Earn 3x To 6x The Market’s Dividends Without Breaking A Sweat

I think I’ve been asked every day this week from ordinary people if I’m trading NVIDIA (NVDA).

Be careful out there, my fellow contrarian!

A sharp pullback is possible. Something has to shake the froth out of this market. When that happens, investors will look for stocks that are high on income and low on volatility. Today we’ll highlight six paying up to 8.6%.

The secret is beta, a measure of an investment’s volatility against a benchmark. For instance, usually the S&P 500.

If a stock has a beta of 1, it means it’s every bit as volatile as “the market.”

But if a stock has a beta of 0.5, it means it’s only half as volatile as the S&P 500. Which means if the market dropped 20%, we’d only be out 10%.

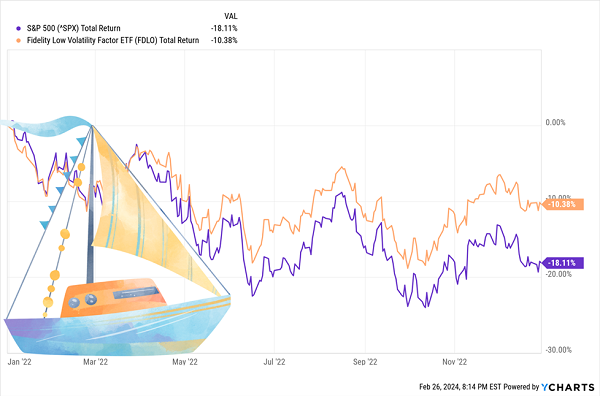

Unsurprisingly, low-beta stocks tend to be most useful during bear turns. Just look at this chart from 2022, when the market lost nearly 20%—a popular low-vol ETF did much, much better.

Smoother Sailing With Low-Vol Stocks

We want to identify the best possible low-vol stocks. These companies can help us maximize our outperformance during bear runs with steadier stock prices and fat dividends that buoy our returns.

Let’s start by digging into six low-beta dividend stocks that currently deliver between 3x and 6x the broader market’s yield right now. Just remember: We want more than yield. We want to keep our dividends and principals intact, too.

Telephone and Data Systems (TDS, 5.1% yield) is a helpful reminder that beta doesn’t always tell the whole story, and that we need to be scrutinizing, even when it comes to supposedly sleepy stocks.

Telephone and Data Systems is a telecom company that provides wireless cable, broadband, TV, and other products and services to roughly 6 million customers nationwide across several brands, including TDS, OneNeck and UScellular.

TDS holds an 83% stake in UScellular parent United States Cellular (USM), and that stake sent shares to the moon in early August, when TDS and USM announced that they were considering “strategic alternatives for UScellular.” (Translation: “looking to either spin it off or sell it.”)

I said a little later in August that this would be an intriguing opportunity if TDS were actually growing—but given that the stock had more than doubled, and given that the deal would significantly shrink the business, it looked like there wasn’t much more juice to squeeze from this orange.

Fast-forward to mid-February: No deal had been done, and thanks to a goodwill impairment charge, what would have been a $58 million net loss for full-year 2023 snowballed into $569 million of red ink. The bloom quickly came off the rose—TDS shares dropped 20% in a day.

Now take a look at TDS’ chart. A 5-year beta of 0.87 does tell us that shares have been less volatile than the market … but they’ve been headed in the wrong direction. And a -0.42 one-year beta would indicate that TDS is less volatile than (but in the opposite direction of) the market … yet clearly, it has been extremely volatile.

In other words, TDS might statistically be low-volatility, but in reality, it’s anything but. The chance of a deal—or deciding, after a strategic review—means there’s at least one more giant move in TDS’ future. Either way, we want to look elsewhere for stocks that can provide smoother (and better) performance.

DT Midstream (DTM, 5.2% yield) is a natural gas pipeline, storage, and gathering provider that was spun off only three years ago. It separated from DTE Energy (DTE) in July 2021, and despite the business (energy infrastructure), it is not a master limited partnership (MLP)—it’s a regular stock producing regular dividends.

