A Dividend King Just Raised Its Payment… Again!

Dividend Kings are extremely popular with dividend investors.

So, what exactly is a Dividend King?

A Dividend King is a company with 50 straight years of increasing dividend payments.

Fifty years is a long time for a company to grow its dividends!

Just think about 50 years of dividend growth. Dividend Kings increased payments during recessions, the dot-com crash, financial crises, and COVID.

Dividend Kings are very committed to their dividend payments, which makes them great picks for us!

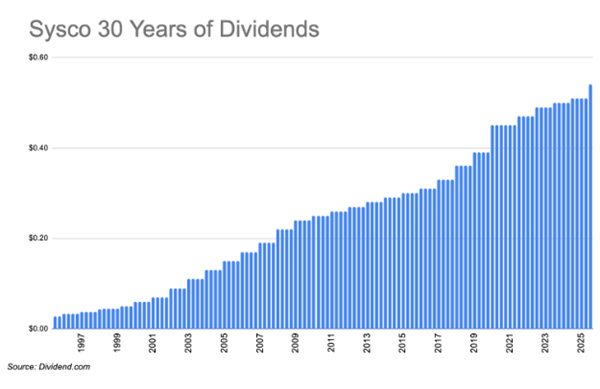

And Sysco (ticker: SYY) has just increased its payment for the 57th consecutive year!

Sysco is the world’s largest broadline food distributor, meaning it provides a wide range of food products to many different customers.

You’ve seen Sysco trucks all over the highway going to places like restaurants, sports stadiums, schools, universities, theme parks, and hospitals.

Essentially, if a place serves food, it probably does business with Sysco.

Food distribution has been a very profitable business for Sysco.

Sysco’s earnings have grown on average by 7% over the past decade.

In 2024, Sysco made almost $2 billion in profit!

And Sysco’s growth allows it to keep increasing its dividend.

Sysco just increased its payment again. If you’re thinking of buying the stock, don’t wait too long.

Only investors of Sysco on July 2nd (Wednesday) will receive the higher dividend.

Sysco’s next payment will be $0.54, which is about 6% higher than its previous payment.

On average, Sysco has increased its payment by a little over 5% in the last 10 years.

While the growth rate isn’t incredible, 5% increases will outpace inflation.

So your payments will keep up with whatever expenses you might have.

And the best part?

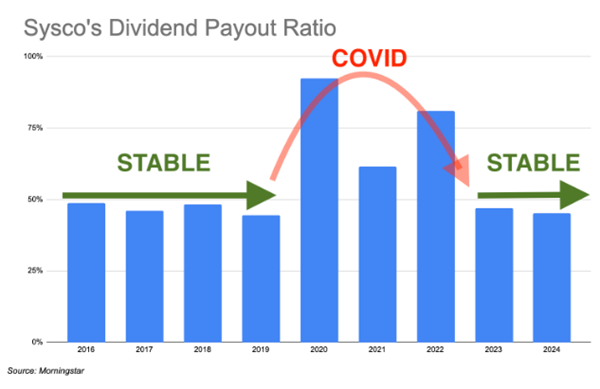

Sysco’s dividend payout ratio is just below 50%.

Outside of COVID, the payout ratio for Sysco typically hovers between 40-50%.

A low payout ratio means Sysco will have no problem continuing to increase its dividend.

Dividend growth for more than 50 years? Check!

Dividend growth outpacing inflation? Check!

Stable payout ratio below 50%? Check!

What’s not to love about Sysco?

Well, the dividend yield isn’t too great.

Sysco currently yields just shy of 3%.

So if you need a dividend stock paying you tons of cash, there are better options.

However, if the yield doesn’t trouble you, then there aren’t too many dividend stocks better than Sysco.

Do you own any other Dividend Kings?

Send me your list of favorites!

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?