Big Dividend Checks From Big Pharma

Pharmaceutical companies don’t seem like a great investment nowadays.

The Trump administration announced a 25% tariff on drug imports into the United States.

Many drug companies produce their products in other countries, but Trump wants manufacturing back in the United States.

Fact is, building pharmaceutical factories in the United States will cost a lot of money…

Plus, cuts to the Food and Drug Administration (FDA) budgets could lengthen the drug approval process.

Those are concerns for the U.S. market.

International pharmaceutical companies have operations all over the world, and they aren’t as impacted by tariffs in the United States.

And they can pay a really nice dividend as well.

Sanofi SA (ticker: SNY) is a French pharmaceutical company with over $40 billion in revenue per year.

Sanofi has products ranging from vaccines and antibiotics to insulin for diabetes and drugs to combat rare diseases such as Fabry disease and Gaucher disease.

The key is, over half of their revenue comes from outside the United States.

Sanofi still sells a lot in the United States, but it isn’t as much as some of their competitors like Johnson & Johnson (ticker: JNJ), Merck (ticker: MRK), and Pfizer (ticker: PFE).

Issues with the FDA or tariffs won’t impact Sanofi nearly as much.

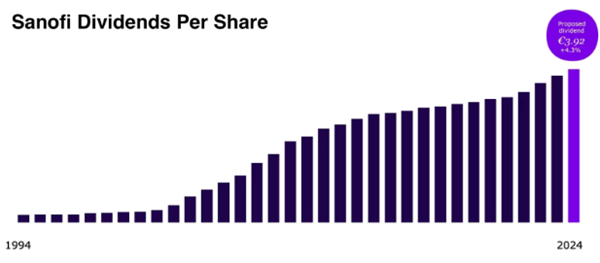

I like Sanofi… They’ve managed to increase their dividend for 30 straight years!

Two things stand out in Sanofi’s dividend chart.

First off, these dividends are annual dividends.

Companies like Sanofi only pay a dividend once per year.

Currently, Sanofi has a dividend yield just above 4%, which means the dividend payment is going to be huge!

And Sanofi’s payment is coming up. Only investors of SNY before May 8th get the dividend!

Secondly, the dividends in the chart are in Euros rather than US Dollars.

Sanofi is a French company so of course it’s going to report and pay everything in Euros.

But put those calculators and exchange rates away!

SNY, the ticker for Sanofi on the NASDAQ exchange, is an ADR, which stands for American Depository Receipt.

SNY trades and pays dividends in US Dollars.

So the €3.92 dividend will actually be $2.12 in US Dollars for SNY investors.

More importantly, ADRs also allow international companies, like Sanofi, to trade in US markets.

So put the alarm clock away too. No need to wake up at 3 AM to trade European stocks!

Sanofi isn’t alone in paying dividends once per year. Here are a few others:

UBS (ticker: UBS) is a massive Swiss bank, which has been around for over 160 years. UBS is the world’s largest private bank and pays a dividend once per year around the middle of April. UBS currently has a dividend yield around 3%.

Deutsche Bank (ticker: DB) is Germany’s largest bank with over $1 trillion in assets under management. Deutsche Bank has a dividend yield just shy of 3% and usually makes their payment in the middle of May. So mark your calendars if you are interested!

Stellantis NV (ticker: STLA) is the fourth largest automaker in the world headquartered in the Netherlands. Stellantis currently operates popular US brands like Dodge, Jeep, and Chrysler as well as European brands like Citroën, Fiat, and Maserati. Stellantis has a great dividend yield over 8%, but we just missed their most recent payment a few weeks ago.

Do you own any stocks with dividends paid only once per year?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?