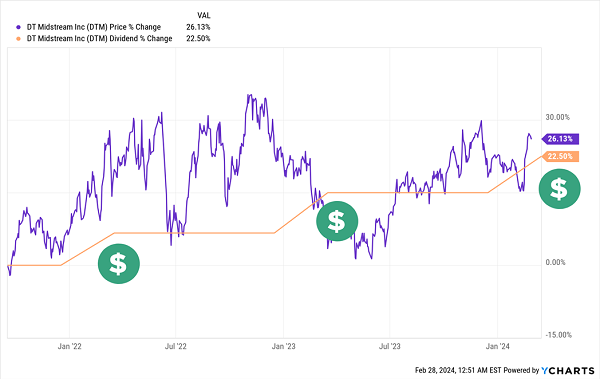

And higher dividends, at that. The payout started at 60 cents quarterly, and it has since been bumped up each year, including in 2024, to its current 74 cents—23% better in three years.

DTM Keeps Striking Dividend Gold

DTM boasts a one-year beta of 0.72 and a five-year beta of 0.75. So basically, for its publicly traded life, the stock has been about a quarter less volatile than the broader market. Given DTM’s short publicly traded history, we’ll want to take that with a grain of salt—albeit a small one.

Still, there’s a lot to like. DTM has largely delivered upside profit surprises since its spinoff, and alongside its strong 2023 report, the energy firm recently raised both its 2024 and 2025 EBITDA guidance. Plus, the nature of energy infrastructure hints that DTM should at least continue to be less volatile than more price-reliant E&P names.

A possible exception is Chord Energy (CHRD, 6.3% yield), an independent oil-and-gas producer that operates in the Big Sky’s Williston Basin. It’s an E&P name that’s on the upswing, in part thanks to a merger with Canada E&P Enerplus (ERF) that will create a combined energy worth about $11 billion in market cap. Importantly, Chord inherits Enerplus’s high-quality Bakken Shale assets.

Among other things to like about Chord? A management team whose incentive is heavily tied to returns, as well as relative stability for an E&P—a five-year beta of 0.93, and a one-year beta of 0.65. The latter covers a period in which Chord outperformed the broader market by more than 20 percentage points.

It’s worth noting, though, that Chord has a fixed-plus-variable payout—most recently, $3.25 per share total ($1.25 in regulars, $2.00 per share in extras), but that’s been as low as $1.35 per share total over the past year. The good news is that fixed-plus-variable dividends are excellent for ensuring dividend safety, but we’re getting the opposite of dividend stability.

National Presto Industries (NPK, 5.7%) is a major name in small kitchen appliances, hocking waffle makers, vacuum sealers, electric griddles, coffee makers, air fryers, slow cookers, popcorn poppers and much, much more.

But what helps NPK remain calm and collected—it has extremely low one- and five-year betas of 0.35 and 0.63, respectively—is its diversified set of businesses.

In addition to small appliances, it also has a safety division that includes fire extinguishers and carbon monoxide detectors, and even a defense division that produces ammunition, cartridge cases, and precision metal parts for defense and aerospace, primarily through Defense Department contracts.

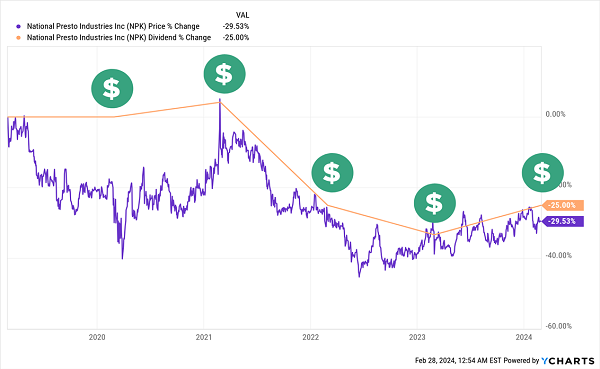

There’s quality here—but it’s a little expensive by many metrics. And like Chord, we’re getting a less-than-ideal dividend program. While NPK yields nearly 6%, it only pays annual regular and special dividends, and those amounts bounce up and down every year. So again, we’re not securing the dividend stability we need in retirement.

