A $50 Billion Dividend Stock Flying Under The Radar

I’m always looking for new dividend stock ideas.

And I love sharing all of those ideas with you.

Sometimes I find a stock, and it absolutely shocks me how little it’s talked about. Recently, I found an amazing stock, with a huge market cap, and a LONG record of paying and increasing dividends.

It’s a $50 billion company, and it’s been paying dividends for more than 20 years!

How could a company so large fly under the radar?

Simple: its competitor is getting a lot more press!

The company stealing the limelight is United Parcel Service (ticker: UPS).

UPS has a dividend yield around 6.5%, which is one of the highest in the entire S&P 500.

How did UPS’ dividend yield get so high?

UPS’ stock price has performed horribly over the last two years. The stock is down over 40%!

So of course, they get all the attention.

Should you buy UPS and lock in an amazing dividend yield?

Or is UPS a yield trap and we’ll see the dividend payments cut soon?

Well, that’s the million dollar question – and a question we’ll tackle in a future article.

Today, what I want to talk about is UPS’ “little brother,” FedEx (ticker: FDX).

FedEx isn’t actually little. Like I said earlier, the company has a market cap over $50 billion.

And while UPS stock has cratered, FedEx stock has held stable.

But what interests me in FedEx is its great dividend growth!

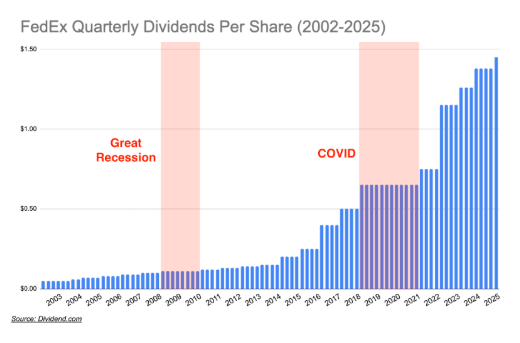

FedEx started paying a dividend back in 2002 and has increased those payments each year, on average, by about 16%.

Just look at the following chart:

FedEx has increased its dividend payments every year except during the Great Recession and COVID pandemic (highlighted in red above).

And FedEx just increased its dividend again to $1.45.

But you need to act quickly to get the next payment.

You must buy FedEx by Friday, June 20, to get the next dividend payment.

FedEx’s dividend yield is around 2.5%, which is low, especially compared to UPS.

But there’s more to life than dividend yield!

FedEx will have no problems increasing its payments in the future.

Its dividend payout ratio is only 30%, which means there’s lots of room for future dividend growth!

Are you adding FedEx to your portfolio?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?