved of late, too. Even after cutting its payout from 41 cents per share to 34 cents in 2020, its coverage was stuck around breakeven for most of the time between 2019 and 2021. But BSCF has since raised its dividend three times, to 42 cents per share—eclipsing 2020 levels—and coverage has rocketed to the 120%-130% range over the past two years.

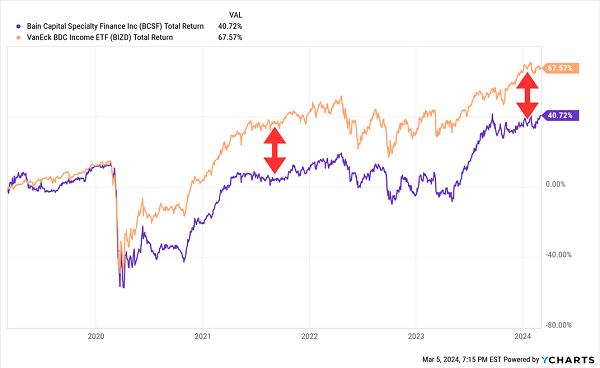

That would make its 11% discount to NAV all the tastier if it weren’t for lackluster portfolio performance. As of the end of 2023, three investments were on non-accrual, representing about 1.2% of the portfolio at fair value. And the company has for years underperformed BDCs as a whole—not exactly a high bar to clear in the first place.

Bain Capital Isn’t Making Up Much Ground on the Pack

CION Investment (CION)

Dividend Yield: 12.5%

CION Investment (CION) is one of the cheapest BDCs on the market, at a price-to-NAV of just 0.68x. In other words, we’re able to buy its net assets for roughly a third less than what they’re worth.

It’s also one of the newest BDCs—it went public by direct listing in October 2021—so it’s possible that we’re getting a great discount on a company Wall Street has yet to figure out.

CION is an externally managed BDC that typically invests around $30 million in companies with $25 million to $75 million in EBITDA. This capital can be used for any number of reasons—growth, acquisitions, refinancing, market expansion, and so on.

Currently, CION has roughly $2 billion in assets invested across 109 portfolio companies. Most of those investments are in first-lien senior secured debt (86%), with another 11% in equity, and the rest peppered across second-lien and unsecured debt, as well as collateralized securities and other products. A good 80% of the portfolio is floating-rate in nature. While its companies are spread out across a few dozen industries, business services and healthcare are its only double-digit exposures.

CION has grown its dividend at a decent clip since going public, but it also pays out sizable special distributions as well. That results in a fantastic headline yield of 12.5% that improves to 14.3% when you account for the past year’s worth of specials.

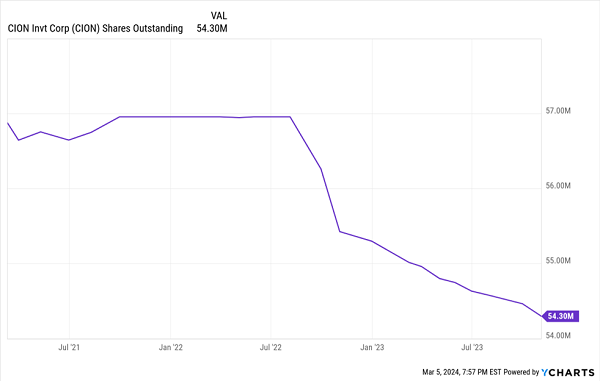

But CION is putting its cash to work in another interesting way (for BDCs): buying back shares. And why not? Given how cheap the stock is, it makes far more sense to repurchase shares than it does to issue more shares to raise capital—a tactic many overvalued BDCs employ.

