11% Dividends For 10% Off. Inside 2024’s Biggest Buying Opportunity

Don’t buy into the fear around office real estate investment trusts (REITs). Truth is, this is our moment to buy strong REIT dividends. We’re going to do it with a well-diversified 11.4%-yielding closed-end fund (CEF) trading at a ridiculous bargain.

Our opportunity lies in the fact that the fear around office landlords (Will the work-from-home crowd ever return? Will lease rates plummet? Is any of that priced in?) completely misses the point for investors.

Negativity Around Office REITs Has Been Off the Charts

To get a sense of the scale of fear around office REITs, consider that Fortune magazine, despite its staid reputation, told us nine months ago that the “office real estate apocalypse” was here and “even worse than expected.”

So it follows that by now, we should be seeing deep losses among office REITs and funds that hold them, right? Well, not exactly.

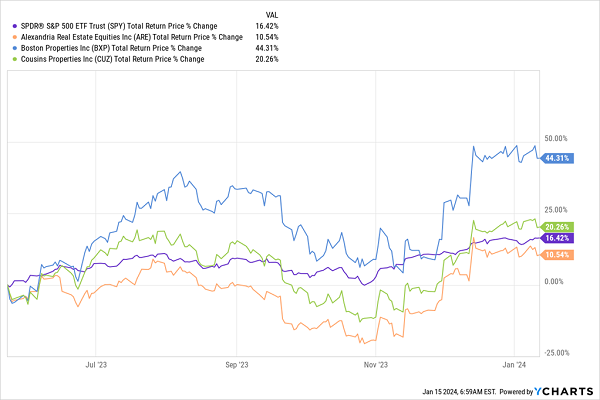

Office REITs Shake Off Overdone Gloom

Since Fortune’s panic-mongering article was published, two of the three largest office REITs, Boston Properties (BXP)—in blue above—and Cousins Properties (CUZ)—in green—have crushed the market. The largest, Alexandria Real Estate Equities (ARE), in orange, has lagged the S&P 500 by a bit, being up “only” 10.5% in nine months.

Still, a “mini-portfolio” of these three crushes the S&P 500, which is also why it’s not surprising that the REIT CEF we’re going to discuss today, the 11.4%-yielding Neuberger Berman Real Estate Securities Income Fund (NRO) has rolled past the S&P 500 over that time, too.

NRO Defies the Naysayers

Someone who took that Fortune article to heart would’ve missed this outperformance, but here’s the funny thing: A reader who saw Fortune’s article about the office-vacancy apocalypse easing in San Francisco would have not missed this at all.

That second article was written a mere two months after the first one and goes to show how dangerous it is to invest based on headlines—even with the most serious and respected financial publications out there.

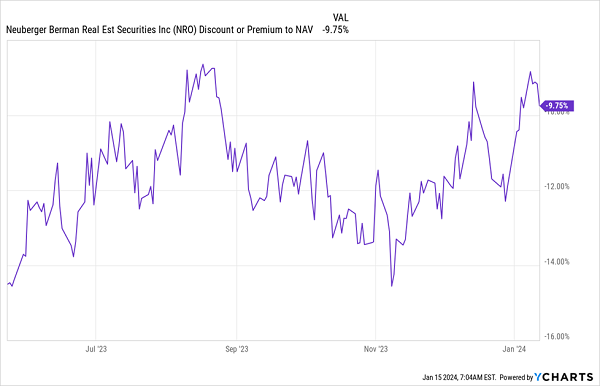

Still, the fear around office REITs remains fierce, which is why NRO, with its strong recent performance and high dividend, is still priced at a near-10% discount to net asset value (NAV, or the value of the REITs it holds). However, that discount has been gradually shrinking since Fortune waved the red flag about the so-called apocalypse.

NRO Is Cheap—But Not as Cheap as It Was in the Summer of ’23

Let’s dig into how NRO has done so well these past few months, because it shows why I see its discount heading back to premium territory, which it last saw in late 2022.

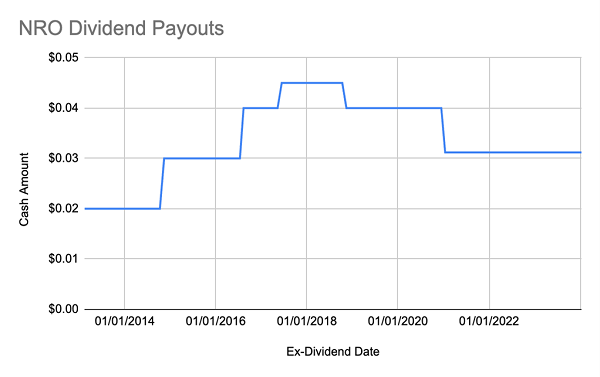

The premium it held then was thanks in large part to NRO’s strong dividend history. While the fund did cut payouts a bit in 2018 and again in 2021, over the long-term, its dividend has been stable at its current level on average, giving investors who bought a decade ago a 9.9% average annualized yield on their investment.

