Top-Performing Stock Restarting Dividend Increases

I really like companies with consistent dividend growth.

But it’s important to be flexible.

If we only buy stocks with stable dividend growth, we’ll miss some amazing opportunities.

Sometimes a stock pauses dividend increases for legitimate reasons.

I wouldn’t want my stocks going bankrupt because they’re trying to keep up with dividend growth.

And sometimes a company wants to keep more of its cash to reinvest back into the business.

If management thinks it’s important, then I don’t want to get in their way!

And for one company, pausing dividend increases has really paid off.

Elbit Systems (ticker: ESLT) lowered its dividend payment during COVID.

It seemed like everyone was cutting their dividend during the pandemic!

Elbit had small dividend increases until 2022, when it kept payments steady at $0.50 per quarter.

Holding onto extra cash has been awesome for Elbit and its investors.

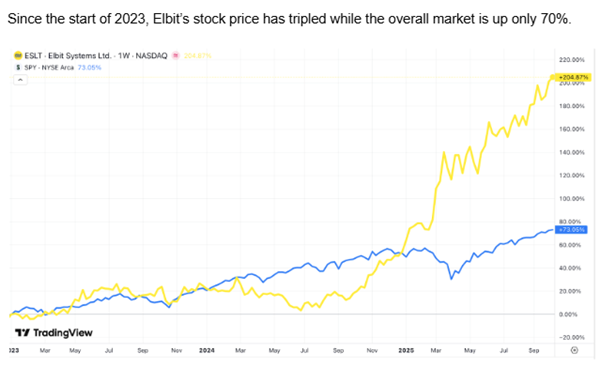

Since the start of 2023, Elbit’s stock price has tripled while the overall market is up only 70%.

And after its incredible success, Elbit has decided to resume raising its dividend.

Elbit raised its dividend in April to $0.60 per share.

But Elbit wasn’t done in 2025.

Elbit’s next payment will be $0.75, which is 25% higher than the last payment, and 50% higher than its dividend payment a year ago.

But if you want the higher payment, you need to act really fast.

You need to own Elbit stock before the market closes today to get the payment.

What type of company is Elbit?

Elbit is Israel’s largest weapons manufacturer, especially of unmanned drones.

Drones are playing an increasingly important role in war, and Elbit is at the forefront.

And with conflicts continuing in Europe and the Middle East, Elbit has plenty of customers for its products.

The one major drawback to Elbit as a dividend stock is its dividend yield.

Elbit’s current dividend yield is only 0.6%, which is low.

But don’t forget the stock price is just as important as the dividend in calculating the yield.

When the stock price triples in such a short amount of time, like it did for Elbit, the dividend yield is going to be low.

And the dividend yield isn’t the only thing low for Elbit.

Elbit’s dividend payout ratio is only 16%, which is half of where it was just a few years ago.

Such a low payout ratio means Elbit has plenty of room to keep raising those dividend payments year after year.

There are only a handful of companies with dividend growth over 20% and a payout ratio as low as Elbit’s.

And Elbit is the only one tripling in value over the past two and a half years.

What stocks do you own with low dividend yields?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?