Turning Trash Into Treasure With 10%+ Dividend Growth

Waste management doesn’t seem like an exciting industry.

But just think about it.

Everyone creates garbage.

And nobody wants to deal with it!

So while it doesn’t seem exciting, the waste management industry is a great place to be.

Especially for dividend investors.

Waste management is incredibly stable.

No matter how bad the economy might get, people are still creating garbage and need a place to put it (and a way to get it there).

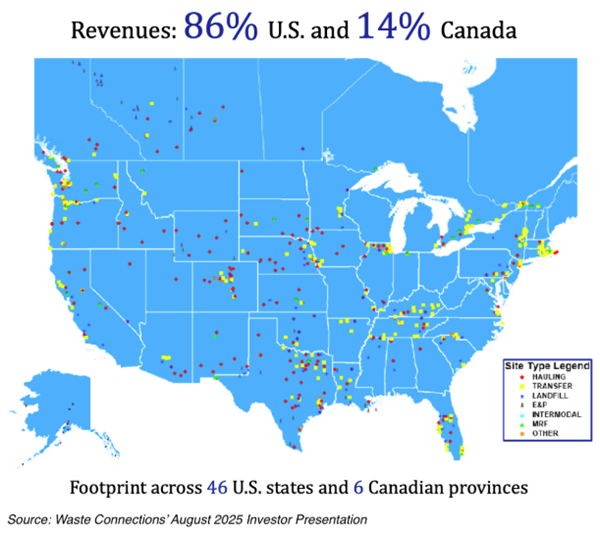

Enter Waste Connections (ticker: WCN), a large waste management company with operations in the U.S. and Canada.

When Waste Connections got on my radar, I’d never heard of it.

We all probably know about Waste Management (ticker: WM) and Republic Services (ticker: RSG), the two largest waste management companies in the U.S.

But Waste Connections shouldn’t be overlooked.

The company is worth over $40 billion, and Waste Connections expects to generate over $1 billion in profit in 2025.

And unlike its larger rivals, Waste Connections focuses on rural and suburban markets, which have less competition than larger, urban areas.

Let’s jump into the dividend.

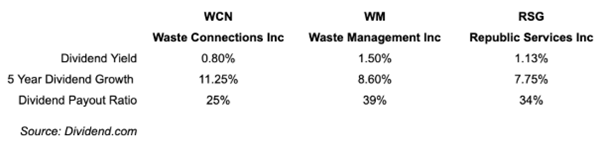

Dividend yields in the waste management industry aren’t particularly high.

Unfortunately, Waste Connections isn’t an exception.

Its dividend yield is only 0.8%, which is very low.

But the last time Waste Connections’ dividend yield was around 0.8% was in 2023.

Waste Connections also just increased its dividend payment for 15 straight years to $0.35 every quarter.

But don’t wait too long.

You need to own Waste Connections by November 4 (tomorrow) to get the higher payment.

What does Waste Connections’ dividend growth look like?

Over the last decade, Waste Connections has grown its dividend by an average of 6.4% each year.

But its latest increase is almost 13% higher than last year’s payment.

And while the dividend yield is low, Waste Connections lines up really well against the competition.

Waste Connections has higher dividend growth rates compared to Waste Management and Republic Services.

And it’s growing its dividends faster with the lowest dividend payout ratio in the group.

And despite the higher dividend growth, Waste Connections’ payout ratio has been around 25% over the last few years.

A stable payout ratio means the people running Waste Connections really know what they’re doing.

Do you own any waste management stocks?

The dividend yields are low, but they’re so stable and profitable.

Every dividend investor should own at least one!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?