Presto’s Dividend Waffles Quite a Bit

Verizon (VZ, 6.7% yield) is the definition of a sleepy telecom stock, with one- and five-year betas at 0.48 and 0.40, respectively.

Of course, Verizon is sleepy: because its growth prospects are slim to nonexistent. The company has been forced to play the lower-rate game with competitors AT&T (T) and T-Mobile (TMUS) lately, dropping prices on unlimited data plans.

As a result, Verizon’s profits are actually projected to drop by about 3% this year. And while the pros expect a rebound in 2025, it’s still to levels below 2023 profitability.

In other words: Verizon could very well do nothing but tread water for at least two years.

I suppose you could fall back on Verizon’s high dividend, but it’s struggling to hold its head above water, too. Verizon’s last hike was a mere 3%, failing to keep pace with inflation.

This is a case where “safe” really means “slowly drowning.”

Omega Healthcare Investors (OHI, 8.6%) is a triple-net lease real estate investment trust (REIT) firm that provides financing and capital solutions to operating partners in the skilled nursing facility and assisted living facility industries.

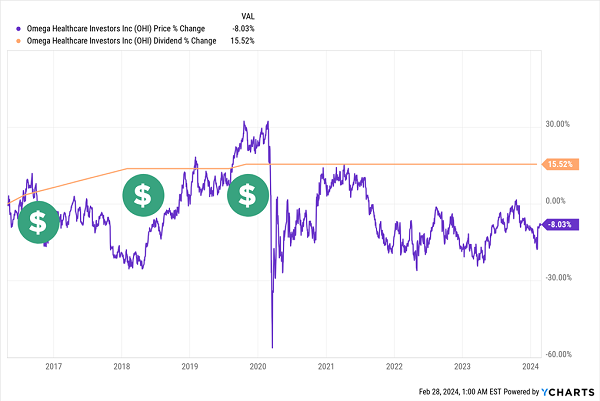

While REITs have long since reclaimed (and re-lost) their COVID highs, Omega’s rebound has been slower—and came from a much deeper bottom. Like the rest of its industry, OHI was hammered during the pandemic thanks to COVID’s outsized toll on nursing homes and assisted living.

Since then, Omega has been in recovery mode, though in a pretty topsy-turvy pattern.

When Dividend Growth Dries Up, Shares Tend to Follow

There are plenty of reasons for optimism, most notably recent improvements in both occupancy and rent coverage. OHI isn’t terribly levered, and the balance sheet looks healthy. It’s also pretty stable, COVID-era performance included—its five-year beta is 0.87.

But for every plus, there seems to be a minus of some sort. Fourth-quarter funds available for distribution (FAD) dropped back below its quarterly payout, which has been stagnant for years. It’s still working on restructuring a deal with LaVie Care Centers, which makes up a decent chunk of OHI’s business. And its recently released adjusted funds from operations (FFO) guidance for 2024 implies a slight decline from 2023.

Give Me 4 Minutes, I’ll 5X Your Retirement Income

If we want a cozy, comfortable retirement without bleeding your nest egg dry, we need to have it all. Big yields. Growth potential. A bargain price. And the ability to take macroeconomic headwinds head-on!

My “Perfect Income” portfolio attacks retirement investing from a different angle. Rather than trying to time the market and chase trends, we target high-yield holdings (roughly 5x the S&P!) that walk their own path, no matter what the Fed, Congress or the rest of the world throws their way.

So, what makes these dividends “perfect”? Well, they have to have a few things in common:

- They DO pay consistently, predictably and reliably.

- They DO survive—and even thrive—in market crashes.

- They DO deliver double-digit returns, with safe, secure investments.

- They DO require minimal management time—just a few minutes every month!

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

This post originally appeared at Contrarian Outlook.

Category: Lists of Dividend Stocks