A Higher Dividend Every Quarter

Companies work hard to attract new investors… And dividend stocks play the same game.

Some dividend stocks pay every month.

Other dividend stocks have really high yields.

Others are growing their dividends quickly, targeting investors looking for more cash in the future.

But one dividend stock is doing something a little different.

One company is increasing its dividend payment every single quarter.

The company is Penske Automotive Group (ticker: PAG), and what it’s doing is incredible.

Penske is probably best known for its yellow rental trucks on the highway.

However, Penske rentals are actually owned by a different company, Penske Transportation Solutions.

Penske Automotive owns almost 30% of Penske Transportation Solutions, so they’re related, but they’re not the same company.

Penske Automotive operates car and truck dealerships across the United States.

About 85% of its revenue comes from its more than 350 car dealerships located in the United States, Europe, and Oceania.

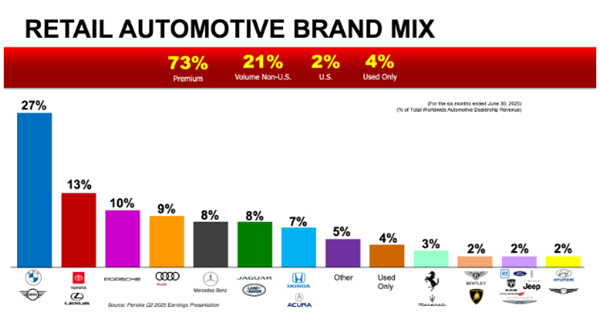

As you can see, Penske Automotive has dealerships catering to every kind of car customer.

Car dealerships don’t seem like a great place to make a lot of money, but Penske Automotive’s growth has been phenomenal.

Over the last 10 years, Penske Automotive’s revenue has averaged 8.6% growth every year.

Its earnings have grown on average almost 20% every year.

And its free cash flow has averaged 25% growth every year.

Free cash flow is what a company uses to pay its dividends.

And the fast-growing free cash flow has allowed Penske Automotive to have incredible dividend growth.

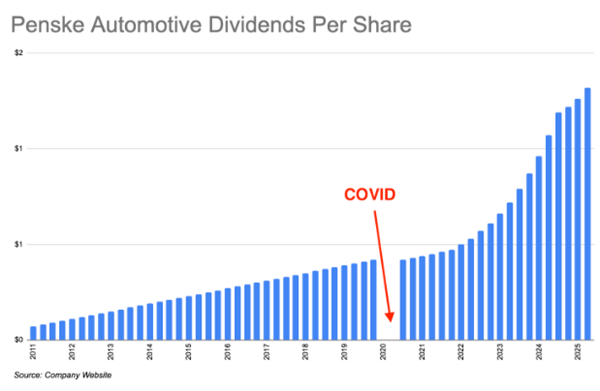

Since 2011, Penske Automotive has grown its dividend every single quarter with one obvious exception.

Penske Automotive skipped two dividend payments in 2020 because of the COVID pandemic.

But once the worst was over, Penske Automotive resumed dividends and started raising payments in early 2021.

Since 2011, Penske Automotive has increased its dividend on average by 23% per year.

The growth isn’t slowing down either.

Penske Automotive’s next dividend payment is $1.32 per share, which is almost 5% higher than the last payment and 23% higher than last year’s payment.

But you need to act quickly to get the next payment.

You need to own Penske Automotive by the end of August 14th (Thursday) to get the money.

Usually, when a company has such amazing dividend growth, its dividend yield is low.

However, Penske Automotive’s dividend yield is just above 3%, which is great when coupled with its amazing growth.

Penske Automotive also has an amazing dividend payout ratio of only 33%!

So, Penske Automotive has plenty of free cash flow to continue to grow its dividends in the future.

What are some of your favorite dividend growth stocks?

I love seeing other people’s lists!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?