Can You Make Money With… EGGS?

Just last week, I paid over $7 for eggs. It’s getting crazy out there! You know, when I see prices like that… somebody is making big money.

I found them…

But more on that in a moment.

Did you know the vast majority of dividend-paying companies in the S&P 500 pay a stable dividend every quarter?

Some even pay them monthly!

Many dividend investors like having stable cash flow hitting their bank accounts. It’s predictable!

I love it too.

But not every stock has stable dividend payments.

A handful of companies pay a different dividend amount each quarter based on how much money they make.

If a company makes a lot of money in one quarter, its dividend payment will be higher.

But if a company has a bad quarter with lower profits, then the dividend payment will suffer.

It sounds like a special dividend, but it isn’t.

Special dividends are usually one-time payments often based on a windfall cash event. An event like selling a division.

Variable dividends, on the other hand, are paid every quarter… and are dependent on company performance.

Why would we want an unstable dividend?

Because you can grab some really high dividend payments!

Want to know how to profit from EGGS? I figured it out…

Take Cal-Maine Foods (ticker: CALM) for example.

Cal-Maine is the largest egg producer in the United States.

Every quarter, Cal-Maine pays 33% of their profit in dividends to their investors.

And they absolutely crushed last quarter.

Cal-Maine made a record-breaking $500 million in their 3rd quarter. (Now you know who’s making all the money from rising egg prices!)

And the company is paying their highest dividend payment ever: $3.456 per share in dividends.

Almost $3.50 for just one quarter!

And Cal-Maine’s payment is coming up soon. Only investors of Cal-Maine on April 29th will get their next payment.

April 29th is TOMORROW – so you need to act fast.

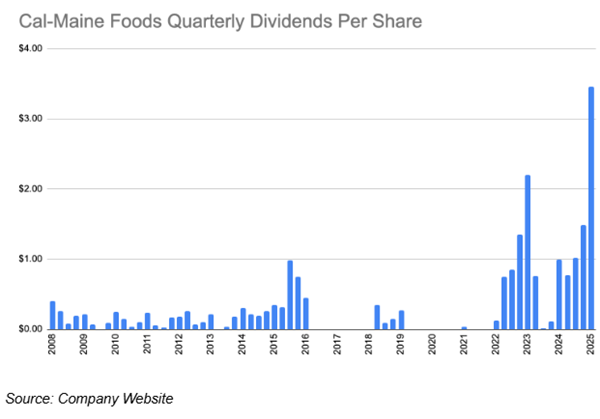

Below is a chart of the quarterly dividend payments for Cal-Maine.

As you can see, their payments are ALL OVER THE MAP! You’ll see a lot of quarters where Cal-Maine lost money, and they didn’t pay a dividend at all!

You can see some huge payouts, but it comes at a risk.

If you need stable income, then companies like Cal-Maine aren’t for you.

Don’t Get Scammed by These Variable Dividend Companies

Here’s something professional investors understand, but many new investors miss…

When researching variable dividend companies, please pay careful attention to the dividend yield.

Some websites multiply the last dividend payment by the number of payments in a year to calculate dividend yield.

Multiplying the last payment works well for companies with stable dividend payments.

But for a company paying a variable rate, it doesn’t work.

Many websites, like seekingalpha.com and dividend.com, get the dividend yield wrong! They give Cal-Maine a dividend yield over 15%!

15% dividend yield sounds amazing!

But it isn’t true.

Cal-Maine’s next payment (sometime in late July) is probably not going to be over $3.

Dividend yield calculations should be based on historical payments.

Yahoo!Finance calculates dividend yield using historical dividend payments and has a dividend yield around 7.25%.

That’s right! One website reports a yield on Cal-Maine DOUBLE the other!

So just be extra careful when looking at dividend yields for companies like Cal-Maine.

Here are a few other companies paying variable dividends:

Blackstone (ticker: BX) is the largest alternative asset manager in the world with over $1 trillion in assets. Blackstone’s next payment is down because of lower profits, but they still have a dividend yield over 3%.

Devon Energy (ticker: DVN) is an oil & gas exploration company with almost $3 billion in income last year. Like Blackstone, Devon’s next dividend payment is down compared to last year. But Devon has a dividend yield around 4.5%.

Diamondback Energy (ticker: FANG) is an even bigger oil & gas exploration company with almost $3.4 billion in profit in 2024. Diamondback’s next dividend payment is also lower, but it still has a dividend yield around 4.5%.

In the world of dividend investing, variable dividend payments are very unique… it’s like finding a four leaf clover – sometimes they bring you luck!

What variable dividends stocks do you own?

Michael Jennings, Editor

Dividend Stocks Research

Category: Dividend Stocks To Buy?