CION Has Been Eating Away at Its Share Count

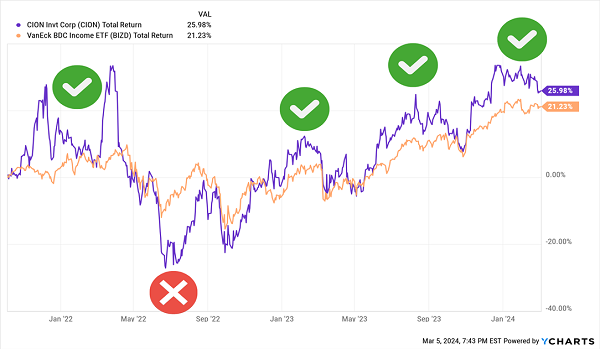

So far, the results say a lot of good things about how CION does business.

It’s hardly perfect. External management means CION investors are absorbing steeper fees than with internally managed BDCs. And three years doesn’t make for much of a track record. But CION is giving a lot for investors to chew on after less than three years as a publicly traded stock.

SLR Investment (SLRC)

Dividend Yield: 10.7%

SLR Investment (SLRC) is a self-described “yield-oriented” BDC that invests predominantly in senior secured loans of private middle market companies.

Its overall portfolio can be broken down into four parts: asset-based loans (32% of assets), equipment financing (32%), cash-flow loans (dubbed “sponsor finance,” 24%), and life science loans (12%). These are spread across some 790 different issuers across 110 industries—as SLR points out, that results in an average exposure of just 0.1% per issuer.

The conservative management style could be appealing to investors looking to tamp down risk. Also an upside in the present moment is its sensitivity to rates—roughly a third of its portfolio is fixed-rate in nature (most of that coming from equipment financing), meaning that SLR Investment will be less vulnerable to the Fed’s inevitable easing than many other BDCs.

Also providing some safety is SLRC’s value proposition—shares currently trade at a fat 16% discount to NAV.

But it’s difficult to tell whether SLRC is a bargain, or just cheap.

For one, SLR Investment is externally managed, too (by SLR Capital Partners); often, external management means higher management and incentive fees, which ultimately drag on investors’ returns. That’s easy to swallow when management is outperforming; not so much when it’s not.

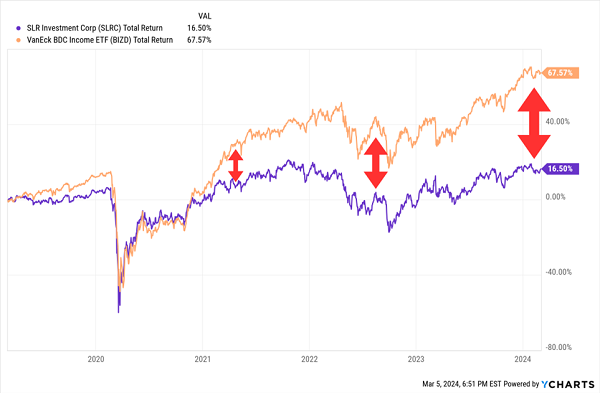

SLRC’s Underperformance Has Been Widening for Years

Also, while generous, SLRC’s payout deserves a word of warning. The company struggled to cover its dividend for much of a three-year period between late 2019 and late 2022. It has successfully covered its payout for each of the past five quarters, but still at a much thinner margin (just a few percentage points) than the rest of the BDC space.

Less worrisome but still worth mentioning: SLRC actually flirted with a monthly payout for a little more than a year, between 2022 and 2023, but reverted back to quarterly dividends right before the start of 2024.

Give Me 4 Minutes, I’ll 5X Your Retirement Income

First-level investors typically assume that dividend investing is a balancing act: Lower yields always equal lower risk, while higher yields always equal higher risk. So they often pinch their nose right before diving into high-yield dividend traps.

But they don’t have to do that!

Big yields. Growth potential. A bargain price. And the ability to take macroeconomic headwinds head-on! All the things you need to secure a cozy, comfortable retirement without bleeding your nest egg dry.

My “Perfect Income” portfolio attacks retirement investing from a different angle. Rather than trying to time the market and chase trends, we target high-yield holdings (roughly 5x the S&P!) that walk their own path, no matter what the Fed, Congress or the rest of the world throws their way.

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

This post originally appeared at Contrarian Outlook.

Category: Best Dividend Stocks