NRO’s Strong Payouts Over the Long Term

Before we go deeper into the dividend’s strength, let’s note what this means: An investor who bought NRO a decade ago would’ve been able to replace the average US salary at the time ($40,508) with an investment of just $410,000.

Now let’s fast forward to today, especially since Moody’s has said the national office vacancy rate rose to 19.6%, which they say “shatters” the 19.3% record set during the pandemic. If that’s true, is NRO doomed to poor performance?

No, and here’s why.

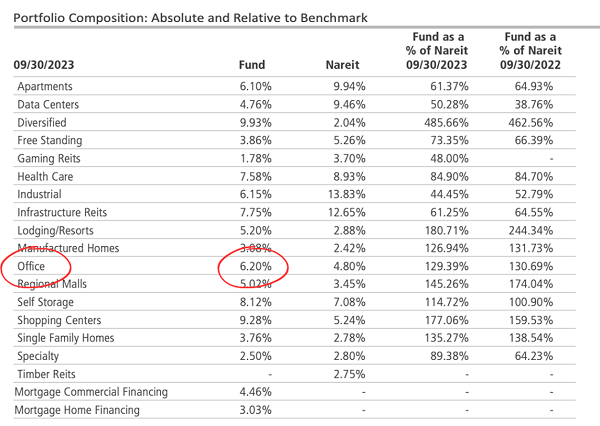

A Diversified REIT Play

I know there are a lot of small numbers here, but as you can see above, only 6.2% of NRO’s holdings are in office REITs! So if we were to assume the office-vacancy rate will balloon to 25% and remain there forever, then 25% of that small sliver of NRO’s holdings would fall sharply.

They wouldn’t go to zero, as many of these buildings are in attractive skyscrapers in densely populated US cities. But let’s go to the extreme and say these properties become worthless. That would cut NRO’s net asset value by a miniscule 1.6%.

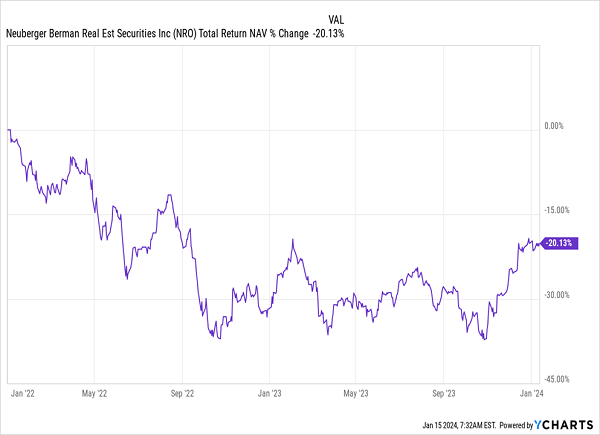

However, we also need to bear in mind that the market is forward looking, and fears of that apocalypse cut NRO’s NAV by 32% in 2022. And even after NRO’s recovery in 2023, as the market realized the selling was way overdone, its NAV is still down 20%.

NRO Is Still Steeply Discounted Thanks to Mr. Market’s Paranoia

I would call assets with a risk of falling 1.5% being discounted 20% a complete bargain, which is why NRO is a smart buy now. That’s not just because the office apocalypse isn’t real but because, even if the worst were to come to pass, it’s priced in—by a lot.

4 MORE Bargain CEFs That “Translate” Your Price Gains Into CASH

I don’t know about you, but when it comes to investing, I prefer to get as much of my gain as possible in safe dividend cash.

Price gains? They’re great, of course, but the trouble is they can disappear tomorrow.

Not so with dividends—and this is the biggest strength of CEFs: these funds literally take the price gains their portfolios generate and “convert” them to an 8%+ dividends for us!

The result? A huge—often double-digit—dividend flowing to us in a predictable stream, in addition to gains in the fund’s market price. Many CEFs pay us every single month, to boot.

My top 4 CEFs to buy for 2024 (current yield: 9.9%) are ripe for buying now. Click here and I’ll share more details on each of them with you, as well as our complete CEF-buying strategy.

This post originally appeared at Contrarian Outlook.

Category: Dividend Stocks To Buy?