18% Dividend Growth From A Popular Investment Firm

We all deal with investment companies.

Otherwise, we wouldn’t be able to buy and hold any of our stocks!

However, despite working with investment firms continually, many investors don’t actually invest in these firms themselves.

And it’s a mistake.

Charles Schwab Corporation (ticker: SCHW) is one of the largest investment companies around.

It manages almost $12 trillion in assets.

Many of you probably use Charles Schwab for your investing.

It’s what I use, and I’m a huge fan.

But I’m not trying to get you to switch brokers.

I want you to know about Charles Schwab’s amazing dividend.

Dividend investors already know a lot about Charles Schwab because of its popular dividend ETF, Schwab US Dividend Equity ETF (ticker: SCHD).

Charles Schwab is not a huge player in exchange-traded funds (ETFs).

It only accounts for about 1% of the market in ETFs.

But Schwab’s Dividend ETF is the second-most popular dividend ETF with over $75 billion in assets under management (AUM).

I’ll talk about SCHD in a later article, but I want to focus on its issuing company today.

Charles Schwab just increased its dividend by an amazing 18%!

18% is huge, especially for Charles Schwab.

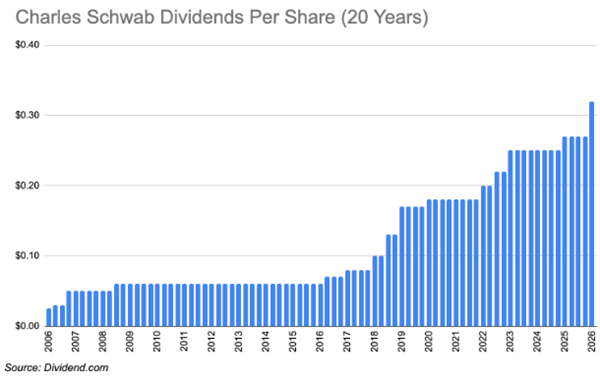

Over the last 20 years, Charles Schwab has averaged almost 12% dividend growth each year.

Its dividend was flat from 2009 until 2016.

Charles Schwab is definitely making up for lost time, especially in the last few years.

Charles Schwab’s next payment is $0.32, which is almost double what it paid in 2019!

But you need to act fast.

You need to own stock in Charles Schwab by February 12 (Thursday) to get the higher payment.

The only negative is Charles Schwab’s low 1.2% dividend yield.

However, your dividend will double every 4 years if Charles Schwab maintains its 18% growth rate.

Let’s talk more about Charles Schwab.

Half of Charles Schwab’s revenue comes from net interest income.

It has deposits and loans out money similar to a bank.

Charles Schwab makes the other half through its investment business by charging fees on its funds or commissions from trades.

And it’s very profitable.

Charles Schwab’s profit margin of 37% is at an all-time high and is more than double the industry average.

And its current price-to-earnings ratio of 22x is the lowest it’s been in over 2 years, outside of the tariff crash last April.

But here’s one of the best parts.

Charles Schwab’s dividend payout ratio is only 22%, so there’s plenty of room for it to continue its dividend growth.

What broker do you use for your stocks?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks