A 50% Dividend Cut! I Hope You Don’t Own This Stock…

More bad news for dividend investors.

A $16 billion company in the S&P 500 just cut its dividend.

And it wasn’t a small cut… The dividend was cut in half!

Who’s the offending company?

It’s Dow, Inc. (ticker: DOW), a chemical company founded in the 19th century.

Dow is lowering its dividend payment to $0.35 every quarter, dropping its dividend yield to around 5.6%.

Dow has nothing to do with the Dow Jones Industrial Average Index, so don’t confuse the two!

But let’s get into Dow – the company.

You might actually own some shares of Dow without even knowing it.

Why? Because Dow and Dupont (ticker: DD) merged in 2015 to form DowDuPont.

The new company traded under the ticker, DWDP.

But then, DowDuPont split into three separate companies just two years later.

Shareholders of DWDP received one share of Dow after the split.

So, if you bought Dupont a long time ago, you might now own some shares in Dow because of all the mergers and separations.

What’s going on with Dow, and why did it cut the dividend?

Dow’s stock performance has been abysmal over the last year.

The Materials sector has underperformed the overall market, which is up around 16%.

But, Dow is down over 50% since last summer.

There isn’t too much good news to report.

Revenue, earnings, and free cash flow all peaked in 2022.

Revenue has fallen 25%, earnings are down 75%, and free cash flow has fallen over 100% since 2022.

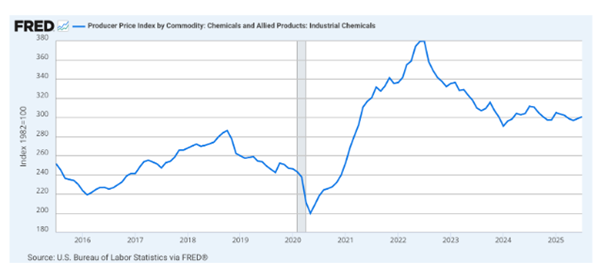

Part of the reason for the large drop is lower prices for Dow’s products.

Chemical prices are down 20% from their peak in 2022.

But tariffs aren’t helping either.

Dow exports tons of products to other markets like China and Europe.

We have a trade deal with Europe, but a deal with China is still in the works.

And if a deal isn’t made, then companies like Dow are in a huge amount of trouble.

Is now the time to dump Dow?

A 5.8% dividend yield, after the cut, isn’t too bad.

However, Jim Fitterling, CEO of Dow, said the following when announcing the dividend cut.

“However, given the current lower for longer earnings environment and the lack of a clear line of sight to a recovery for our industry, this is the most prudent way to maintain financial flexibility and maximize long-term value for our shareholders.”

Yikes!

The dividend cut is probably the best option for Dow shareholders.

But when the CEO sounds pessimistic, like in the quote above, it’s time to jump ship.

I’m going to let someone else sit on this risky stock…

Dow is in trouble, and the chemicals industry is in terrible shape.

The latest dividend cut is the first. But what are the odds it’s not the last cut?

Am I right? Are you selling Dow? Or are you holding your shares?

Email me back… I want to hear your thoughts.

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Bust