This Dividend Is Exploding… In A Good Way!

Dividend growth is great.

It ensures the cash we get in our bank account covers our expenses. And, it’s getting expensive out there!

I love companies with consistent dividend growth.

I don’t need a lot, but if a stock grows its dividend by the same amount every year, then I’m a happy camper.

There’s only one other type of company I prefer over consistent dividend growth.

A company with a growing dividend growth rate!

It’s not common, but Archrock (ticker: AROC), an oil & gas equipment provider, is giving it a shot.

Archrock is a natural gas contract compression services company.

Natural gas needs to be compressed before it can be transported in pipelines.

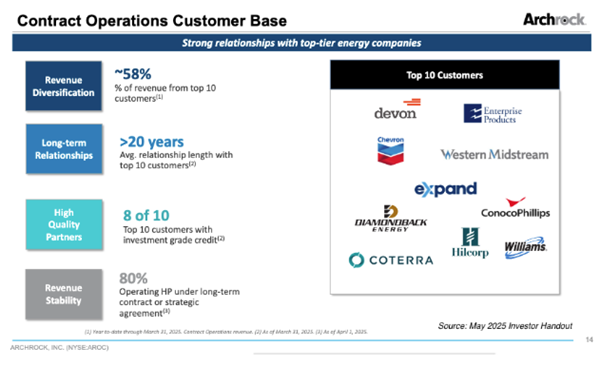

And Archrock works with some of the largest natural gas pipeline companies in the United States. Here’s a slide from one of their investor presentations…

Archrock started growing its dividend in 2023, which isn’t too noteworthy.

However, Archrock’s dividend growth is gaining steam and growing faster and faster.

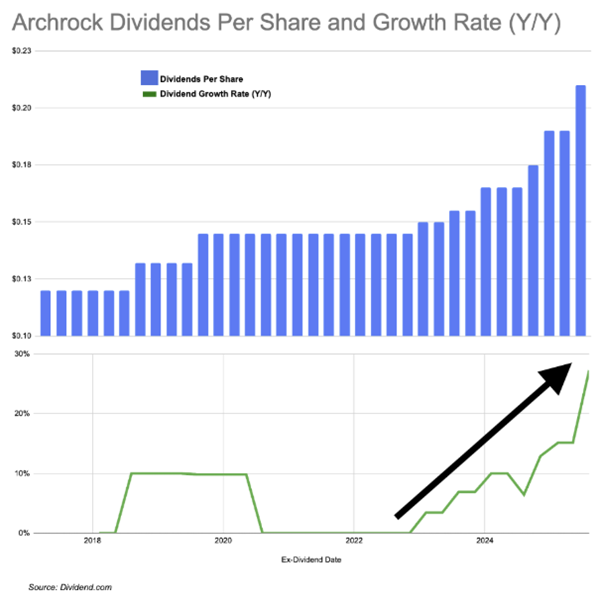

Just look at its dividend chart.

The green line on the bottom is the growth rate of the dividend, and it just keeps rising and rising.

Archrock’s next payment is 27% higher than last August’s payment!

Just two years ago, Archrock was growing its dividend 7% per year.

But you need to act fast for the cash to show up in your pocket.

You must own Archrock by the end of MONDAY (August 4th) to get the money.

Archrock has around a 3.6% dividend yield, so you’re getting a decent amount of money for owning some shares.

Archrock sounds like the perfect dividend stock…until you look at its dividend payout ratio.

Using free cash flow, Archrock’s dividend payout ratio is usually above 100%.

For 2024, Archrock’s dividend payout ratio was around 150%, which sounds bad.

However, Archrock is generating plenty of cash.

Its operating cash flow was $430 million in 2024.

The lower free cash flow is because Archrock is investing a ton of money into its business.

Archrock spent $360 million on capital expenditures (capex), which is money spent maintaining and upgrading Archrock’s equipment.

In Archrock’s latest earnings call, management said they can be flexible with their capex spending based on operational needs.

If cash gets low, then Archrock will pull back on its capex spending.

So, on the surface, a dividend payout ratio above 100% sounds risky.

But a little digging shows it isn’t as scary as we first feared.

Do you own any stocks with dividend growth as high as Archrock?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?